Donald Trump has been elected as the 47th President of the United States. With his “America First” trade policy, we need to closely monitor how the global economic landscape will shift.

Source : https://mexiconewsdaily.com/business/jpmorgan-chase-mexico-investment-destination/

JPMorgan Chase CEO Jamie Dimon stated in a November 2023 interview that Mexico could become the best country in the world for investment, citing it as a prime destination for nearshoring and business expansion.

Background on This Statement

Due to the impact of the reshoring policy, which encourages U.S.-based manufacturing companies to relocate their overseas factories back to the U.S., many firms have been constructing and operating new plants domestically. However, reshoring presents a challenge: high labor costs in the U.S. increase production expenses, reducing price competitiveness and exacerbating inflation.

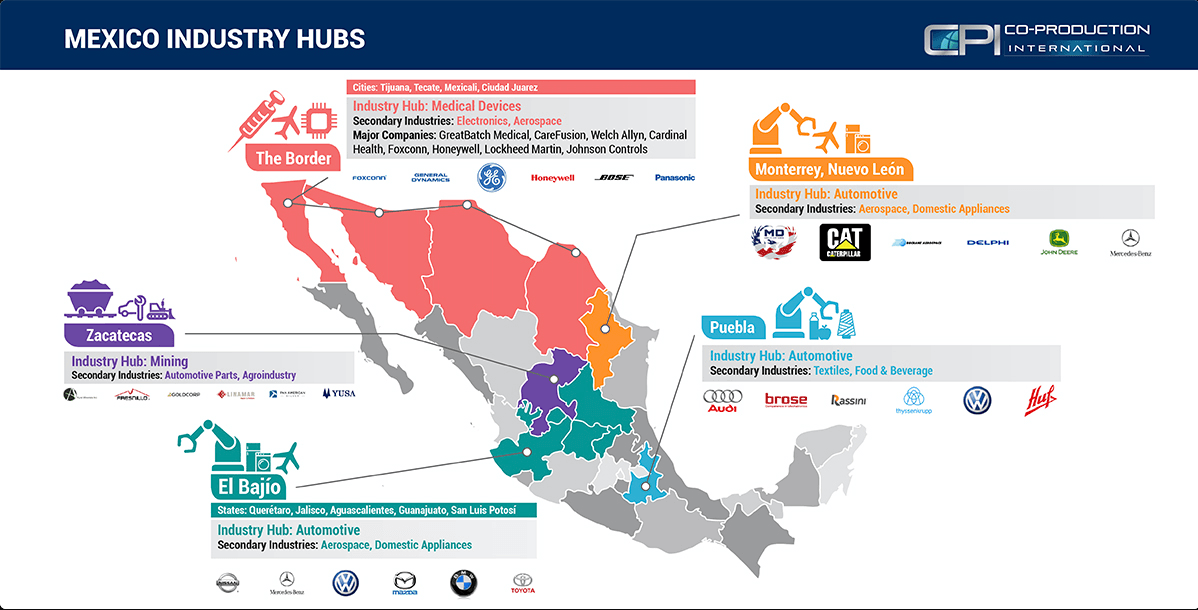

As a compromise, nearshoring has emerged as an alternative, with Mexico being the ideal candidate due to:

A. Proximity to the U.S. and ease of land-based transportation.

B. Duty-free trade under the United States-Mexico-Canada Agreement (USMCA).

C. Lower labor costs.

Given these advantages, not only U.S. companies but also manufacturers from South Korea, Europe, and Japan that export to the U.S. have already established or are in the process of setting up factories in Mexico.

