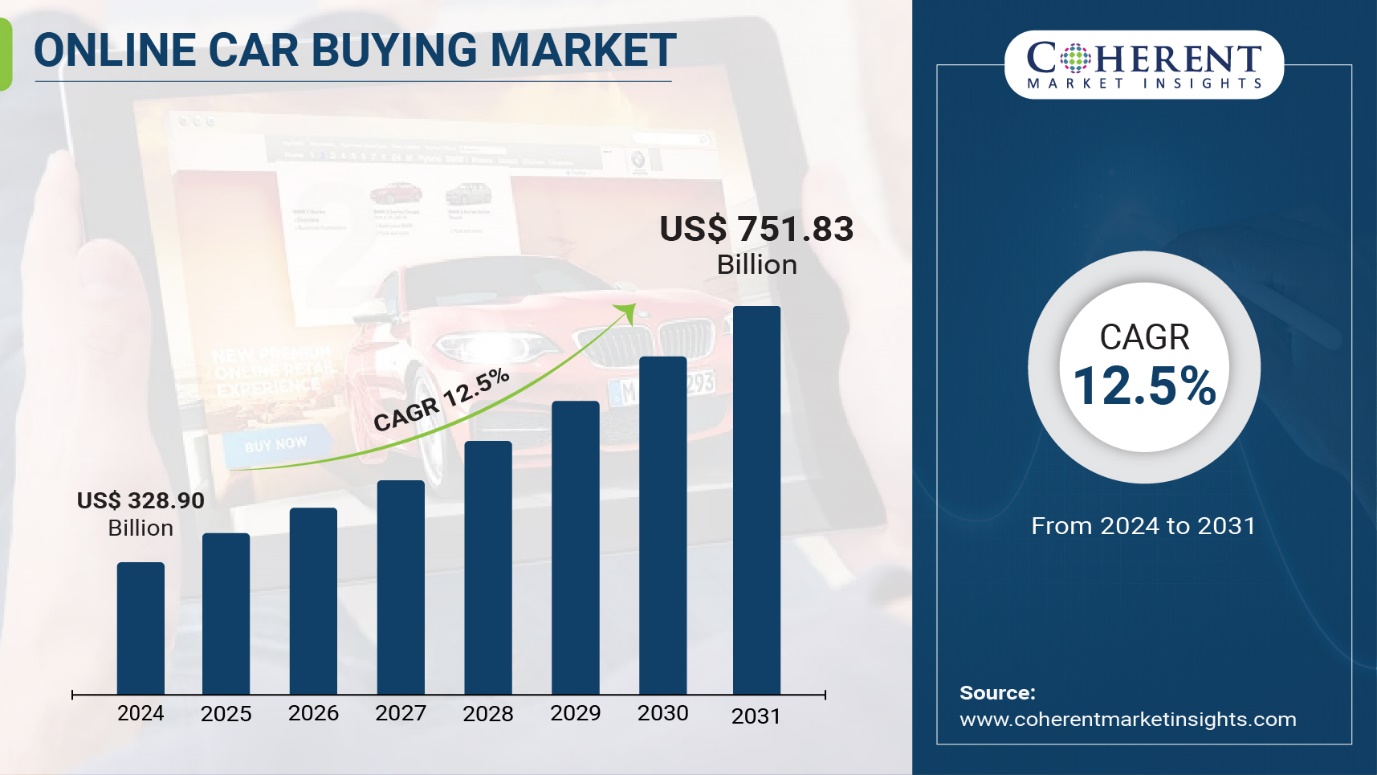

“Consumers are increasingly completing some or all of their vehicle transactions online. According to Cox Automotive, 39% of car dealers now facilitate the entire purchasing process online. In comparison, in 2019, only about one in ten buyers completed the entire transaction digitally, and even fewer finalized delivery online. As digital transactions replace traditional dealership visits, automotive retailers are prioritizing seamless online experiences to meet consumer preferences and engage customers where they are.”

(Excerpt from an article)

Key Advantages of Online Car Purchases

- Convenience: Browse vehicles comfortably from home.

- Transparency: Easily compare prices across platforms.

- Freedom of Choice: Select a vehicle without sales pressure.

- Additional Services: Access real-time consultations and virtual test drives.

