With President Trump’s election victory, U.S. defense-related stocks have risen. Let’s explore the reasons behind this trend:

Increased Defense Budget Expectations:

President Trump has emphasized strengthening military power, which makes it highly likely that the defense budget will increase. During his first term, the defense budget saw significant growth, and similar trends are expected during his second term as well.

1. Military Modernization and Advanced Technology Investments:

Trump has highlighted investments in military modernization and the development of new technologies. This creates opportunities for defense contractors to benefit across various sectors such as missile defense systems, cybersecurity, and space military capabilities.

2. NATO Burden-Sharing Demands:

Trump has consistently urged NATO allies to increase their defense spending. If reelected, European countries are likely to boost their defense budgets in response.

3. Geopolitical Uncertainty:

Trump’s foreign policies often take unpredictable directions, potentially escalating geopolitical tensions. Such uncertainties can drive up demand for defense-related industries.

Source : https://www.politico.com/live-updates/2024/11/12/congress/elon-musk-vivek-ramaswamy-trump-00189209

Meanwhile, Elon Musk has been appointed as the head of the Government Efficiency Bureau.

President-elect Trump stated, “These two outstanding Americans will work together to dismantle government bureaucracy, eliminate excessive regulations, reduce wasteful spending, and pave the way for restructuring federal agencies.”

Elon Musk and SpaceX have frequently criticized excessive regulations for stifling innovation, expressing frustration over launch approval processes taking longer than rocket development itself. If Musk leverages his strong authority to remove excessive regulations hindering Tesla and SpaceX, rapid technological advancements in autonomous driving and aerospace sectors are anticipated.

While autonomous driving is a somewhat familiar concept, aerospace can feel like a broad term that’s harder to grasp. To clarify its scope, aerospace can be divided into four main categories:

1. Civil Aviation

- Commercial aircraft manufacturing: large passenger planes (e.g., Boeing, Airbus), regional aircraft, business jets

- General aviation: personal aircraft, business aircraft, recreational aircraft

- Commercial avionics (aviation electronics)

- Maintenance, repair & overhaul (MRO)

2. Military Aviation

- Military aircraft manufacturing: fighter jets, bombers, transport planes, reconnaissance planes, military helicopters

- Missile systems

- Military electronics and defense systems

3. Space Systems

- Satellite systems: communication satellites, observation satellites, navigation satellites

- Launch vehicles and rockets

- Space exploration systems

- Commercial spaceflight

4. Unmanned Aerial Systems (UAS)

-

Military drones

-

Commercial drones

-

Recreational drones

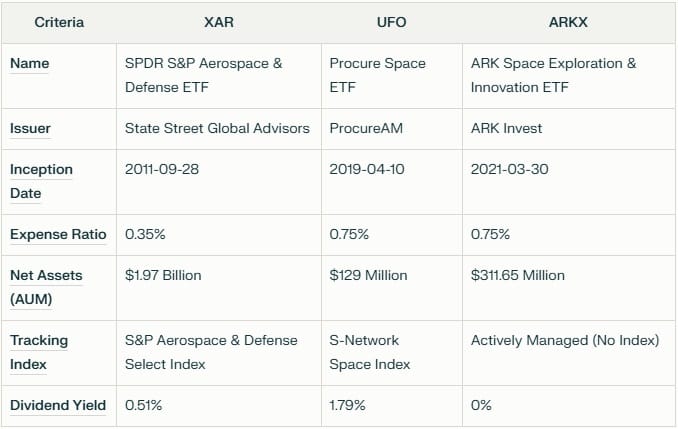

Identifying stocks that benefit from both Trump’s defense industry policies and Elon Musk’s deregulation efforts in aerospace is challenging due to the sheer number of U.S. defense contractors and the vast scope of aerospace industries. For non-expert investors unfamiliar with mechanisms or critical components of each company’s unique strengths or economic moats (competitive advantages), seeking expert assistance through ETFs may be a viable option. Today, we’ll introduce three Aerospace & Defense ETFs for comparison:

- XAR (SPDR S&P Aerospace & Defense ETF)

- UFO (Procure Space ETF)

