Running Trends in 2024

In 2024, running gained significant popularity in the United States. This surge led to an increase in both the number of participants in running events and the number of running clubs.

On June 20, 2024, RunSignUp, a leading technology platform for endurance events, released a mid-year update on race trends. Data from early 2024 indicated a continued rise in race participation, higher registration fees, and a gradual increase in younger runners joining races.

On average, race registrations increased by 8% compared to 2023.

Source: RunningUSA

Chloe Thompson, a spokesperson for Strava, mentioned in an interview with CNN:

“More than 20% of weekend runs are done with at least one other person,” she said, adding that the number of weekend runs involving groups of at least six people has been increasing by 12% annually.

Why Has Running Become So Popular?

CNN attributes the sudden surge in running’s popularity to the potential for romantic connections.

Source: https://edition.cnn.com/2024/11/25/health/running-romance-wellness/index.html

Are People Choosing Running Clubs Over Dating Apps?

NBC News reported that many people now prefer to meet potential partners in real life rather than through dating apps.

Excerpt from an NBC News interview:

People want to meet “In Real Life.”

“By meeting people in person, you can catch the vibe immediately,” she said.

According to data from Match Group, which owns Tinder and Hinge, the number of people willing to pay for dating apps like Tinder declined in 2024.

Source: https://www.nbcnews.com/news/nyc-running-clubs-dating-market-singles-apps-rcna167424

During the pandemic, dating apps became the primary way for people to connect. However, these platforms were often cumbersome, costly, and made it difficult to gauge chemistry through text messages alone. As a result, post-pandemic daters have turned to in-person interactions, with running clubs meeting this demand.

Source: LUNGE Running Club

https://www.nbcnews.com/news/nyc-running-clubs-dating-market-singles-apps-rcna167424

LUNGE is a running club specifically designed for dating. Participants wear black clothing to signal that they are single.

Consumer Spending on Running Gear

A survey by RunningUSA examined runners’ spending patterns:

-

24.9% of respondents spend over $400 annually on running shoes, purchasing an average of three pairs.

-

24.7% spend between $301 and $400, while 24.8% spend between $101 and $200.

-

For running apparel:

-

29% spend between $100 and $200.

-

21% spend between $201 and $300.

-

20% spend under $100.

-

As more people take up running, the demand for running shoes continues to grow. Today, we introduce On Holding AG (NYSE: ONON), a company specializing in premium running shoes.

1. Company Overview

On Holding AG (NYSE: ONON) is an innovative running shoe and sports apparel brand founded in Switzerland in 2010. It has a market capitalization of $19 billion. Most On products are priced around $200, positioning the brand in the premium segment.

2. On’s Proprietary Technologies

A. CloudTec®: Walking on Clouds

CloudTec® is a Swiss-engineered innovation that compresses vertically and horizontally based on individual foot movement, providing targeted cushioning. It is a core feature of all On shoes.

Key design elements include an arched outsole, recessed midsole, and perforated outsole.

B. Cyclon™: Sustainable Running Products

Cyclon shoes and apparel are made from high-quality, renewable materials and are fully recyclable. Shoes made with Cyclon technology contain 90% recycled materials.

C. LightSpray™: Minimizing Waste

LightSpray™ is an advanced manufacturing innovation that simplifies multiple production processes into a single three-minute step, significantly reducing waste and CO2 emissions by up to 75% compared to other On racing shoes.

3. On’s Corporate Vision: Built on Innovation, Design, and Sustainability

On’s corporate vision, “built on innovation, design, and sustainability,” is founded on these three core principles. Among them, sustainability is a key focus for the company.

On prioritizes sustainability because it believes that environmental responsibility serves as the foundation for technological advancements and design innovation. By emphasizing sustainability, the company positively influences consumer perception, leading to increased purchases and stronger brand loyalty.

A company’s philosophy defines its purpose and the fundamental principles guiding its business operations. The more investors and consumers understand and resonate with this philosophy, the more trust they place in the company, making long-term investment decisions more compelling.

A. Foundations

- Reducing overall environmental impact (e.g., cutting greenhouse gas emissions, eliminating coal use by suppliers, increasing renewable electricity use).

- Improving accountability, traceability, and regulatory compliance throughout the product lifecycle.

B. Material Innovation

- Advancing materials and production processes for greater durability and sustainability.

- Example: CleanCloud® Technology, which captures carbon monoxide (CO) emissions from steel mills to create sustainable materials.

C. Circularity

C. Circularity

- Developing circular business models and recycling initiatives.

- Onward™ Program: Collects and resells used products.

- Cyclon™ Program: Subscription-based circular running shoe model ($29.99/month).

D. Social Impact

- Ensuring fair, safe, and inclusive working conditions.

- Supporting mobility rights for all individuals.

4. Financial Performance

A. 2023 Results

- Revenue: CHF 1.792 billion (+46.6% YoY)

- Gross Profit: CHF 1.067 billion (+55.8% YoY)

- Operating Income: CHF 180.2 million (+111.8% YoY)

- Net Income: CHF 79.6 million (+37.9% YoY)

- Gross Margin: 59.6%

B. 2024 Projections

- Expected Revenue: CHF 2.303 billion (+32% YoY)

-

Q3 Revenue: Q3 revenue was CHF 635.8 million, a 32.3% increase compared to the same period last year.