Growth of the Online Used Car Market

These advantages contribute to the rising trend of online car purchases in the U.S. Leading platforms such as Carvana (NYSE: CVNA) and CarMax (NYSE: KMX) are expected to be the top online automotive retailers in 2024, gaining consumer trust.

These advantages contribute to the rising trend of online car purchases in the U.S. Leading platforms such as Carvana (NYSE: CVNA) and CarMax (NYSE: KMX) are expected to be the top online automotive retailers in 2024, gaining consumer trust.

Both Carvana and CarMax operate as major sellers and buyers, offering vehicles with minimal damage and mechanical issues, which significantly boosts consumer confidence.

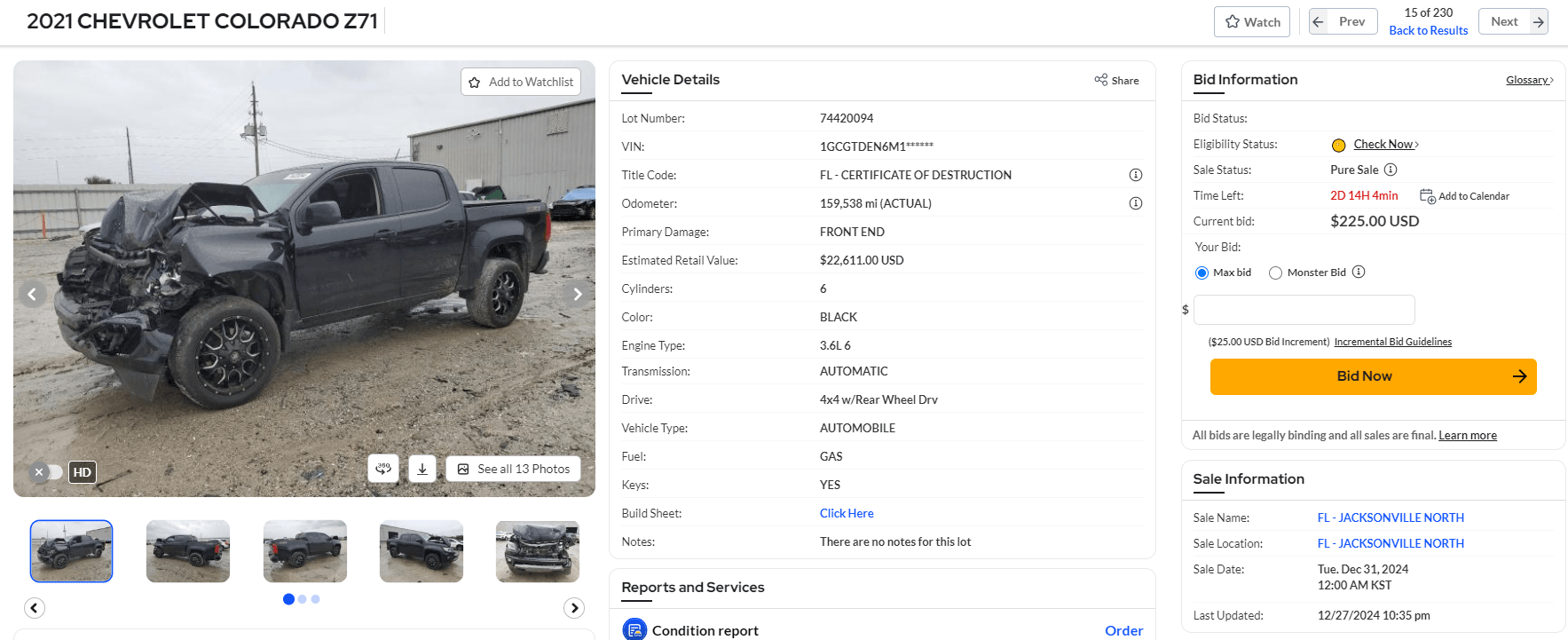

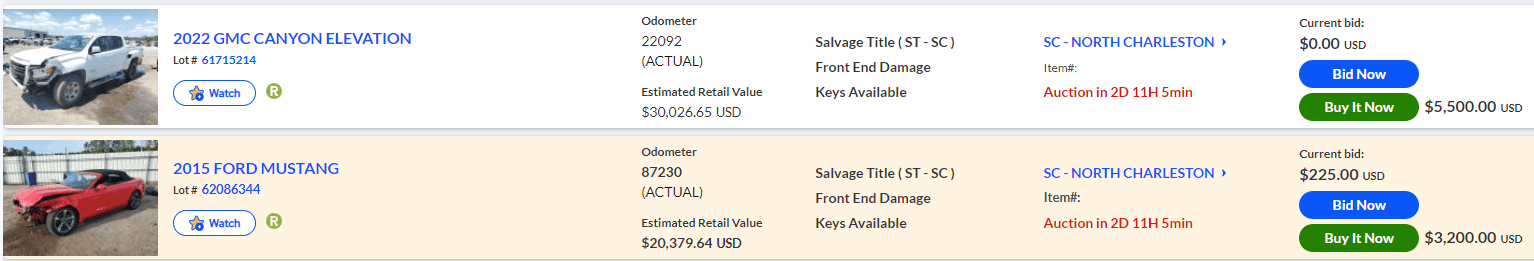

However, other companies have adopted different strategies, such as Copart, Inc. (NASDAQ: CPRT). Unlike Carvana and CarMax, Copart specializes in selling damaged or non-operational vehicles to dismantlers, repair license holders, used car dealers, exporters, and the general public.

1. Company Overview

Copart, Inc. (NASDAQ: CPRT) is a global leader in online vehicle auctions. Founded in 1982 and headquartered in Dallas, Texas, Copart operates in 11 countries across North America, Europe, and the Middle East. The company processes over 3.5 million transactions annually and has a network of more than 750,000 registered buyers. Copart’s market capitalization stands at $56.9 billion.

2. Copart’s Business Model

A. Sellers and Buyers

