December 12, 2024, President-elect Donald Trump visited the New York Stock Exchange (NYSE) for an interview with Jim Cramer regarding the stock market. The discussion covered several critical questions about the future of the United States. Here, we introduce one particularly interesting question from the interview.

Jim: You say you want to make the U.S. the king of artificial intelligence?

Trump: “We are going to be ahead of AI. Way ahead of AI. We have to produce tremendous amounts of electricity. We need more than twice what we already have.”

Apart from this, the interview covered topics such as stock purchases, corporate tax rate adjustments, big tech, and cryptocurrency.

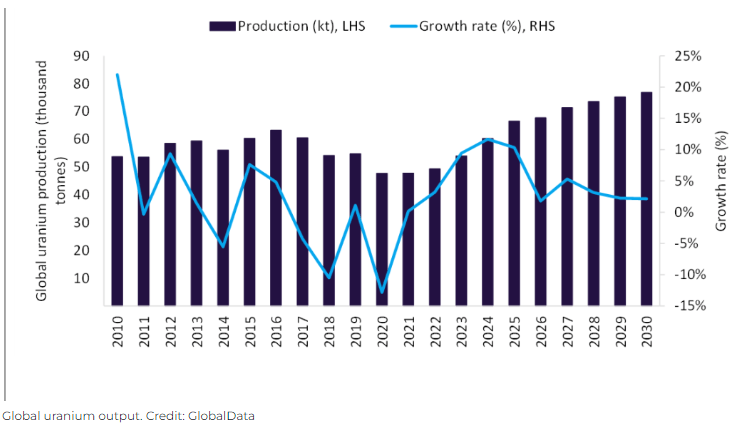

Expected Growth in Nuclear Power Capacity

- The International Atomic Energy Agency (IAEA) projects that global nuclear power capacity will increase 2.5 times by 2050.

- According to the International Energy Agency (IEA), nuclear power generation worldwide is expected to reach an all-time high by 2025.

Market Outlook

- The global nuclear power market is projected to grow from $34.43 billion in 2023 to $45.31 billion by 2032, at a compound annual growth rate (CAGR) of 3.10%.

