Understanding America’s Aging Population and the Healthcare & Senior Care Landscape

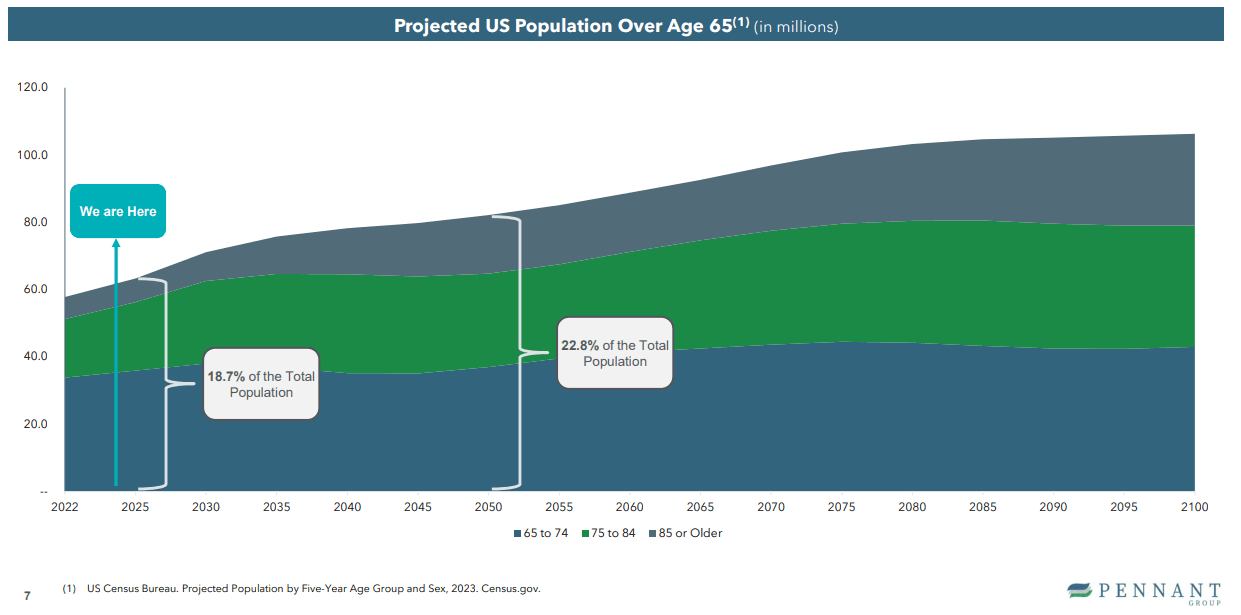

Most developed nations are experiencing a demographic shift towards an aging population, and the United States is no exception. As the Baby Boomer generation enters retirement, the proportion of older adults is increasing significantly. In 2024, 18.7% of the U.S. population is 65 or older, a figure projected to reach 22.8% by 2050. This trend also includes a growing proportion of individuals in the 65-75, 75-84, and 85+ age brackets.

Source: Pennant Group Presentation

The U.S. Healthcare and Senior Care Continuum

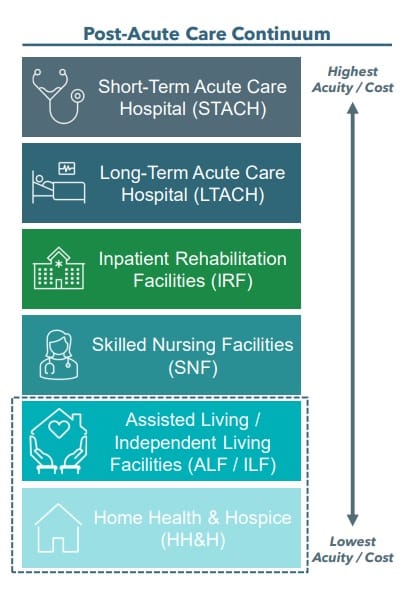

Healthcare and senior care services in the United States are generally structured in a phased approach, progressing as follows:

Source: Pennant Group Presentation

- Higher Levels: Characterized by acute care and higher costs.

- Lower Levels: Focused on rehabilitation, ongoing management, and lower costs.

1. Hospital Care:

- Involves hospitalization for the treatment of acute illnesses or surgical procedures.

- Care is provided by physicians and specialists, with the primary goal of achieving a full recovery.