- Sellers: Primarily insurance companies (81%), along with dealers, individuals, charities, rental companies, banks, and financial institutions.

- Buyers: Dismantlers, rebuilders, repair license holders, used car dealers, exporters, and the general public.

Unlike typical online used car retailers, where sellers are mostly private consumers, Copart’s main sellers are insurance companies. Why do insurance companies sell damaged vehicles through Copart?

a. Economic Efficiency

- Total Loss Vehicle Management: When repair costs exceed a vehicle’s value, insurance companies declare the vehicle a total loss. Copart provides an efficient way to dispose of these vehicles.

- Cost Reduction: Using Copart helps insurers cut repeated towing and storage expenses.

- Quick Value Recovery: Copart’s auction system allows insurers to recover value from damaged vehicles swiftly.

b. Process Optimization

- Comprehensive Management: Copart handles everything from vehicle collection to auctions and payment processing, reducing insurers’ administrative burdens.

- Automated Auctions: Insurers can leverage Copart’s digital auction platform for a seamless sales process.

B. Revenue Model

a. Auction Revenue

Copart generates revenue through vehicle auctions, with transaction fees as its primary income source. Sales occur via preliminary online auctions and real-time auctions.

b. Additional Service Fees

- Storage Fees: Charges for vehicle storage.

- Transportation Fees: Revenue from vehicle transport services.

- Listing Services: Fees for showcasing vehicles in auctions.

- Seller Fees: Fees paid by insurers or individuals selling vehicles.