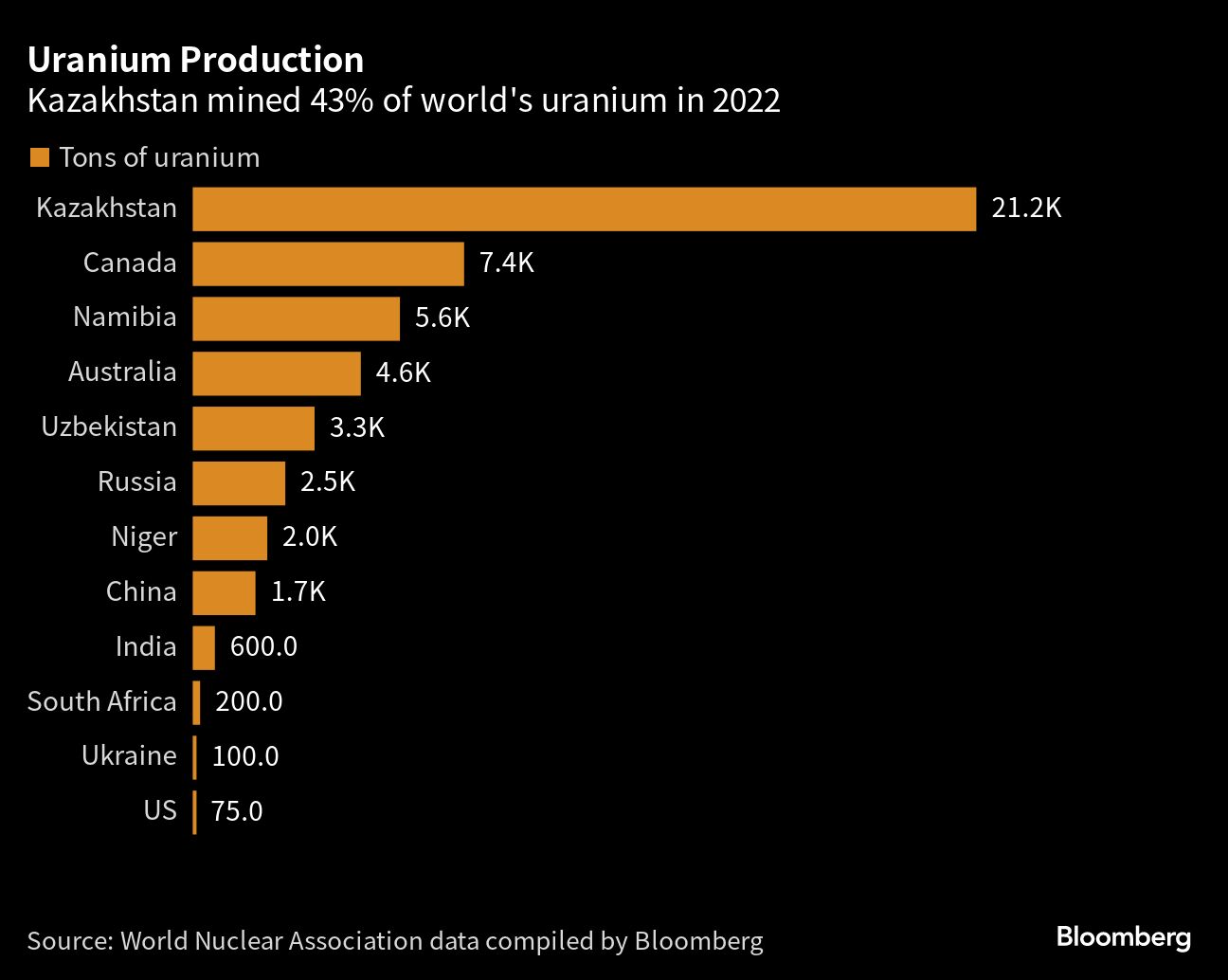

Top Uranium Producing Countries in 2022

Do you know which country leads in uranium production? It’s Kazakhstan, located in Central Asia.

Kazakhstan is the world’s largest uranium producer, accounting for 37.3% of global uranium supply as of 2023.

Just as oil-exporting countries experienced rapid economic growth due to rising oil demand, uranium-producing nations are expected to see significant economic expansion driven by increased uranium demand. This growth will lead to higher foreign exchange inflows, positively impacting the broader economy. The resulting effects include GDP growth, job creation, and technological advancement, all contributing to overall economic expansion.

As GDP per capita rises, consumer spending naturally increases, leading to more online and offline transactions and greater use of financial services. Amid this transformation, one noteworthy company stands out: Kaspi.kz AO – ADR (NASDAQ: KSPI), a tech company that has built Kazakhstan’s innovative financial ecosystem.

Before learning about Kaspi.kz, I had little knowledge of Central Asian countries. My preconceptions about Kazakhstan included an underdeveloped economy and a high reliance on cash transactions rather than card payments. However, I discovered that Kazakhstan’s financial ecosystem rivals China’s, with minimal cash usage and a strong presence of mobile payment services. Before diving into Kaspi.kz, let’s briefly introduce Kazakhstan as a country.