2. Rehabilitation Facilities:

- Patients who are not ready to return home directly after hospital care transition to rehabilitation facilities.

- These facilities offer specialized rehabilitative therapies and nursing care.

- This phase serves as a crucial preparation for returning to independent living.

3. Home Health Care:

- Provides services to patients in their homes after they are discharged from hospitals or rehabilitation facilities.

- Nurses and therapists visit patients to administer care and support.

4. Hospice Care:

- Represents the final stage of care, designed for terminally ill patients.

- The emphasis is on pain management and enhancing the quality of life, rather than extending life.

The significantly higher costs of hospitalization in the U.S. lead to minimized hospital stays, with a greater reliance on rehabilitation facilities and home health care.

- Average Daily Medicare Cost Comparison: Home Health Care: $61 vs. Inpatient Rehabilitation Facility: $1,850

1. Company Overview

As populations age, the need for dedicated care and senior living facilities becomes paramount. Today, I’m introducing the Pennant Group, Inc. (NASDAQ: PNTG), a key player in the healthcare services sector.

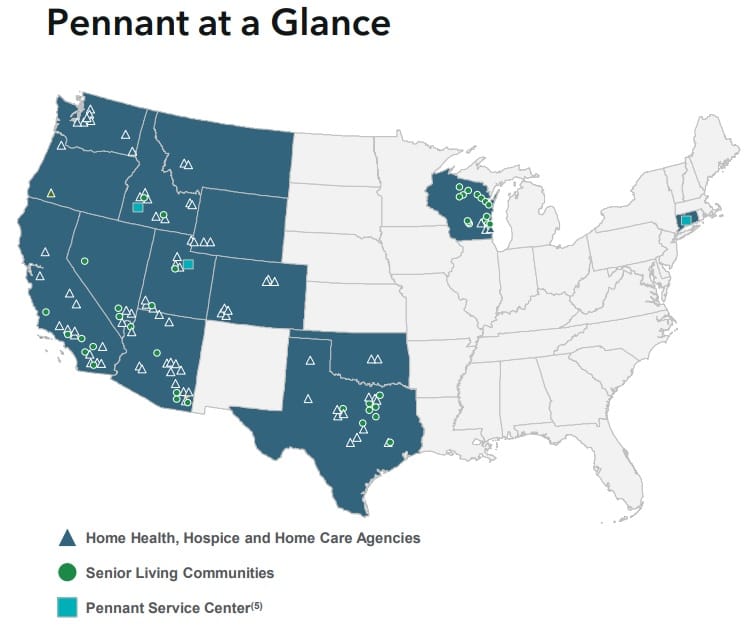

Pennant Group is a U.S.-based healthcare services company with a market capitalization of approximately $0.9 billion. The company operates 95 home health and hospice agencies and 49 senior living communities, comprising a total of 3,500 units.

Source: Pennant Group Presentation

Pennant Operating Regions

2. Key Services

A. Home Health & Hospice Services

a. Home Health Care Services:

- Nursing care, speech therapy, occupational and physical therapy.

- Medical social work and home health aide services.

- In-home caregiving.

b. Hospice Care:

- Clinical care, education, and counseling for terminally ill patients and their families.

B. Senior Living Services

- Independent Living Facilities.

- Assisted Living Facilities.

- Memory Care Communities (specialized care for individuals with dementia).

- Assistance with Activities of Daily Living (ADLs).

- Meal preparation and housekeeping services.

3. Financial Performance

A. Total Revenue Growth (2021-2023)

- Pennant Group achieved an impressive 11% compound annual growth rate (CAGR) in total revenue from 2021 to 2023. This demonstrates consistent and strong growth across all business segments.

- The growth is primarily driven by strong market demand for home health care and hospice services, coupled with operational excellence.