-

Gross Profit Margin: Q3 gross profit margin was 60.6%, the highest since the company went public.

-

Adjusted EBITDA Margin: Adjusted EBITDA margin was 18.9%, an improvement from 16.9% in the same quarter of the previous year.

- Continued DTC (Direct-to-Consumer) growth (DTC sales up 39% YoY, accounting for 38% of total revenue).

5. Growth Strategy for 2026 Goals

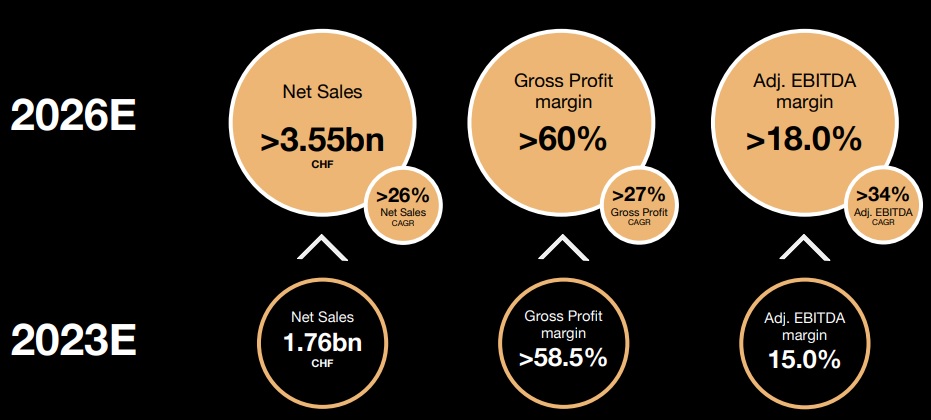

Forecast for Net Sales, Gross Profit Margin, and Adjusted EBITDA Margin from 2023 to 2026

- Brand Awareness & Community Expansion: Strategic marketing through events like the Paris Olympics.

- Geographic Expansion via Multichannel Strategy: Strengthening DTC sales and wholesale partnerships, with APAC revenue up 85% and two flagship stores planned in China.

- Product Portfolio Expansion through Innovation: Investing in R&D to introduce new technologies and expand into apparel.

- Operational Efficiency Improvements: Automating supply chain operations, targeting 18%+ EBITDA margin by 2026.

- Premium Positioning Strategy: Maintaining premium pricing with no discounting, differentiating from Nike and Adidas.

- Strong Balance Sheet: CHF 750 million in cash with no debt.

6. Risk Factors

- Market Competition: Competes against major brands like Nike and Adidas.

- Supply Chain Risks: 85% reliance on third-party manufacturers.

- Economic Uncertainty: High pricing limits accessibility for price-sensitive consumers.

- Limited Product Diversification: Over 90% of revenue comes from running shoes and apparel.

- High P/E Ratio: Compared to competitors, On trades at a premium valuation.

Comparison of PER (Price-to-Earnings Ratio) for Nike, Crocs, and Birkenstock

7. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

On Holding AG (NYSE: ONON) is an innovative running shoe and sports apparel brand founded in Switzerland in 2010. The CloudTec®, Cyclon™, and LightSpray™ technologies applied to On’s footwear exemplify the company’s commitment to innovation.

The key driver of On’s financial performance is the growth of its Direct-to-Consumer (DTC) channel, which has led to increased revenue, profit margins, and EBITDA margins. The company’s growth strategy to achieve its 2026 goals includes expanding brand awareness and community engagement, geographic expansion through a multichannel strategy, product portfolio diversification through innovation, improving operational efficiency, maintaining a premium positioning strategy, and leveraging a strong balance sheet. When evaluating On’s performance, it is essential to assess how well these factors are being executed.

On’s corporate vision, “built on innovation, design, and sustainability,” is founded on these three principles. Among them, sustainability is a key focus for the company.

On’s sustainability efforts are based on four key pillars:

- Foundations – Reducing environmental impact through emissions reduction, renewable energy adoption, and responsible sourcing.

- Material Innovation – Advancing materials and production processes for greater durability and sustainability.

- Circularity – Developing circular business models and recycling initiatives to minimize waste.

- Social Impact – Ensuring fair, safe, and inclusive working conditions while promoting mobility rights.

These four pillars form the foundation of On’s vision. Consumers who align with and support this vision are more likely to continue purchasing On products, contributing to long-term sales growth and brand loyalty.

On faces several risk factors, including market competition, supply chain risks, economic uncertainty due to its premium pricing strategy, lack of product diversification, and a higher price-to-earnings (P/E) ratio compared to industry peers. Among these, the high P/E ratio is particularly noteworthy. A high P/E ratio does not necessarily indicate overvaluation—it often reflects strong growth expectations. As long as On’s fundamentals remain solid, a high P/E ratio should not be a deterrent, making long-term investment in the company a viable option.

0 Comments