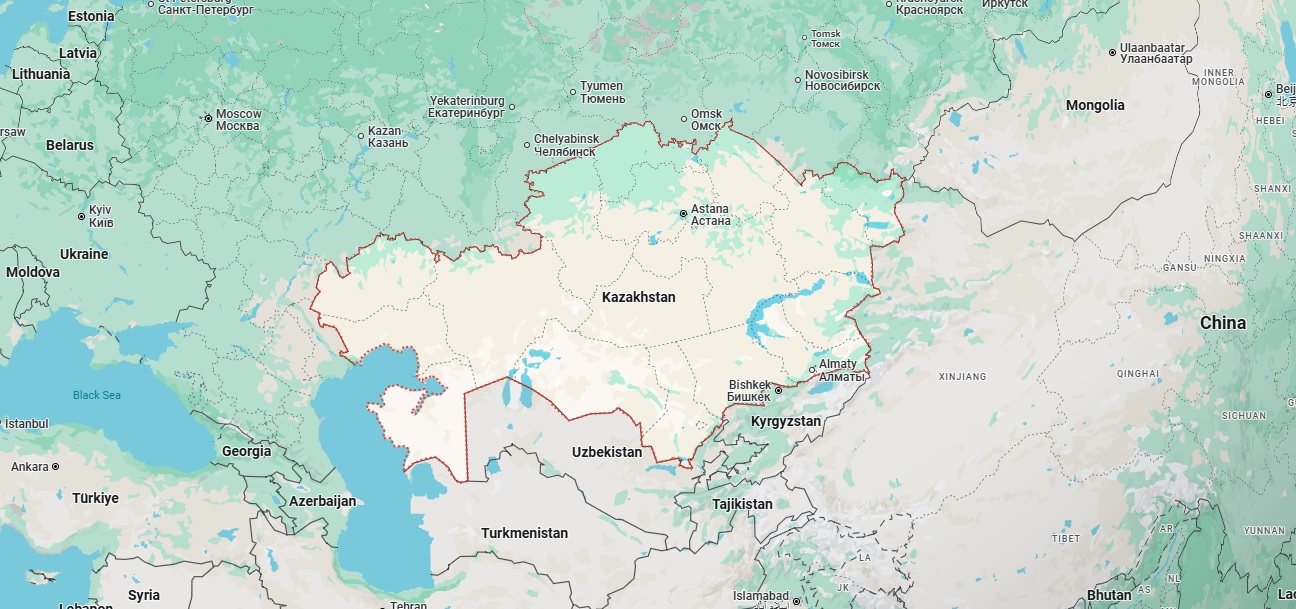

1. Introduction to Kazakhstan

Geography and Population

- Kazakhstan is the 9th largest country in the world and the largest landlocked nation.

- It has a population of approximately 20 million.

Political System

- Kazakhstan operates as a presidential republic.

- The government consists of the executive, legislative, and judicial branches.

- The president is the head of state and the highest-ranking official, determining the country’s key domestic and foreign policies.

Economy

- Kazakhstan’s economy relies heavily on oil and gas exports, accounting for approximately 35% of GDP and 75% of total exports.

- The estimated GDP growth rate for 2024 is 3.4%.

- Major industries include oil and gas extraction, mining, metallurgy, chemicals, machinery manufacturing, and agriculture.

Natural Resources

- Kazakhstan possesses abundant natural resources, including oil, natural gas, coal, iron ore, manganese, chrome ore, nickel, cobalt, copper, lead, zinc, bauxite, and uranium.

- It is also a major global wheat producer.

2. Company Overview

Kaspi.kz, founded in 2008 and headquartered in Almaty, Kazakhstan, offers payment, marketplace, and fintech solutions.

Kaspi.kz’s super app accounts for 68% of all electronic transactions in Kazakhstan, with 13.5 million users—nearly 70% of the country’s population.

Kaspi.kz has a market capitalization of approximately $19 billion.