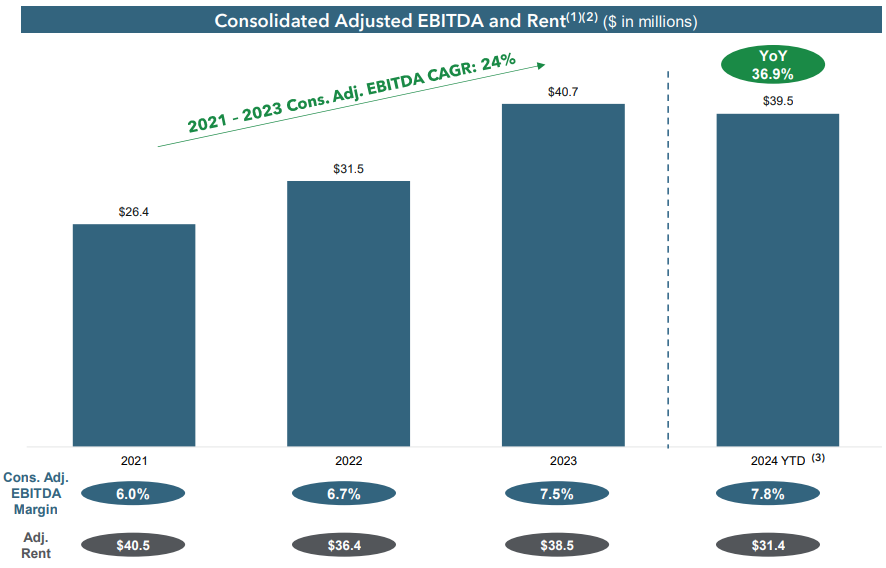

B. Adjusted EBITDA (2021-2023)

- The company achieved a remarkable 24% CAGR in adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) from 2021 to 2023. This signifies strong financial momentum.

- The adjusted EBITDA margin expanded from 6.0% in 2021 to 7.5% in 2023, indicating improved profitability and operational efficiency.

C. Adjusted Rent Expense

- 2021: $40.5 million

- 2022: $38.4 million

- 2023: $38.5 million

- 2024 YTD: $31.4 million

- Adjusted rent expenses are declining, a result of Pennant Group’s strategic real estate acquisitions. This strategy aims to reduce long-term rental costs and bolster its asset portfolio.

D. Debt Stability

a. Debt Ratio:

- Q1 2024: 252%

- Q2 2024: 248%

- Q3 2024: 245%

- While the debt ratio is above 200%, indicating a high level of debt, the company’s ability to service its debt remains stable.

b. Net Debt to EBITDA Ratio:

-

- 2021: 1.7x

- 2022: 1.9x

- 2023: 1.4x

- Q3 2024: 2.0x

- This ratio indicates how many years it would take for the company to repay its debt using its EBITDA. A lower ratio generally indicates better debt management. Generally:

- 1x or less: Very stable

- 1x to 2x: Relatively stable (industry-dependent)

- 2x to 3x: Moderately high debt burden (requires monitoring)

- 3x or more: High financial risk

4. Competitive Advantages

A. Innovative Operating Model

a. Localized Decision-Making:

- Each operating subsidiary functions independently, guided by local clinical and operational leaders. These leaders are crucial for understanding and addressing the unique needs of their communities.

b. Cluster Model:

- Geographically proximate operating units are grouped into “clusters,” fostering the sharing of real-time data, best practices, and benchmarking of clinical and financial performance.

c. Flat Leadership Structure:

- Pennant Group avoids a top-heavy corporate hierarchy, empowering each local community to autonomously implement programs tailored to its specific needs.

d. Emphasis on Local Leadership Development:

- A cornerstone of Pennant Group’s long-term strategy is the development of local leaders. In 2024, the company added over 60 CEO trainees and promoted nearly 40 internal clinical leaders.

5. Digital Healthcare

- Through a partnership with Kno2, Pennant Group will enhance health information exchange across its network of home health, hospice, and senior living facilities by integrating Electronic Health Record (EHR) systems.

B. Diversified Service Portfolio

Pennant Group offers a comprehensive range of services, encompassing home health care, hospice care, and senior living. This diversification allows the company to cater to a wide spectrum of customer needs and adapt to evolving market dynamics.

a.Service Bundle Sales

- Offering a combined package of home health + hospice services has increased average revenue per customer by 23%.

b.Cross-Selling Strategy

- 35% of senior living facility residents have transitioned to [or utilized] home health services.

C. Service Center Support

- All pennant affiliates receive expert support in a variety of fields, including quality monitoring, billing cycle management, legal services, and accounting services.

5. Risk Factors

A. Financial Risks:

- Decreases in service prices or insurance reimbursement rates could negatively impact profitability.

- Increased debt from acquisitions and operational improvements could lead to higher interest expenses and reduced financial flexibility.

B. Operational Risks:

- Intense competition may present challenges in acquisitions and facility operations.

