Table of Contents

- Company Overview

- Key Services

- Core Business Areas

- Financial Performance

- Competitive Advantages

- Risk Factors

- Future Vision and Outlook

- Two-Minute Speech

Introduction

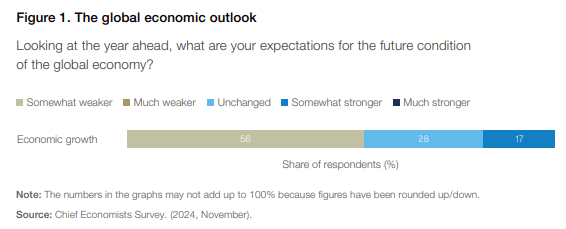

As the global economy wavers amidst uncertainty, financial and commodity markets are becoming more complex and dynamic than ever before. In an environment with numerous exchanges, diverse commodities, and constantly evolving regulatory landscapes, how can businesses and investors efficiently access markets and manage risks?

The inauguration of President Trump on January 20, 2025, has introduced significant shifts in U.S. policies, further amplifying global economic uncertainties. Unpredictable economic policies such as protectionism and deregulation are having a profound impact on financial and commodity markets. In this context, thorough risk management and reliable partnerships are more critical than ever for businesses and investors navigating market volatility.

In the Era of Trump Tariff Conflicts, Marex Group PLC (NASDAQ: MRX) is a company that fulfills these needs by simplifying the complexities of financial and commodity markets while providing essential liquidity and market access to clients during times of economic uncertainty. Additionally, it offers a wide range of financial solutions to help clients prepare for volatility and effectively manage risks.

1. Company Overview

Marex Group began in 2005 under the name Marex Financial as a derivatives and foreign exchange broker. Today, it is a diversified global financial services platform headquartered in the United Kingdom. The company provides essential liquidity, market access, and infrastructure services across energy, commodities, and financial markets to its clients.

- Operates over 35 offices worldwide with access to 60 exchanges.

- Employs more than 2,000 staff across Europe, Asia, and the Americas.

- Listed on NASDAQ as Marex Group PLC (NASDAQ: MRX) on April 25, 2024.

- Market capitalization: $2.5 billion.

Why Companies Trade Futures Instead of Buying or Selling Goods Immediate

Futures trading offers several advantages, making it a preferred choice for many investors and companies.

1. Risk Management

Futures trading is an effective tool for managing price fluctuation risks. By agreeing to trade at a predetermined price at a specific point in the future, companies can protect themselves from potential losses caused by price volatility. This is particularly valuable in highly volatile markets such as commodities or energy.

2. Hedging Against Price Volatility

By locking in a fixed price, companies can establish a predictable cost structure. This plays a critical role in business planning and budgeting, allowing for greater financial stability.

3. Improved Capital Efficiency

Futures trading allows companies to reserve future transactions without the need to immediately buy or sell assets. This enables more efficient use of capital, contributing to better liquidity management.

2. Key Services

A. Clearing

Clearing is a critical process in financial transactions that ensures the execution of trades after they are agreed upon by managing payment settlements between parties.

1. Marex’s Clearing Services:

- Access to over 60 global exchanges.

- Offers clearing services across energy, commodities, metals, agriculture, and financial securities markets.

- Clients include banks, hedge funds, asset managers, corporations, and trading groups.

- Operates on a fee-per-transaction model.

2. Importance of Clearing Services:

-

- Reduces credit risk and settlement risk between trading parties.

- Enhances transaction accuracy and speed for market efficiency.

- Contributes to increased market liquidity.

3. Example of Clearing Process:

1. Trade Execution [Market Making]

Let’s assume that a major Korean milling company, Company A, purchases a futures contract for 5,000 tons of wheat on the Chicago Mercantile Exchange (CME) with delivery scheduled in six months.

2. Clearing Process Initiation [Clearing]

This trade is transmitted to Marex’s clearing system. As a clearing member of CME, Marex directly provides clearing services. Marex’s agriculture-focused clearing team verifies the trade details and ensures that Company A’s account has sufficient margin funds.

3. Risk Management [Clearing]

Marex collects and manages the initial margin from Company A. These funds are segregated to cover the risks associated with Company A’s trade. Marex reevaluates the position daily based on fluctuations in wheat futures prices and requests additional margin if necessary.

4. Market Insights

Marex’s team of agricultural experts provides Company A with in-depth analysis and insights into the wheat market.