3. Key Business Segments and Services

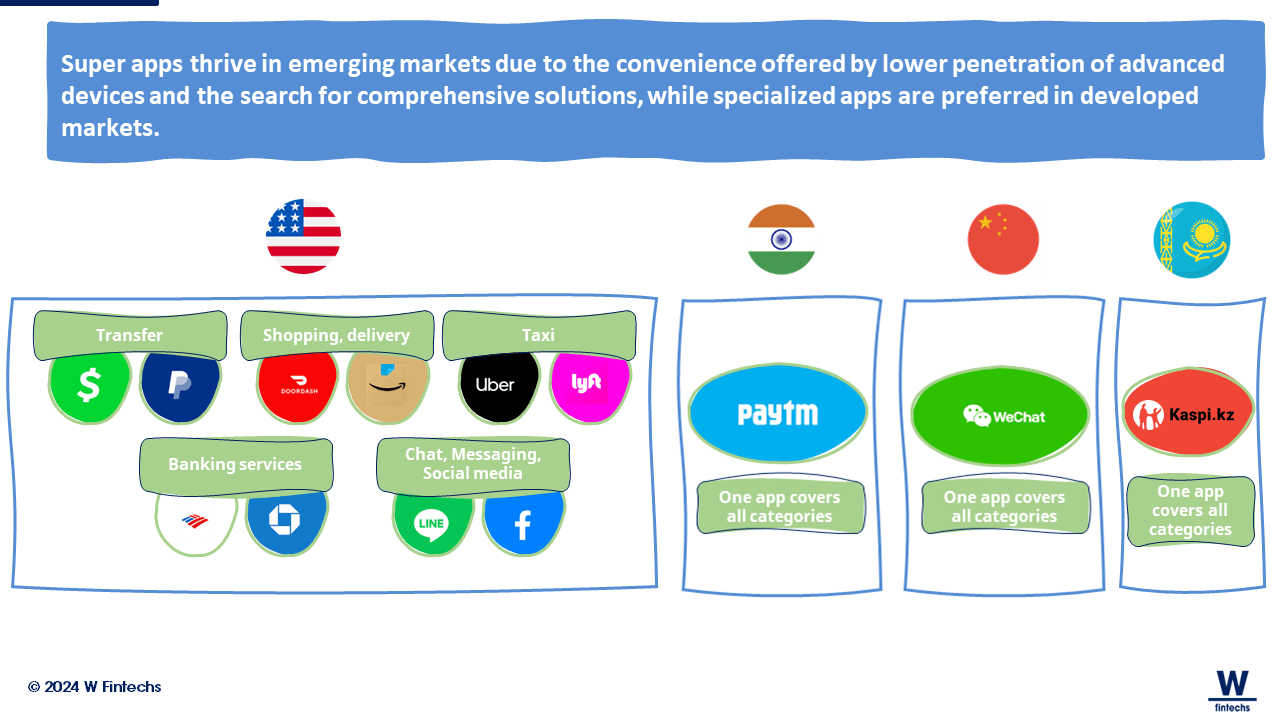

source : https://wfintechs.substack.com/p/107-kaspi-the-growth-strategy-of

A. Key Business Segments

Payments

Payments

-

- Provides services for shopping transactions, bill payments, and P2P transfers.

- Offers a simple payment system through Kaspi QR.

b. Marketplace

Marketplace

Marketplace

-

- Connects online and offline sellers with consumers.

- Provides free shipping services through e-commerce.

- Offers travel booking services via Kaspi Travel.

c. Fintech

-

- Provides BNPL (Buy Now, Pay Later), financial, and savings products.

- Offers financial services for merchants.

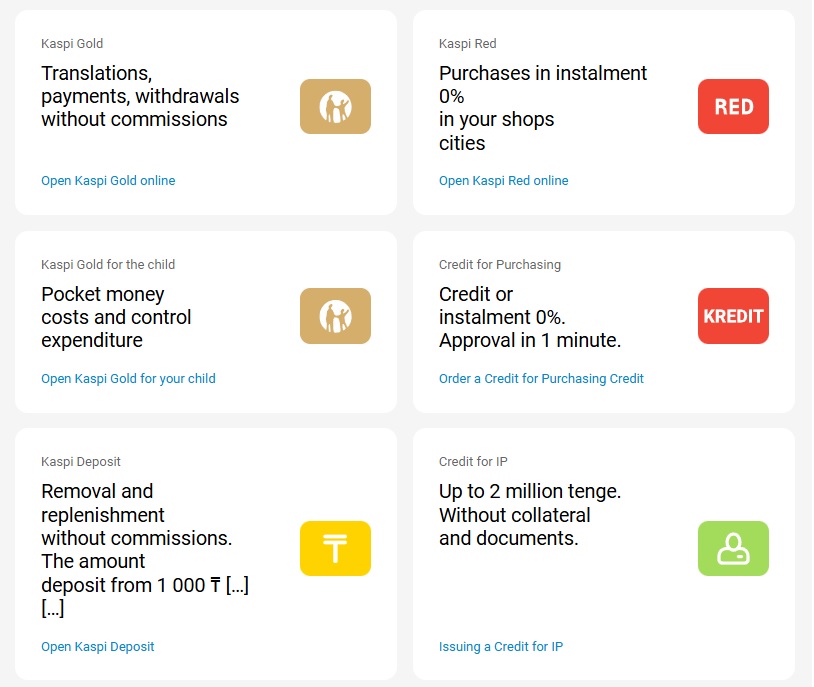

B. Key Services

- Kaspi.kz Super App: Integrates payments, shopping, and financial services.

- Kaspi Gold: Card and account services.

- Kaspi Red: Credit services.

- Kaspi Postomat: Automated parcel locker service.