- ARKX (ARK Space Exploration & Innovation ETF)

Here is the revised table with XAR, UFO, and ARKX on the X-axis:

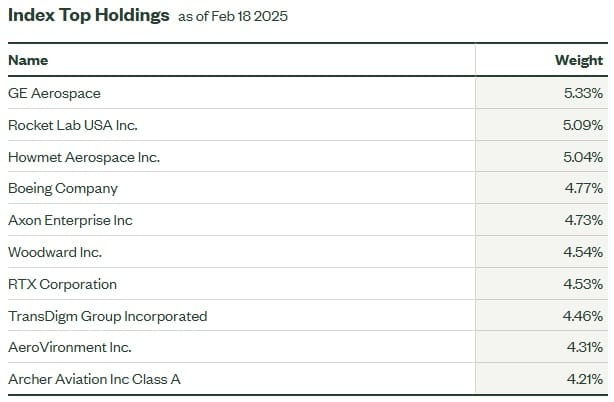

1. XAR (SPDR S&P Aerospace & Defense ETF)

XAR tracks the S&P Aerospace & Defense Select Industry Index and invests in U.S.-based aerospace and defense industries using an equal-weighting approach to maintain balanced exposure between large-cap and small- to mid-cap stocks. This method helps create a diversified portfolio that combines the growth potential of smaller companies with the stability of larger firms.

For long-term ETF investments, expense ratios are crucial since compounding costs over time can significantly impact returns. While other Aerospace & Defense ETFs like ITA (0.4%) or PPA (0.58%) exist, XAR has a lower expense ratio compared to its peers.

Top 10 Holdings of XAR (as of Feb 18, 2025):

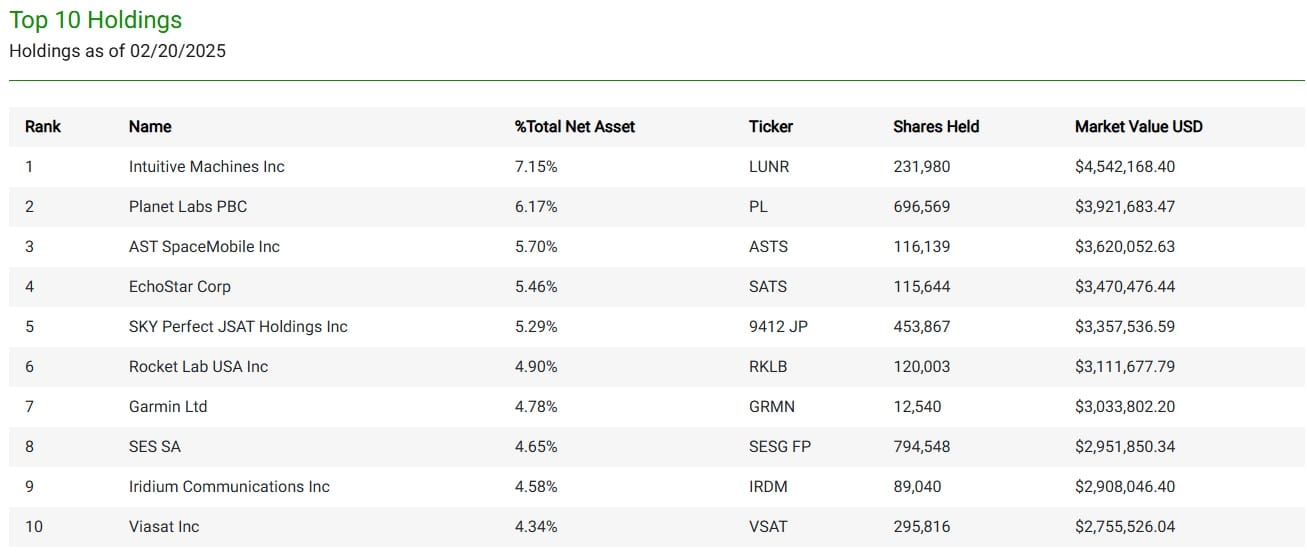

2. UFO (Procure Space ETF)

UFO tracks the S-Network Space Index. The criteria for inclusion provide insight into selected stocks: companies must generate “space revenues” by offering products or services reliant on space-based capabilities or operations conducted in space.