5. Hedging Strategy Support [Hedging Solutions]

If needed, Marex offers Company A over-the-counter (OTC) hedging solutions to provide additional risk management against wheat price volatility.

6. Intermediation with the Exchange [Agency & Execution]

Marex interacts directly with CME on behalf of Company A, handling all clearing and settlement obligations associated with the trade.

7. Physical Delivery at Maturity [Agency & Execution]

Upon contract maturity, Marex manages the physical delivery process of wheat on behalf of Company A.

8. Reporting and Regulatory Compliance

Marex handles all regulatory reporting obligations related to the trade and provides detailed transaction reports to Company A.

B. Agency & Execution (A&E)

1. Agency Services:

Acts as an intermediary to negotiate optimal trading conditions for clients by analyzing markets and identifying opportunities.

2. Execution Services:

Executes client orders quickly and accurately for buying or selling financial products.

3. Examples of agency & execution :

Energy Market Example

European Gas and Power Markets (Agency):

Marex holds a leading position in Europe’s major gas and power markets. For instance, when a large German energy company seeks to hedge against natural gas price volatility, Marex’s Agency and Execution team identifies suitable counterparties and executes trades at the most favorable prices. In this process, Marex acts as an intermediary to secure optimal pricing for its client.

Financial Securities Market Example

Bond Trading (Execution):

When a major asset management firm intends to purchase U.S. Treasury bonds, Marex connects the firm with various bond dealers to secure the most advantageous terms. This service focuses on promptly executing client orders with precision.

Agricultural Sector Example

Options Trading (Execution):

When a food processing company wants to prepare for potential increases in corn prices, Marex purchases corn call options on behalf of the company. This service ensures the immediate and accurate execution of client trade instructions.

C. Market Making

1. Market Making involves Marex acting as a counterparty in trades byquoting prices directly to clientswhile providing liquidity.

2. Example of market making :

Example of Market Making in the Metals Market

- A client, Company A, wishes to purchase a copper futures contract.

- Marex acts as the counterparty anddirectly quotes a selling price for the copper futures contract.

- In this scenario, Marex provides an immediate price quote, allowing the client to execute the trade without the need to search for a counterparty in the market. By taking the opposite side of the trade, Marex offsets the client’s position and limits overall market risk.

D. Hedging & Investment Solutions

Marex Group’s Hedging and Investment Solutions division specializes in providing tailored derivatives and structured products for corporations and investors. This service is divided into two main areas:

1. Hedging Solutions

The Hedging Solutions team develops customized over-the-counter (OTC) hedging products to help companies manage market risks arising from volatility in commodity and currency prices.

- Direct Access to Global Markets:

Marex provides direct access to major global exchanges and OTC markets, ensuring liquidity and competitive pricing. - Custom Products for Illiquid Markets:

The team has the capability to offer bespoke products even in less liquid markets. - Diverse Commodity Coverage:

Hedging solutions are available across a wide range of commodity markets, including agriculture, dairy, metals, energy, and environmental markets.

2. Investment Solutions

The Financial Products team supports investors in pricing and creating fully customized investment products through a proprietary platform.

- Agile Platform:

Using Marex’s exclusive Agile trading platform, the team designs, structures, hedges, and distributes tailored investment products under its own issuance program. - Focus on Private Banks and Asset Managers:

Marex specializes in crafting bespoke products for private banks and asset managers. - Broad Asset Class Exposure:

The division manufactures diverse financial products across all asset classes, offering exposure to equities, credit, digital assets, foreign exchange (FX), commodities, and more.

3. Key Benefits of Marex Solutions

Marex Solutions delivers several advantages to its clients:

- Optimal Counterparty Matching:

As a non-bank issuer, Marex helps investors diversify risks by connecting them with the most suitable counterparties. - Competitive Pricing:

Clients benefit from lower production costs and funding levels, enabling highly competitive pricing. - Flexible Product Offerings:

Marex aims to provide the best pricing regardless of payment structure, currency, or maturity of the product. - Multi-Channel Communication:

Clients can interact with Marex through various channels such as email, Bloomberg, or third-party vendors.