4. Financial Performance

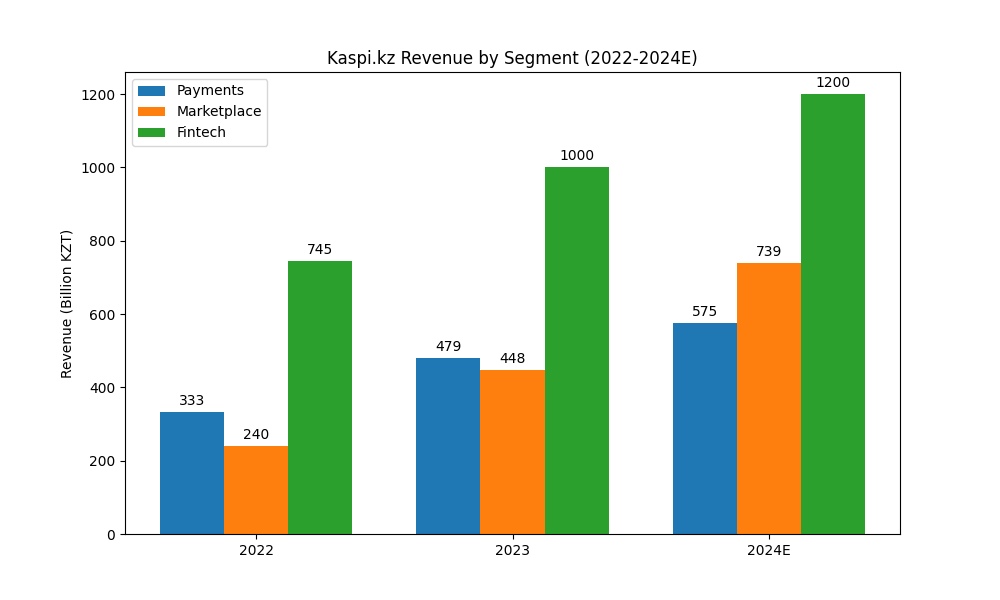

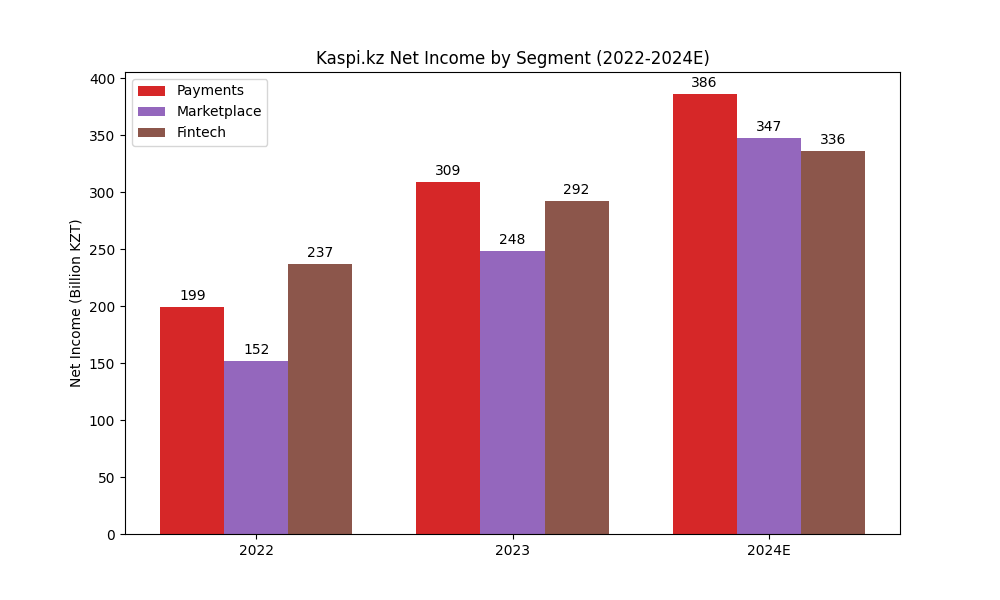

A. Revenue and Net Income Performance

- 2022: Revenue grew by 40% YoY, with adjusted net income up by 36%.

- 2023: Revenue grew by 51% YoY, with net income up by 44% and diluted EPS increasing by 45%.