Economic Impact on Mexico

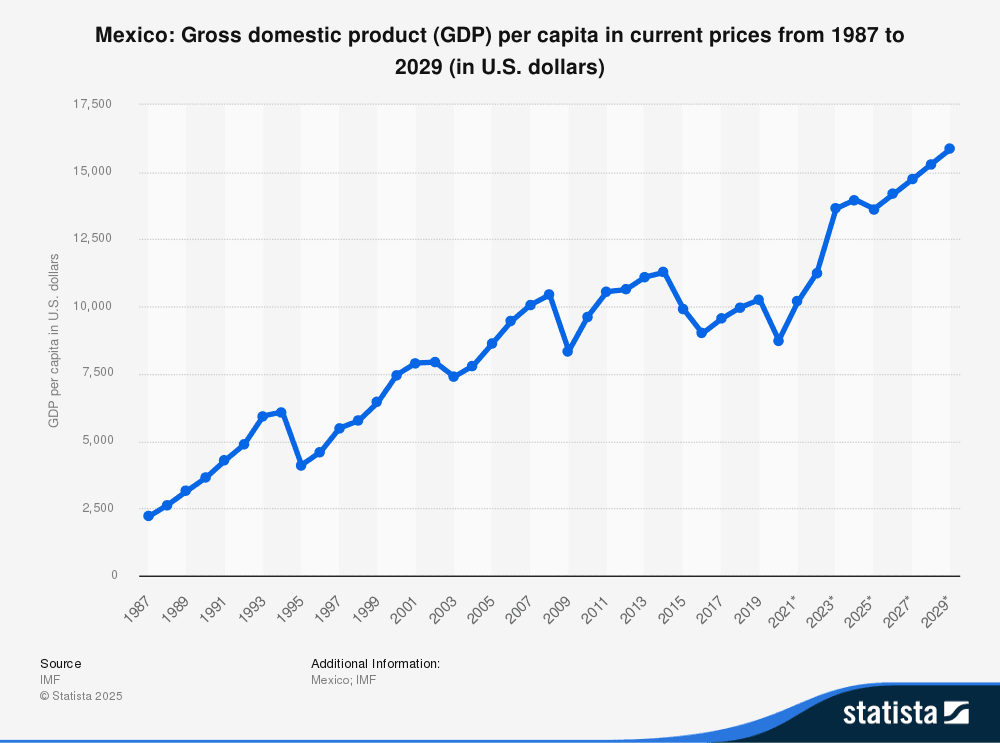

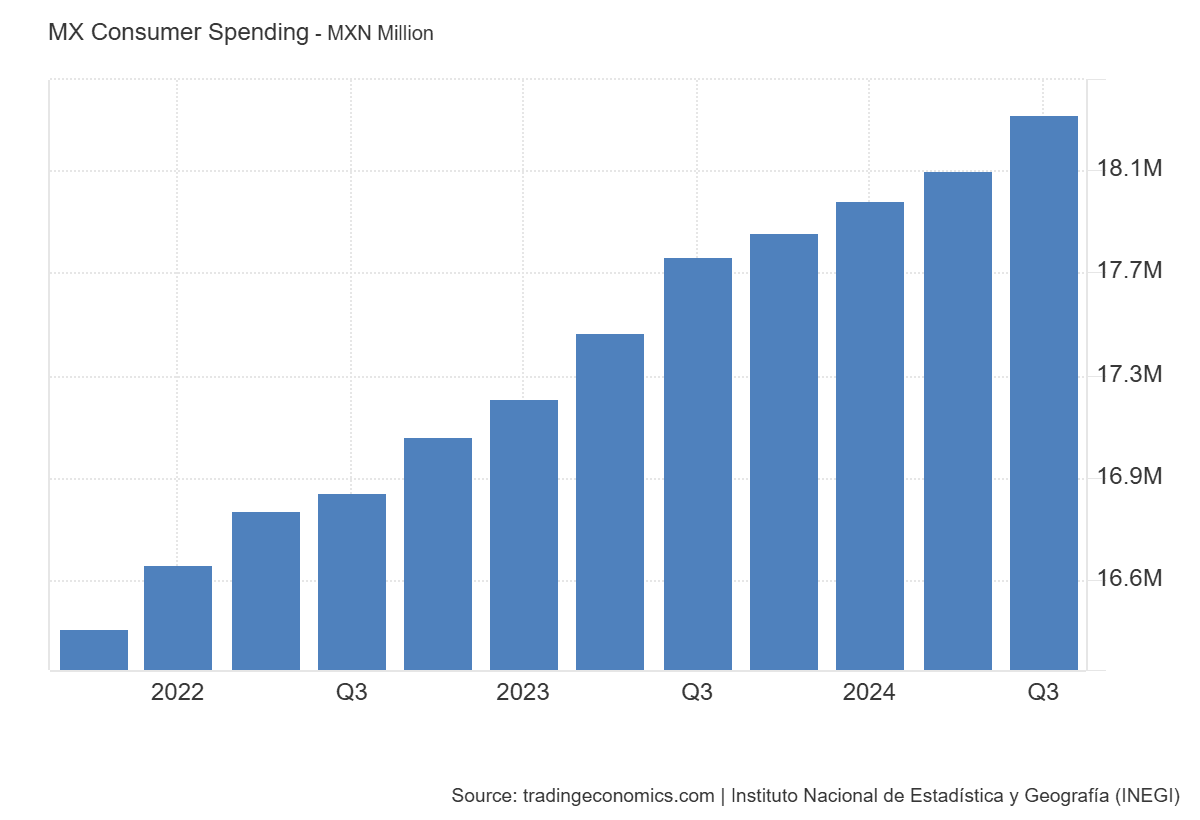

With an increasing number of manufacturing firms establishing factories in Mexico, local employment is on the rise, leading to a higher GDP per capita. As income levels grow, consumption naturally follows.

2023 Mexican Consumer Trends

According to a report by KOTRA (Korea Trade-Investment Promotion Agency), which analyzes global market trends, alongside market insights from firms such as McKinsey & Company and Bloomberg, the following consumer behavior trends have been observed in Mexico:

A. Polarization in Consumer Spending (Trading Up & Trading Down)

Severe inflation in 2022 has led to polarized consumer behavior:

- Consumers continue to spend on luxury goods despite rising prices (Trading Up).

- For essential items like groceries, they seek the cheapest available options (Trading Down).

Interestingly, middle-class consumers are cutting costs on non-essential items to afford luxury goods:

- Trading Down: A preference for lower-cost options or postponing purchases for non-essential items like clothing or electronics.

- Trading Up: Middle-class consumers increasingly purchase affordable luxury brands for higher quality and emotional satisfaction.

B. Popularity of Private Labels and No-Brand Products

A survey by Merca 2.0, a leading consumer insights firm, highlights that:

- 98% of respondents expressed a preference for private-label or no-brand products due to their affordability.