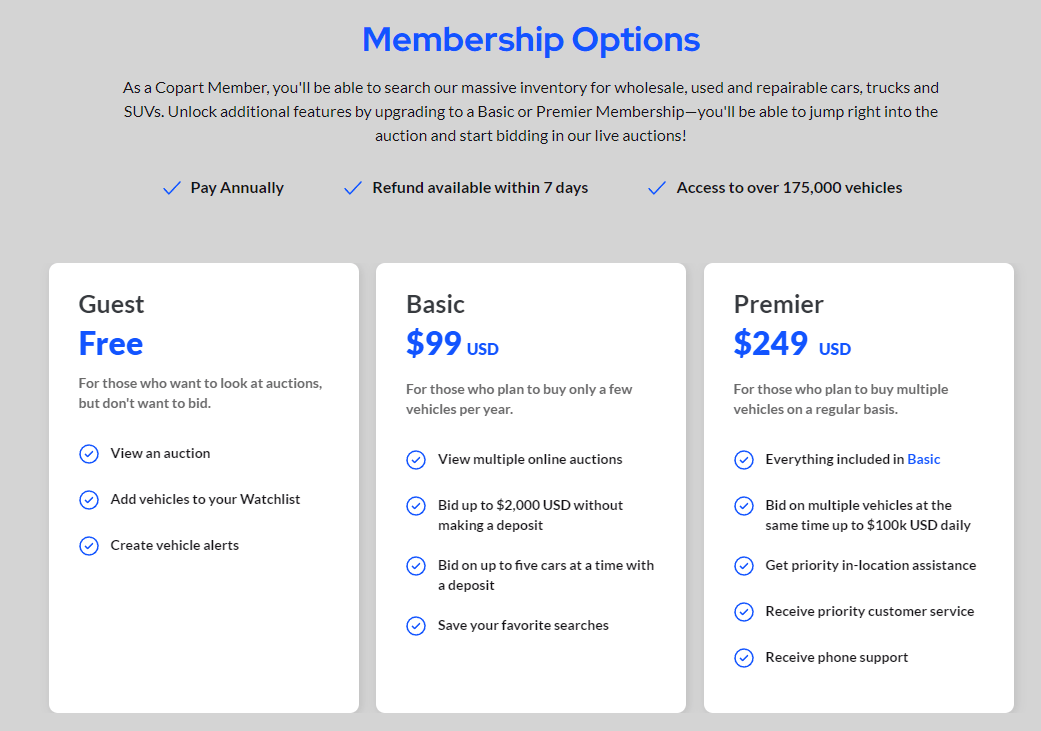

c. Membership Services

- Copart offers a membership model for auction participation, with additional premium features.

- Members pay sign-up and annual maintenance fees.

D. International Sales

Operating in 11 countries with over 250 facilities, Copart conducts vehicle auctions globally, generating substantial international revenue.

3. Key Services

A. Online Vehicle Auctions

Copart provides real-time digital auctions through its proprietary Virtual Bidding Third Generation (VB3) platform.

B. Vehicle Remarketing

The company connects vehicles from insurance companies, banks, financial institutions, charities, fleet operators, and dealers with buyers worldwide.

C. Value-Added Services

Copart offers transportation, storage, title transfer, and residual value estimation services.

D. Vehicle Inspection & Reporting

Detailed reports, photos, and videos help buyers assess vehicle conditions.

What is the VB3 (Virtual Bidding Third Generation) Auction System?

VB3 (Virtual Bidding Third Generation) is Copart’s proprietary, patented platform designed for online vehicle auctions. As a core technology in Copart’s business model, VB3 plays a crucial role in streamlining and enhancing the auction process with the following key features and functions:

A. Key Features

- Real-Time Bidding: Buyers can participate in live auctions from anywhere in the world.

- Two-Stage Bidding Process: The system maximizes buyer participation through a preliminary bidding phase followed by a final, internet-exclusive auction.

- Global Accessibility: Over 750,000 registered buyers from more than 170 countries can join the auctions.

- Mobile Optimization: Seamless auction participation via apps available for iOS, Android, and Windows Phone.

- Buy It Now Option: Some vehicles can be purchased immediately without waiting for an auction.

B. Business Impact of VB3

- Copart facilitates the sale of over 3 million vehicles annually through VB3.

- More than 60% of auctions are now conducted via mobile apps.

- VB3 is a key driver in maintaining Copart’s leading position in the global market.

- An average of 40,000 bidders participate daily, with up to 5,000 bidders in a single auction.