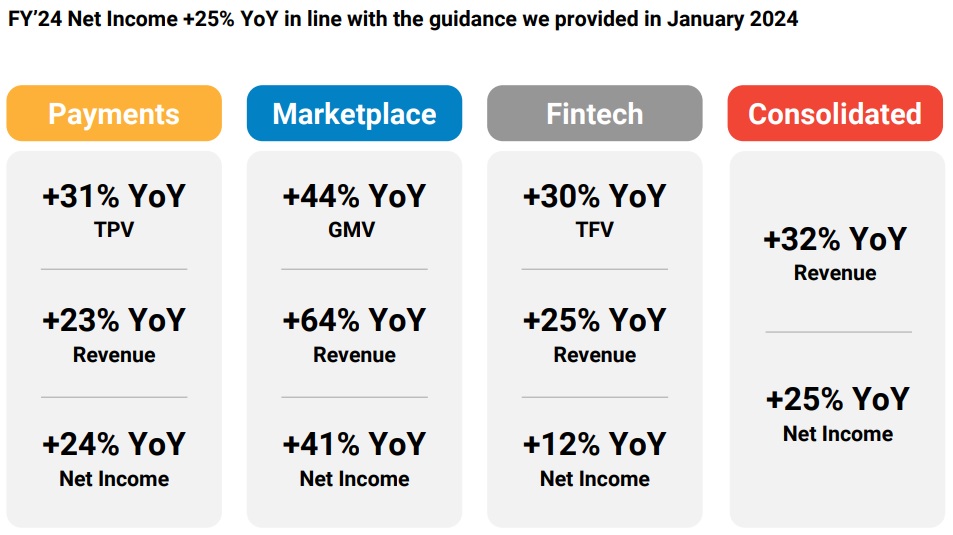

- 2024 :

- Payments: 23% YoY revenue growth.

- Marketplace: 64% YoY revenue growth.

- Fintech: 25% YoY revenue growth.

- Net income projected to grow 25% YoY.

B. Dividend Performance

- Current Dividend Yield: Around 6.7%–7.5% as of December 2024.

- Dividend Growth Rate: Approximately 13.66%–19.1%.

- Payout Ratio: ~66%–69.82%.

5. Competitive Advantages

A. Super App Model

Kaspi.kz has established a dual-sided platform business model through the Kaspi.kz Super App for consumers and the Kaspi Pay Super App for merchants.

- Integrates payments, marketplace, and fintech services into a single app

- Seamlessly connects transactions between customers and merchants, creating network effects

- Achieves structurally high profitability through synergies among various services

B. Closed-Loop Payment System

Kaspi.kz operates a self-sufficient payment network, eliminating reliance on external card networks like Visa and MasterCard.

- Dominates 66% of Kazakhstan’s total payment transaction volume

- Provides innovative payment services, including P2P transfers and QR code payments

- Builds its own payment infrastructure, achieving over 60% higher margins compared to traditional card networks like Visa and MasterCard

C. Data-Driven Financial Services

Kaspi.kz leverages advanced data analytics to enhance financial services:

-

- Real-time credit evaluation system enables loan approvals within seconds

- Offers BNPL (Buy Now, Pay Later) services integrated with the marketplace

- Utilizes customer data to provide personalized financial products

D. Integrated Marketplace

Kaspi.kz connects online and offline sellers with consumers through a fully integrated marketplace ecosystem:

-

- Effectively connects online and offline sellers with consumers

- Provides a unified shopping experience, including product search, reviews, and seller information

- Integrates logistics, financial, and marketing support services for merchants

6. Risk Factors

- Economic dependency on oil prices.

- Regulatory and legal uncertainties.

- Intense competition from global players.

- Risks associated with international expansion.

7. Future Vision and Strategy

A. Future Vision

a. Leading the Digitalization of Everyday Life

Kaspi.kz aims to digitize everyday financial, shopping, and payment experiences to enhance convenience for both consumers and merchants. To achieve this, the company is expanding its super app platform and continuously introducing new services and features.

b. Global Market Expansion

Kaspi.kz has set a long-term goal of reaching 100 million users and is actively expanding beyond Kazakhstan.