- 16% reported increased consumption of no-brand items due to inflation.

- In 2022, sales of no-brand products in Mexico rose by 3.5% year-over-year.

1. Company Overview: BBB Foods Inc.

Today’s featured stock is BBB Foods Inc. (NYSE: TBBB), a Mexico-based hard discount supermarket chain targeting price-conscious consumers.

Founded in 2005 as Mexico’s first hard discount supermarket, BBB Foods emphasizes affordability under its name—”Bueno (Good), Bonito (Nice), y Barato (Cheap).” The company went public in February 2024 and operates in grocery retail, food distribution, and logistics centers.

With a market capitalization of $3.3 billion, BBB Foods operates smaller supermarkets instead of large-scale stores like Walmart.

TBBB Interior Photos (Source: TBBB website)

2. Key Products & Services

A. Product Categories

- Food & Beverages

- Hygiene & Beauty Products

- Household Cleaning Supplies

- Personal Care Items

- Cosmetics

- Pharmaceuticals

- General Merchandise

- Pet Supplies

- Coffee, Tea & Chocolate

- Bakery & Confectionery

- Frozen Foods

- Snacks

- Paper Products

B. Brand Strategy

- Branded Products: Offers well-known national brands.

- Private Labels: Develops and sells its own brand products.

- Special Deals: Provides discounted items at competitive prices.

C. Online Services

BBB Foods enhances accessibility by operating both offline stores and online shopping platforms.