3. Core Business Areas

A. Metals Markets

1. Base Metals

Marex is a Category 1 member of the London Metal Exchange (LME), providing 24-hour global market access. The primary base metals traded include:

- Aluminum

- Copper

- Zinc

- Nickel

- Lead

- Tin

- NASAAC (North American Special Aluminum Alloy Contract)

- Alloys

- Cobalt

2. Precious Metals

Marex is also a member of the London Bullion Market Association (LBMA) and offers trading in the following precious metals:

- Gold

- Silver

- Platinum

- Palladium

3. Ferrous Metals

- Iron ore

B. Agriculture Markets

- Grains & Oilseeds

- Sugar

- Coffee & Cocoa

C. Energy Markets

- Crude Oil

- Natural Gas

D. Capital Markets

- Equities

- Credit

- FX

4. Financial Performance

A. Growth Metrics:

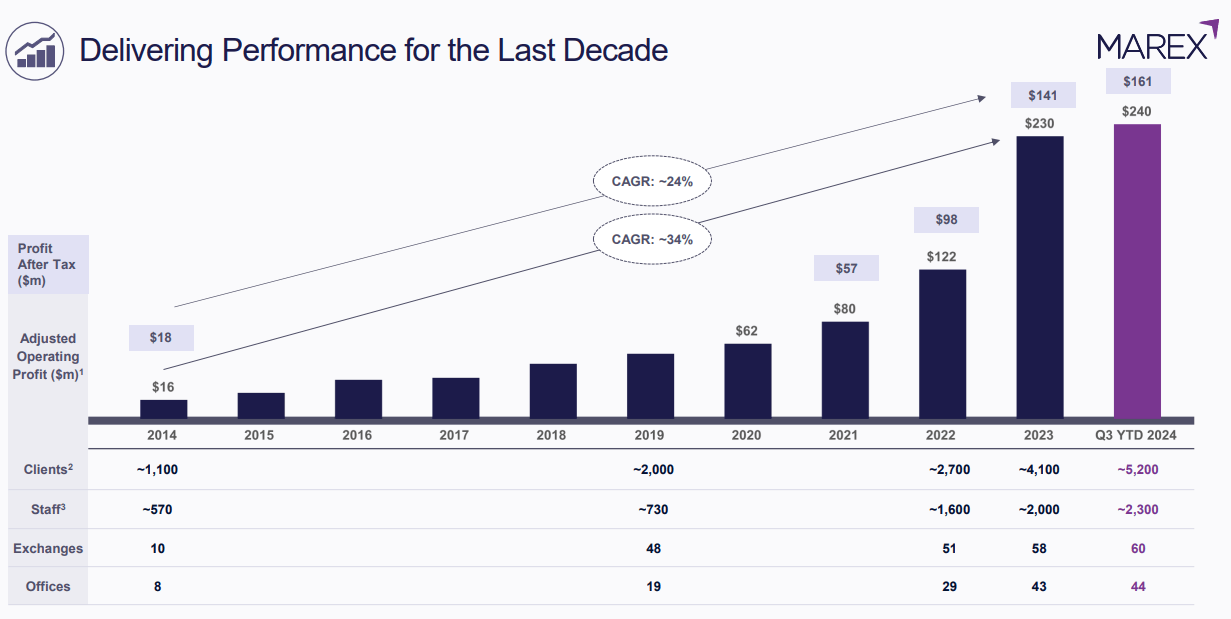

- Adjusted Operating Profit grew from $13 million in 2014 to $230 million in 2023(34% CAGR).

- Profit After Tax increased from $18 million in 2014 to $161 million in 2023(24% CAGR).

B. Expanded Scale:

- Clients grew from ~1,100 in 2014 to ~5,200 in 2023.

- Employees increased from ~570 in 2014 to ~2,300 in 2023.

C. Q3 2024 Financial Performance

- Revenue: Q3 revenue increased by 32% year-over-year to $391.2 million.

- Pre-Tax Profit: Achieved $79 million, a 66% increase compared to the same period last year.

- Post-Tax Profit: Rose by 80% to $58.4 million.

- Adjusted Operating Profit: Reached $80.5 million, up 52% year-over-year.

- Adjusted Operating Margin: Improved from 18% in the prior year’s Q3 to 21%.

- Return on Equity (ROE): Increased by 7 percentage points, rising from 18% in the previous year’s Q3 to 25%.

D. 9-Month Financial Performance for 2024

- Revenue: Total revenue for the first nine months of 2024 grew by 28% year-over-year, reaching $1.179 billion.

- Pre-Tax Profit: Increased by 39%, amounting to $218 million.

- Post-Tax Profit: Recorded a 42% rise, totaling $161.3 million.