4. Financial Performance

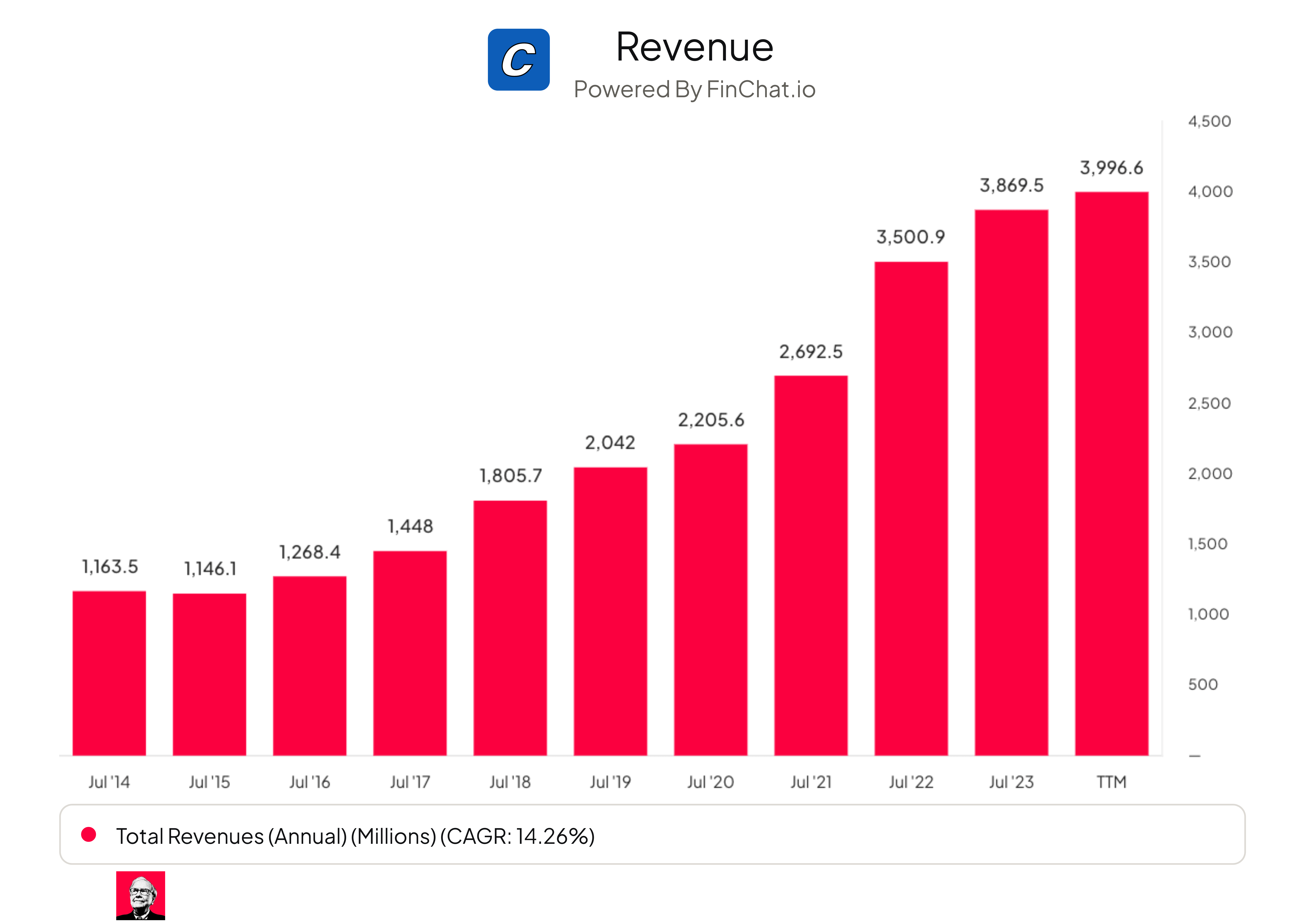

A. Revenue Growth

Copart has demonstrated consistent revenue growth over the past few years:

- Fiscal Year 2024: $4.237 billion (+9.49% YoY)

- Fiscal Year 2023: $3.87 billion (+10.53% YoY)

- Fiscal Year 2022: $3.501 billion (+30.02% YoY)

Notably, in 2022, Copart recorded an exceptional revenue growth rate of over 30%, highlighting its strong market performance.

B. Net Income Growth

- Fiscal Year 2024: $1.4 billion (+10.1% YoY)

- Fiscal Year 2023: $1.275 billion

C. Earnings Per Share (EPS) Improvement

- Fiscal Year 2024: $1.40 (+9.4% YoY)

- Fiscal Year 2023: $1.28

D. Recent Quarterly Performance (Q1 FY 2025)

- Revenue: $1.146 billion (+12.39% YoY)

- Net Income: $362.09 million (+8.9% YoY)

- Earnings Per Share (EPS): $0.37 (+8.8% YoY)

E. Key Highlights

- Copart has consistently maintained strong revenue and profit growth in recent years.