3. Financial Performance

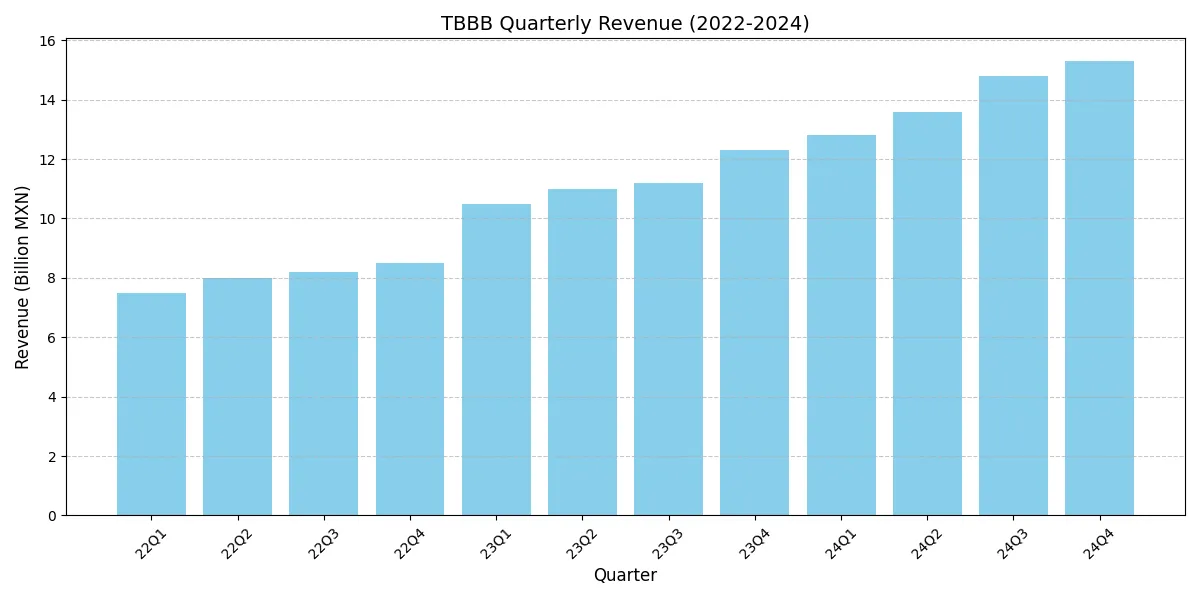

A. Revenue Growth

BBB Foods has seen steady revenue growth driven by store expansions. However, as a hard discount retailer with low-price offerings, its margins remain slim. Despite ongoing losses, net income deficits have been narrowing annually, signaling a path toward profitability.

B. Debt Stability

a. Debt-to-equity ratio

The debt-to-equity ratio is a financial metric that indicates the proportion of a company’s assets that are financed by debt. It is calculated as follows:

Debt-to-equity ratio = (Total debt / Total equity) * 100

- Total debt: The sum of all of a company’s liabilities

- Total equity: The sum of all of a company’s assets minus its liabilities

b. TBBB Quarterly Debt Ratio Report (2022–2024)

Exchange Rate: 1 USD = 17.00 MXN (as of November 25, 2024, per Bloomberg)

| Quarter | Total Debt (USD Million) | Total Assets (USD Million) | Debt Ratio |

|---|---|---|---|

| 4Q 2023 | 864.7 | 880.2 | 98.3% |

| 1Q 2024 | 902.1 | 931.3 | 96.9% |

| 2Q 2024 | 997.0 | 1,030.9 | 96.7% |

| 3Q 2024 | 1,006.8 | 1,228.7 | 82.0% |

c. Key Observations

Sharp Decline in 3Q 2024:

-

-

Debt ratio dropped from 96.7% (2Q 2024) to 82.0% (3Q 2024)—a 14.7 percentage point improvement.

-

Driven by repayment of MXN 420 billion (~USD 24.7 billion) in long-term debt using IPO proceeds.