5. Competitive Advantages

A. Marex Group: Diversified Business Model and Global Platform

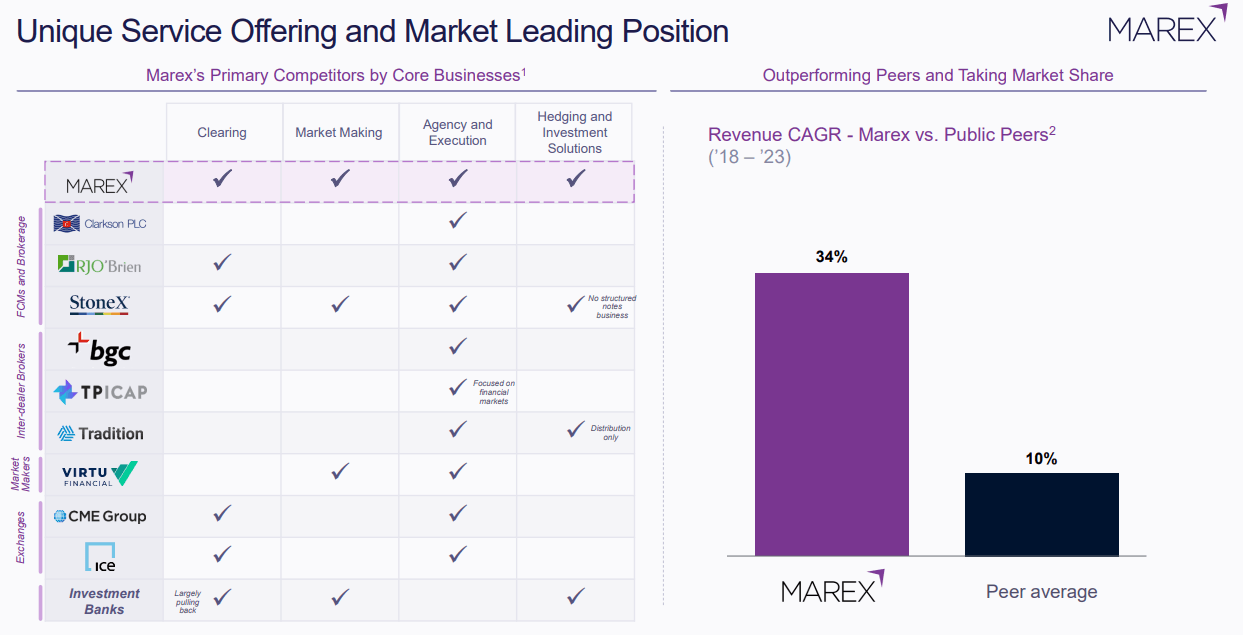

Marex Group provides a wide range of financial services through its diversified business model and global platform. The company operates across four core business segments: Clearing, Agency & Execution, Market Making, and Hedging & Investment Solutions. These services deliver essential liquidity, market access, and infrastructure to clients across energy, commodities, and financial markets. This diversified strategy not only mitigates risks across various products and markets but also serves as a key competitive advantage, enabling the company to achieve stable performance even in changing market conditions.

- Comprehensive Services:

Marex offers all four core business areas—Clearing, Agency & Execution, Market Making, and Hedging & Investment Solutions. Unlike most competitors that provide only a subset of these services, Marex delivers a fully integrated offering across all segments. - Growth Performance:

From 2018 to 2023, Marex achieved a compound annual revenue growth rate (CAGR) of 34%, significantly outperforming the industry average growth rate of 10%.

B. High Barriers to Entry

The markets in which Marex operates are characterized by significant infrastructure requirements and regulatory as well as technological complexities. These high barriers to entry protect Marex’s market position by making it difficult for new competitors to enter the space.

C. Technological Leadership

Marex maintains a leading position in the financial services industry through its technological innovations. The company employs over 120 in-house innovation specialists who develop cutting-edge tools and platforms that set Marex apart from competitors.

- Neon Platform:

A comprehensive platform integrating electronic trading, execution, data, research, and risk management. Neon enhances operational efficiency, supports organic growth, and offers clients versatile trading applications on both mobile and desktop environments. - Nanolytics:

A state-of-the-art analytics tool leveraging big data and machine learning to process billions of data points. Nanolytics helps clients manage risks based on fundamental insights. - Agile:

A proprietary web-based pricing and execution platform that is fast, user-friendly, and efficient. Agile enables seamless pricing for customized investment products. - Marex FX:

A platform for foreign exchange trading that has been further strengthened by the acquisition of Hamilton Court Group, enhancing Marex’s competitiveness in FX services.