- Net income growth aligns closely with revenue expansion, ensuring sustained profitability.

- The company’s international revenue grew by 14%, underscoring its strong global presence.

- As of October 2024, Copart holds over $4.6 billion in liquidity, reinforcing its financial stability.

5. Competitive Advantages

A. Extensive Network Effects

-

Copart has 750,000+ members in 170+ countries, creating a strong marketplace that is difficult for competitors to replicate.

B. Integration of Physical & Digital Infrastructure

-

With 200+ auction sites across 11 countries, Copart blends physical and digital platforms to maximize reach and efficiency.

C. Technological Leadership

-

A pioneer in digital auctions, transitioning to online auctions in 2003.

-

VB3 enhances real-time bidding and user experience.

D. AI Implementation

-

AI-powered tools optimize bidding, vehicle evaluation, and logistics.

-

Enhancements include dynamic pricing, predictive analytics, and personalized recommendations.

E. Customer-Centric Services

-

Offers a mix of online and in-person auctions to maximize convenience.

-

Dedicated customer support ensures seamless transactions.

6. Risk Factors

A. Economic Risks

-

Economic downturns may reduce demand for used and salvage vehicles.

-

Fluctuations in fuel and raw material prices can impact profitability.

B. Operational Risks

-

Loss of key insurance company partnerships could reduce inventory.

-

Storage facility constraints may affect customer relationships.

C. Technology & Security Risks

-

Online transaction fraud and data security issues.

-

Intellectual property risks related to Copart’s proprietary auction technology.

D. Regulatory & Legal Risks

-

Compliance challenges in international markets.

-

Privacy regulations (GDPR, CCPA, etc.) could increase operational costs.

E. International Expansion Risks

-

Managing cultural and business differences across global markets.

-

Potential liquidity constraints from overseas investments.

7. Future Outlook & Strategy

A. Sustained Growth Strategy

-

“Land and Expand” approach: Expanding facilities and infrastructure.

-

EV-focused infrastructure development to accommodate growing electric vehicle sales.

-

Emergency response services expansion.

B. Technological Advancements

-

Continuous innovation in VB3 and AI-powered solutions.

-

Enhancing data analytics and digital services.

C. Market Diversification

-

Expansion into heavy equipment auctions via acquisitions.

-

Growth in non-insurance vehicle sales and dealership partnerships.

-

Ongoing global expansion beyond the current 11 markets.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Recently, online used car transactions have been on the rise. Due to advantages such as convenience, transparency, and the freedom of choice, transaction volumes have been increasing not only in South Korea but also in the United States.

Copart is a global leader in online vehicle auctions. Founded in 1982 and headquartered in Dallas, Texas, the company operates in 11 countries across North America, Europe, and the Middle East.

The primary sellers on Copart’s platform are insurance companies, while buyers include dismantlers, rebuilders, repair license holders, used car dealers, exporters, and the general public. Copart’s main revenue source is auction fees, with additional income from vehicle storage fees, transportation services, listing fees, and vehicle recovery services. The company also generates significant revenue from international vehicle sales, strengthening its global presence.

Copart’s core services include online vehicle auctions, vehicle remarketing, value-added services, and vehicle inspections and reporting. Over the past few years, Copart has maintained steady revenue and profit growth, with net income rising in proportion to revenue, ensuring stable profitability. Notably, international revenue grew by 14%, highlighting strong performance in global markets. As of October 2024, Copart holds over $4.6 billion in liquidity, maintaining financial stability.

Copart’s competitive advantages stem from its extensive network effects, integration of physical and digital platforms, technological leadership, AI utilization, and customer-centric services. These factors give Copart a strong edge over competitors in the industry.

At the same time, the company faces various risks, including economic, operational, technological, regulatory, and international business challenges.

Copart’s Future Vision & Outlook

- Pursuing continuous growth through its “Land and Expand” strategy.

- Driving technological innovation with VB3 and AI-powered solutions.

- Expanding international markets while growing its presence in heavy equipment auctions and non-insurance vehicle sales.

0 Comments