-

d. Asset Expansion:

- Total assets grew by 32% from 1Q 2024 (USD 931.3M) to 3Q 2024 (USD 1,228.7M) due to new logistics centers.

e. IPO Impact:

-

-

IPO raised MXN 78.42 billion (~USD 4.61 billion) in February 2024, enabling debt reduction.

-

4. Competitive Advantages

A. Hard Discount Model

- BBB Foods focuses on offering extremely low prices through limited product offerings (800–3,000 SKUs) and private-label dominance while maintaining gross margins under 15%.

B. Strengthening Private Labels

- Private-label products account for 46.5% of total sales.

- These products offer higher profit margins compared to branded alternatives.

- They also foster customer loyalty, leading to repeat purchases and word-of-mouth marketing.

C. Niche Market Focus

- BBB Foods reduces marketing costs while maximizing impact by targeting price-sensitive consumers.

- The company effectively competes in market segments overlooked by larger retailers like Walmart.

D. Efficient Operations

- Small store formats minimize rent and labor costs.

- An optimized supply chain boosts inventory turnover rates.

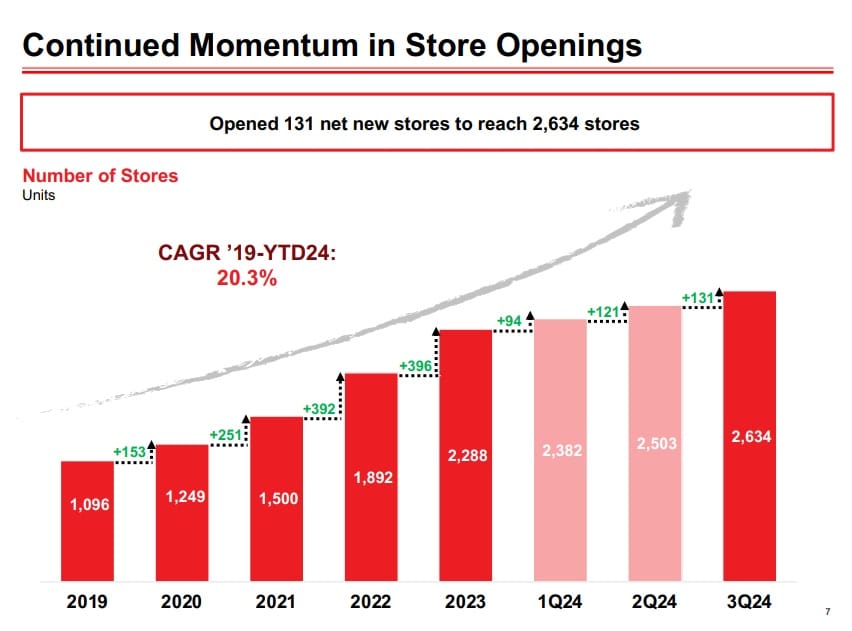

- In Q3 2024 alone, BBB Foods opened 131 new stores.

- EBITDA increased by 54% YoY due to operational efficiency.

5. Risk Factors

A. Trump’s Tariff Policies and Their Impact on Mexican Businesses

The tariff policies introduced by President Donald Trump’s second administration are creating multilayered disruptions for local Mexican businesses and the global supply chain.

a. Tariff Implementation Timeline and Delays

- A 25% tariff was initially set to take effect on February 4, 2025.

- However, negotiations with the Mexican government led to a conditional delay until March 4, 2025, based on Mexico’s commitment to deploying an additional 10,000 border police officers and intensifying drug enforcement measures.

- These tariffs could significantly impact U.S. manufacturers and traders, particularly in the automotive and semiconductor supply chains.

b. Gradual Tariff Increase Scenarios

The White House Council of Economic Advisers is internally reviewing a plan to gradually increase tariffs based on Mexico’s level of cooperation.

i) Proposed Tariff Increase Plan

- Base Tariff: 25%

- Phase 1: 50% (Immediate Implementation Possible)

- Phase 2: 75%

- Phase 3: 100% (Final Stage)

The automotive sector is at the center of these discussions, with additional restrictions and penalties emerging as a key issue.