D. Risk Management

Marex Group has implemented a robust risk management framework to ensure stability and resilience.

- Enterprise-Wide Risk Management (EWRM):

This framework identifies, measures, evaluates, monitors, controls, and reports risks across the organization. - Three Lines of Defense Model:

Promotes a strong risk management culture and communication throughout the company. - Risk Characterization Model (RCM):

Aligns with Marex’s risk appetite while addressing diverse risks faced by the group. - Low Risk Exposure:

Marex’s business model is characterized by low risk exposure:- Consistent profitability with 87% positive trading days.

- Average daily Value-at-Risk (VaR) of $2–2.5 million—remarkably low for its size.

- Focus on client-driven business while avoiding directional market exposure.

6. Risk Factors

A. Changes in Trade Policies Under the Trump Administration

The Trump administration’s protectionist policies and tariff impositions could significantly impact global trade. These measures may directly affect Marex Group’s core business areas, such as commodity and energy trading. In particular, escalating U.S.-China trade tensions could reduce demand for dry bulk shipping, potentially having a negative impact on Marex’s revenue.

B. Market Risks

Marex Group operates in commodity, energy, and financial markets, exposing it to substantial market volatility:

- Commodity Price Fluctuations: Changes in the prices of raw materials can affect trading volumes and profitability.

- Interest Rate Movements: Variations in interest rates can influence the cost of financing and hedging strategies.

- Foreign Exchange Volatility: Currency fluctuations pose risks to international transactions and profitability.

C. Credit Risks

There is a risk of default by clients or counterparties. While Marex closely monitors the creditworthiness of its clients, unexpected defaults could result in financial losses for the company.

D. Liquidity Risks

Marex faces potential liquidity shortages due to adverse market conditions or unanticipated cash outflows. To mitigate these risks, the company conducts extensive stress testing to ensure sufficient liquidity under various scenarios.

E. M&A-Related Risks

As part of its growth strategy, Marex Group actively pursues mergers and acquisitions (M&A). However, this approach carries inherent risks:

- Inaccurate Valuation of Target Companies: Misjudging the value of an acquisition target could lead to financial inefficiencies.

- Integration Challenges: Difficulties in integrating acquired businesses may delay or hinder operational synergies.

- Failure to Achieve Expected Synergies: The inability to realize anticipated benefits from acquisitions could impact overall performance.

7. Future Vision & Outlook

Souce: Marex Group 2024 Q3 presentation

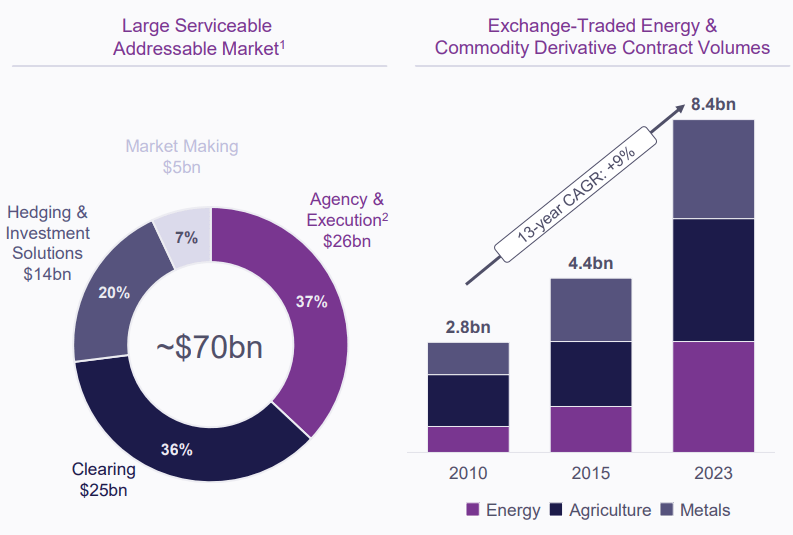

A. Large Market Size and Share

Marex’s Serviceable Addressable Market (SAM) is estimated at approximately $70 billion. Currently, Marex holds about 2% of this market (~$1.4 billion), indicating significant growth opportunities. The relatively low market share suggests that Marex has substantial potential to expand its presence and acquire new clients within this vast market.