- Difficulties in attracting and retaining skilled professionals could affect the quality of service.

C. Regulatory Risks:

- Changes in federal and state reimbursement policies could affect the company’s revenue and operating costs.

- Legal or regulatory claims related to service delivery could impose financial burdens. D. Market Risks

D. Economic Conditions:

- Factors such as housing market downturns, inflation, and interest rate hikes can impact seniors’ affordability of care, potentially affecting the company’s service delivery.

6. Future Vision and Outlook

A. Home Health Care:

- Home health care spending is projected to grow at a CAGR of 7.7% from 2023 to 2032.

- Home health care is the most cost-efficient post-acute care setting, approximately 97% less expensive than facility-based alternatives.

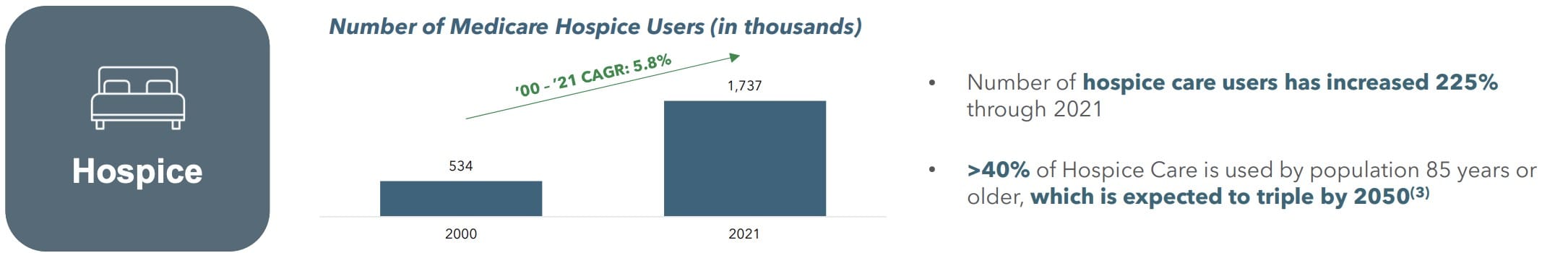

B. Hospice:

- Hospice utilization increased from approximately 534,000 individuals in 2000 to over 1.73 million in 2021, representing a growth of over 225%.

- Over 40% of hospice care is utilized by individuals aged 85 and older, which is expected to triple bty 2050

C. Senior Living Facilities:

- From 2023 to 2026: Projected facility supply growth rate: 4.1%; Projected demand growth rate: 8.0-14.0%.

- Demand growth is expected to outpace supply growth by a factor of 2-3, indicating sustained strong demand over the next decade.

D. Strategic Acquisitions and Growth:

- Pennant Group strategically selects underperforming companies or operating facilities for acquisition and integrates them effectively. This approach enables expansion into new markets and enhances performance in existing ones.

- Empowering local leaders is key to swiftly stabilizing newly acquired facilities and boosting the overall performance of local operations.

7. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Pennant Group, Inc. is a leading U.S. healthcare services provider, offering home health care, hospice services, and senior living options. The company is well-positioned to capitalize on the growing demand for these services, driven by the aging U.S. population and the increasing preference for cost-effective care.

Pennant Group’s competitive strength lies in its innovative operating model. This model features:

- Independent Subsidiaries: Allowing for localized decision-making.

- Cluster Grouping: Facilitating collaboration and best-practice sharing.

- Flat Leadership Structure: Empowering local communities.

- Local Leader Development: Investing in the growth of its leadership.

This approach enables rapid adaptation to new markets and effective response to local needs.

Financially, Pennant Group demonstrates consistent growth in revenue, EBITDA, and margins. The company is also proactively managing expenses through strategic real estate acquisitions. However, it faces risks related to reimbursement rates, competition, workforce retention, regulatory changes, and economic fluctuations.

Looking ahead, the market outlook is positive, with projected growth in home health care spending, hospice utilization, and demand for senior living facilities. Pennant Group’s strategy of acquiring and integrating underperforming entities, combined with its focus on empowering local leaders, positions it for continued success.

In essence, Pennant Group’s vision is to provide high-quality, efficient healthcare services that address the evolving needs of an aging society. The company’s innovative operating model and strategic acquisitions are expected to be key drivers of its long-term growth and market leadership.

0 Comments