Key areas include:

-

Manufacturing/operating rockets & satellites

-

Ground equipment used in satellite systems

-

Space technologies & hardware

-

Space-based imagery & intelligence services

-

Communication services like TV/radio broadcasting

In simpler terms, UFO emphasizes satellite-based services and communication companies.

Though its high expense ratio of 0.75% may be burdensome for long-term investors, if you foresee Elon Musk’s SpaceX revolutionizing satellite technology in 5–10 years, this ETF could be worth considering.

Top 10 Holdings of UFO (as of Feb 20, 2025):

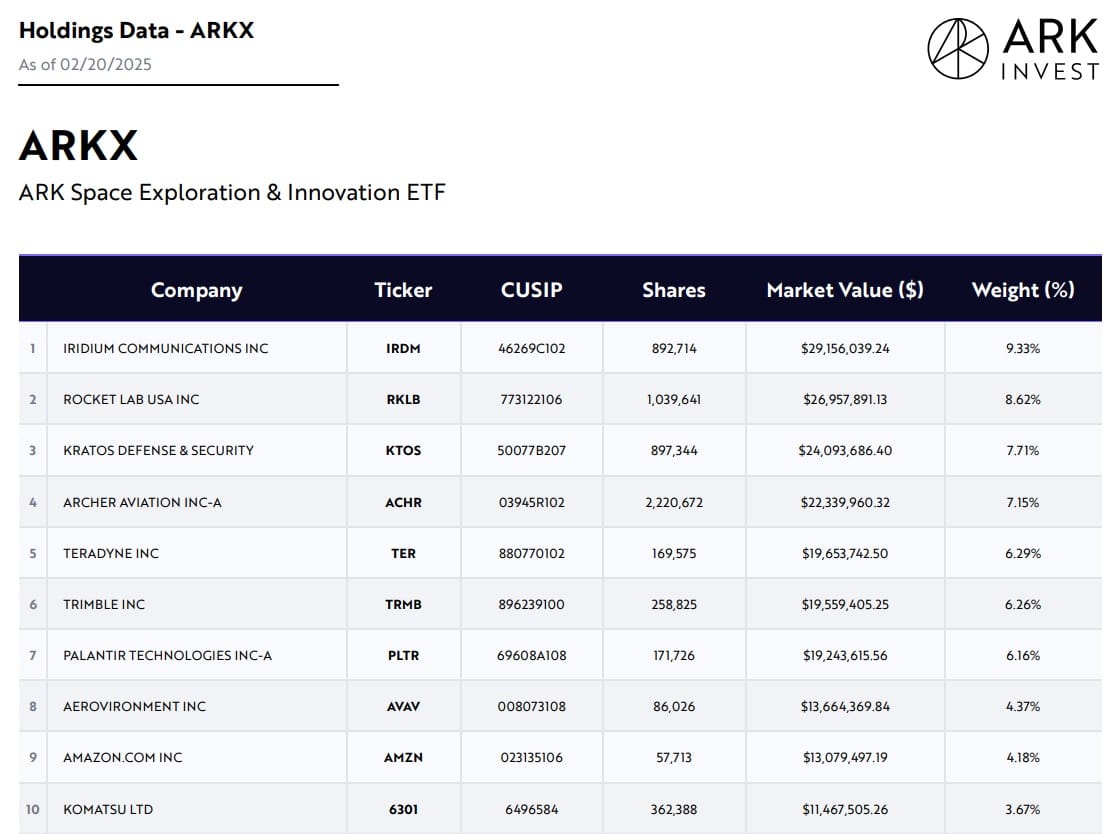

3. ARKX (ARK Space Exploration & Innovation ETF)

Managed by ARK Investment under CEO Cathie Wood, ARKX is an actively managed ETF that doesn’t track an index like XAR or UFO but instead selects stocks based on the management team’s judgment.

According to ARK Investment’s description:

Companies within ARKX focus on innovations across “SPACE,” defined as technology-enabled products/services occurring beyond Earth’s surface.