B. Composition of the Total Market

- Clearing Services: $25 billion

- Agency & Execution Services: $26 billion

- Market Making Services: $5 billion

- Hedging & Investment Solutions: $14 billion

C. Growth in Exchange-Traded Energy & Commodity Derivative Contract Volumes

The graph on Exchange-Traded Energy & Commodity Derivative Contract Volumes illustrates growth from 2010 to 2023, increasing from 2.3 billion contracts in 2010 to 8.4 billion contracts in 2023—a compound annual growth rate (CAGR) of 9%. This reflects the overall market’s upward trend rather than Marex’s individual performance.

D. Declining Competitive Intensity

Investment and commercial banks are increasingly withdrawing from commodity trading due to declining profitability, stricter regulations, and risk management concerns. As these banks reduce their involvement in capital-intensive activities, non-bank institutions like Marex are stepping in to fill the gap left by traditional players.

E. M&A Growth Strategy

- Diversification and Market Share Expansion

Marex uses M&A to diversify its revenue streams by expanding product lines and geographic reach while strengthening its position in existing markets through complementary business acquisitions. - Entry into New Markets

Strategic acquisitions enable Marex to penetrate new regions and market segments. - Recent Key Acquisitions:

- ED&F Man Capital Markets (End of 2022): Expanded global footprint and strengthened clearing, metals, bonds, and equities capabilities.

- Cowen’s Prime Brokerage & Outsourced Trading Division (December 2023): Enhanced securities services.

- Hamilton Court Group (October 2024 Agreement): Bolstered FX services and expanded mid-sized corporate client base in Europe.

- Aarna Capital (Announced October 2024): Strengthened clearing operations and expanded presence in the Middle East region.

- Performance and Outlook:

Over the past three years, acquisitions have led to a 25% increase in revenue and a 190% rise in profits, with an average Return on Equity (ROE) of 20%. Marex continues to actively seek M&A opportunities, focusing on markets such as the Middle East, Asia-Pacific, Australia, and the United States.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Marex Group PLC (NASDAQ: MRX) is a global financial services platform that provides essential services to clients navigating complex financial and commodity markets. Even during periods of heightened economic uncertainty, Marex delivers liquidity and market access while offering a wide range of financial solutions to help clients prepare for volatility and effectively manage risks.

The company operates across four primary business segments: Clearing, Agency & Execution, Market Making, and Hedging & Investment Solutions. These services span multiple sectors, including metals, agriculture, energy, and capital markets.

Over the past decade, Marex Group has demonstrated consistent growth. Adjusted Operating Profit increased from $13 million in 2014 to $230 million in 2023, reflecting a compound annual growth rate (CAGR) of approximately 34%.

Marex’s key competitive advantages lie in its diversified business model and global platform, its strong position in high-barrier-to-entry markets, and its innovative service offerings driven by technological superiority. The company employs advanced platforms like Neon for trading and risk management, Nanolytics for big data analytics, Agile for pricing solutions, and Marex FX for foreign exchange services.

Marex also boasts a robust risk management framework that includes an Enterprise-Wide Risk Management (EWRM) system, a “Three Lines of Defence” governance model to foster a strong risk culture, and a Risk Characterization Model (RCM) to align with its risk appetite. Its business model is characterized by low-risk exposure, as evidenced by consistent profitability (87% positive trading days) and a low average daily Value-at-Risk (VaR) of $2–2.5 million.

Despite these strengths, Marex faces various risks that could impact its operations and profitability. These include changes in trade policies under the Trump administration that could affect commodity and energy trading volumes; market risks such as commodity price fluctuations, interest rate changes, and foreign exchange volatility; credit risks from potential client or counterparty defaults; liquidity risks due to adverse market conditions or unexpected cash outflows; and challenges related to mergers and acquisitions (M&A), such as inaccurate valuations or integration difficulties.

Nonetheless, Marex’s future vision remains highly positive. The company’s Serviceable Addressable Market (SAM) is estimated at approximately $70 billion. Currently capturing only 2% (~$1.4 billion) of this market highlights significant growth potential. Additionally, declining competitive intensity—driven by traditional investment banks exiting commodity trading due to regulatory pressures—creates opportunities for non-bank institutions like Marex to strengthen their market position.

Through its M&A growth strategy, Marex has expanded its product lines and geographic reach while diversifying revenue streams. Recent acquisitions such as ED&F Man Capital Markets (2022), Cowen’s Prime Brokerage division (2023), Hamilton Court Group (2024), and Aarna Capital (2024) have bolstered its capabilities across clearing operations, metals trading, FX services, and more.

With its diversified business model, advanced risk management systems, innovative technology platforms, and strategic M&A initiatives, Marex is well-positioned for sustained growth even amidst uncertain economic environments.

0 Comments