- Currently operates in Azerbaijan, Ukraine, and Uzbekistan

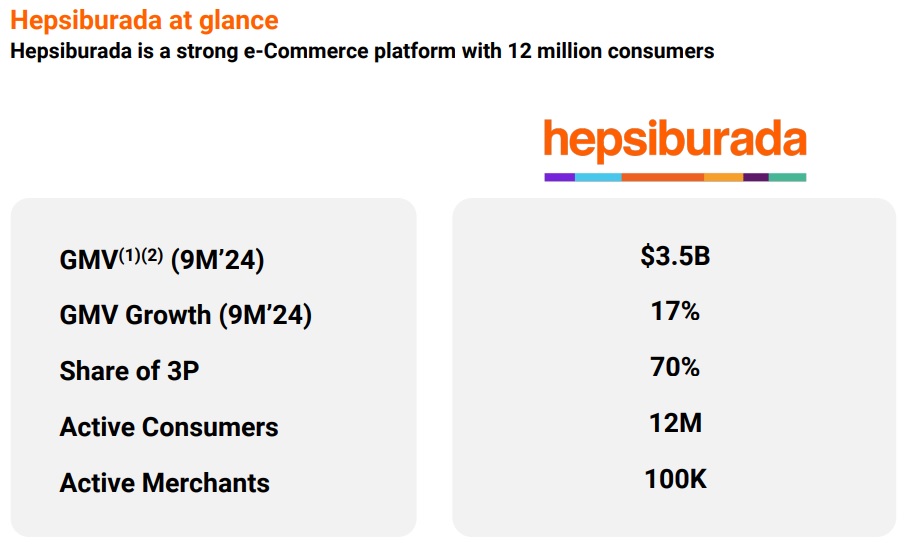

- Strengthened its global presence through the acquisition of Turkish e-commerce company Hepsiburada

c. Economic and Social Contribution

Kaspi.kz is committed to developing Kazakhstan’s digital economy by focusing on:

- Technological innovation

- Economic diversification

- Attracting foreign investment

B. Growth Drivers

a. Expansion of the Super App Model

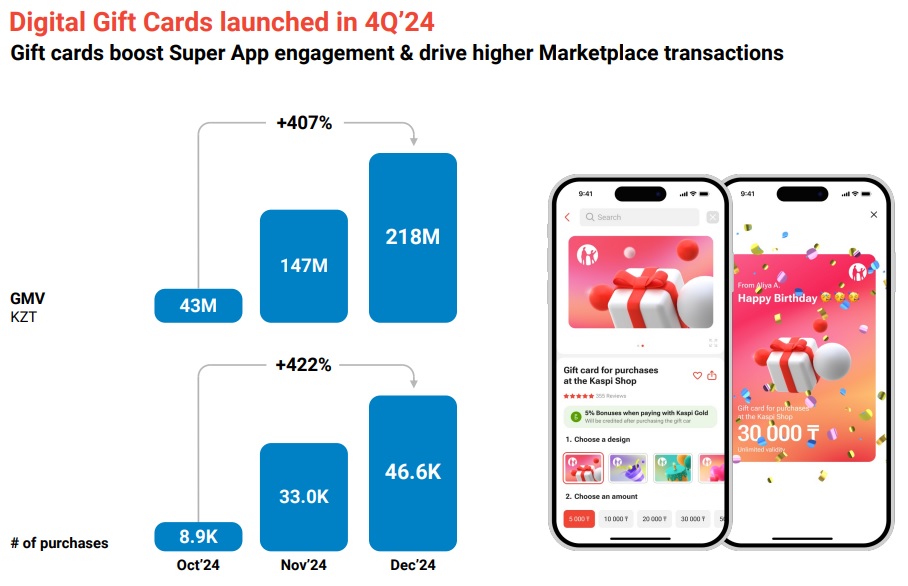

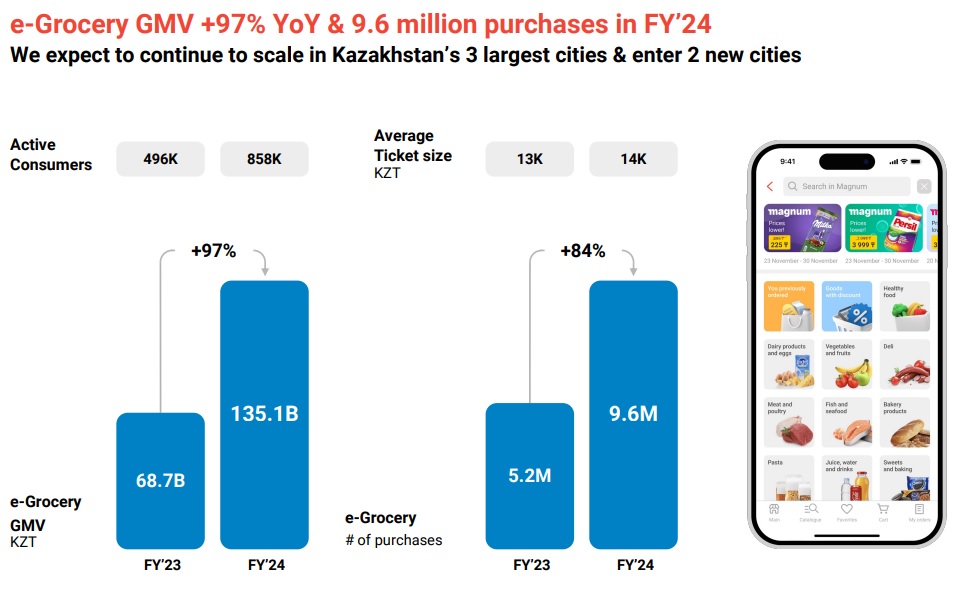

Kaspi.kz’s integrated payments, marketplace, and fintech platforms drive high user engagement and transaction volume growth. The company is enhancing consumer experiences by introducing new, vertically integrated services:

- Kaspi Travel – Travel booking services

- e-Grocery – Online grocery shopping & delivery

- e-Cars – Vehicle-related services

- Digital Gift Cards – Expanding digital payment options

b. Development of New Services

Kaspi.kz is diversifying its revenue streams by launching new services such as Kaspi Tours (travel packages) and advertising solutions. The digital advertising market and B2B payment platforms are expected to be key growth areas in the future.

- The Kaspi Fresh e-grocery delivery service is experiencing rapid growth and currently operates in 10 cities, with ongoing expansion.

- Consumer finance is also expanding, with strong growth in the ‘Buy Now Pay Later’ (BNPL) service and an increasing consumer loan portfolio.

c. Structural Growth of Digitalization

The rapid digital transformation in Kazakhstan and neighboring regions continues to drive demand for Kaspi.kz’s services.

- A young and growing population and rising income levels create a favorable environment in Kaspi.kz’s core markets.

d. Attracting Global Investment

- Kaspi.kz has gained international investor attention through its NASDAQ listing.

- The company is leveraging this to secure funding for further technological development and global expansion.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Kaspi.kz is a company in Kazakhstan that provides payment, marketplace, and fintech solutions. To put it into perspective, you can think of it as an all-in-one platform combining Uber, Bank of America, PayPal, Facebook, and Amazon in the U.S.

Kaspi.kz’s super app dominates 68% of all electronic transactions in Kazakhstan and serves 13.5 million customers, nearly 70% of the country’s population. The company primarily focuses on Payments, Marketplace, and Fintech, achieving strong annual growth rates. Its recent dividend yield ranges from approximately 6.7% to 7.5%, with a dividend growth rate of 13.66% to 19.1%, making it an attractive high-dividend stock.

Kaspi.kz’s competitive advantages include:

- A fully integrated super app model

- A closed-loop payment system with its own infrastructure

- Data-driven financial services

- A seamlessly connected online and offline marketplace

However, there are risks to consider, such as Kazakhstan’s economic volatility, regulatory and legal uncertainties, competition from global corporations, and challenges associated with international expansion.

Kaspi.kz’s future vision is to continuously expand its super app platform, introduce new services and features, and lead the digitalization of everyday life. Additionally, the company aims to expand into global markets, targeting 100 million users. It has already launched services in Azerbaijan, Ukraine, and Uzbekistan, and has strengthened its global presence through the acquisition of the Turkish e-commerce company Hepsiburada.

Ultimately, Kaspi.kz is a stock that combines strong growth potential with high dividends. If you can confidently deliver a two-minute investment pitch about this company, it may be worth considering as an investment opportunity.

0 Comments