Key themes include:

-

Autonomous mobility

-

Intelligent devices

-

Advanced battery technologies

-

3D printing

-

Reusable rockets

-

Adaptive robotics

-

Neural networks

ARKX invests in innovative space exploration companies while also including major tech firms like Amazon, Palantir, Google, and Nvidia—offering lower sector risk due to diversification.

Active ETFs typically have higher expense ratios exceeding 1%, but ARKX offers a relatively lower fee at 0.75%. If you trust Cathie Wood’s vision and believe in an upcoming space age, this ETF might be worth exploring.

Top 10 Holdings of ARKX:

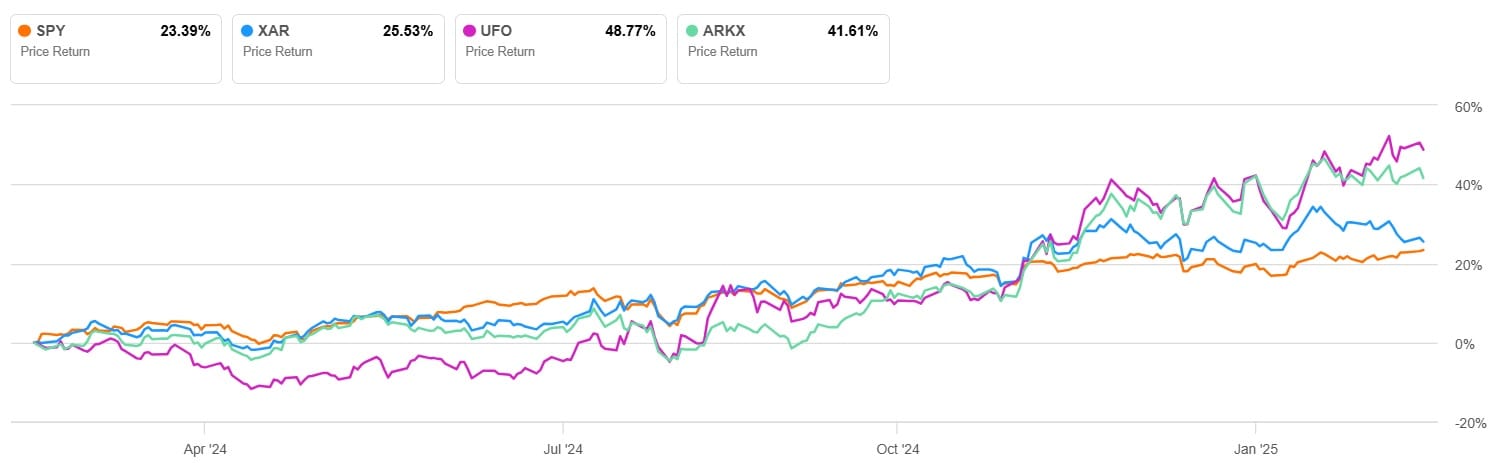

4. Comparison with SPY (S&P500 ETF)

Souce : Seekingalpha

All funds/ETFs are compared against SPY because most fail to outperform its returns over time after accounting for fees. However, this doesn’t guarantee that Aerospace & Defense ETFs will underperform SPY in the future either! If you have confidence in these sectors’ growth potential over time, consider long-term investments.

5. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

With President Trump’s election victory raising expectations for increased defense budgets, military modernization investments in advanced technologies like missile defense or cybersecurity are likely to benefit defense stocks significantly due to NATO demands or geopolitical uncertainties.

Additionally, Elon Musk’s appointment as head of deregulation could accelerate aerospace advancements by removing excessive regulatory barriers—potentially benefiting aerospace-related stocks as well.

Since individual investors may find it difficult to grasp intricate details about aerospace/defense industries or unique competitive advantages among companies within these sectors—leveraging ETFs managed by experts seems like a sound approach:

-

XAR focuses on stable aerospace/defense investments.

-

UFO emphasizes satellite-based services/communication firms.

-

ARKX targets innovative space exploration technologies.

If you see future growth opportunities within these ETFs’ holdings/goals—consider them for long-term investment!

0 Comments