B. High Debt Levels

1. Short-Term and Long-Term Debt

As of September 2024, BBB Foods holds approximately $517 million in debt maturing within one year and an additional $345 million in long-term debt. This substantial debt burden poses challenges to the company’s financial stability and may create difficulties in managing cash flow.

2. Debt Repayment Capacity

Although BBB Foods currently holds $214 million in cash reserves, its total debt far exceeds this amount, raising concerns about short-term liquidity risks. This imbalance suggests potential difficulties in meeting its debt obligations on time.

C. Profitability Challenges

BBB Foods has reported continuous losses over the past few years, recording a $15.5 million loss in 2024. Such financial setbacks threaten the company’s stability and could negatively impact future capital-raising efforts.

Currently, BBB Foods has a gross profit margin of 15.69% and an operating margin of just 1.9%. These low profitability figures indicate that management must implement strategic improvements to enhance financial performance.

D. Operational Risks

BBB Foods is rapidly expanding its store network at an aggressive pace. While this expansion fuels revenue growth, it also increases operating costs and presents management challenges related to scaling operations efficiently.

Furthermore, BBB Foods faces intense competition from large multinational retailers like Walmart, which dominate the Mexican grocery market. Competing against these industry giants may require significant investment in marketing, logistics, and customer acquisition strategies to maintain a competitive edge.

6. Future Vision & Outlook

A. Growth Potential

- Mexico’s population is expected to grow from 130 million to 140 million by 2025.

- Hard discount stores currently account for just 2% of the Mexican retail market, compared to 17% in Colombia and 40% in Germany.

- BBB Foods’ hard discount model and efficient operations serve as significant strengths in attracting price-sensitive consumers.

- The Mexican retail market is expected to grow at an annual rate of over 5% from 2025 to 2030.

B. Rapid Expansion

- In Q3 2024 alone, BBB Foods opened 131 new stores (+42% YoY).

- The company plans to open an additional 380–420 stores in 2024 (~1 store/day).

- Long-term projections indicate potential for up to 20,000 stores across Mexico.

Source : 2024Q3 TBBB Presentation

The cookie-cutter business model refers to a strategy where a successful store format is replicated across shopping malls and retail locations worldwide. Many highly successful companies in the retail sector, including McDonald’s, Walmart, Starbucks, and Taco Bell, have leveraged this model.

BBB Foods is also rapidly expanding across Mexico by implementing a cookie-cutter approach, rolling out identical store formats at scale. A key metric when evaluating this model is same-store sales growth:

- 3Q24 same-store salesincreased 11.6% compared to 3Q23

- 2Q24 same-store sales rose 10.7% compared to 2Q23

- 1Q24 same-store sales rose 14.8% from 1Q23

- 4Q23 same-store sales grew 14.9% versus 4Q22

BBB Foods is not only expanding its store footprint rapidly but also achieving strong same-store sales growth, reinforcing the effectiveness of its business strategy.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

BBB Foods is a hard discount supermarket chain that primarily targets price-sensitive consumers. The company has been experiencing consistent growth in revenue and net income, and as sales of private-label products increase, profit margins are also expected to improve. By adopting a cookie-cutter business model, BBB Foods continues to expand both its store count and same-store sales annually.

With a population of approximately 130 million. Mexico presents significant opportunities for expansion and a large consumer market. Additionally, hard discount supermarkets currently account for only 2% of the Mexican retail landscape, indicating substantial growth potential in the years ahead.

The rise of manufacturing plants in Mexico has contributed to an increase in per capita GDP and consumer spending. Furthermore, inflation-driven shifts in consumer behavior, such as extreme spending patterns and a growing preference for low-cost goods, are positively impacting BBB Foods’ sales.

However, risks remain, including President Trump’s tariff policies, political instability, economic policy shifts, and rising inflation, all of which could lead to a decline in consumer spending. As a result, a cautious investment approach is recommended.

.

0 Comments