Netflix’s Ad-Supported Tier Sees Significant Growth

According to recent announcements, Netflix’s ad-supported tier has reached 70 million monthly active users. This marks a 75% increase from 40 million in May 2024. Additionally, in countries where the ad-supported tier is available, more than 50% of new subscribers are opting for this plan.

Not only Netflix but also Disney+ is seeing growth in its ad-supported tier. According to information accidentally disclosed by Disney CEO Bob Iger, about one-third of Disney+ subscribers are using the ad-supported plan.

Streaming services are generating new revenue streams through ad-supported models, and many consumers are choosing this option to enjoy content at a lower price. This trend serves as an important indicator of changing revenue models in the streaming industry and evolving consumer behavior patterns.

As the number of ad-supported users on platforms like Netflix and Disney+ increases, demand for digital advertising is also rising. The expansion of ad-supported streaming services contributes to the overall growth of the Connected TV (CTV) advertising market.

Today, we introduce The Trade Desk (NASDAQ: TTD), a leading global technology platform for advertisers and ad agencies. The Trade Desk has a strong presence in the CTV advertising sector and is expected to benefit from this market expansion.

To understand The Trade Desk, it is crucial to grasp related terminologies. We have provided explanations with examples for unfamiliar terms. If you are already familiar with them, feel free to skim through; if not, take your time to read them carefully.

Terminology (1)

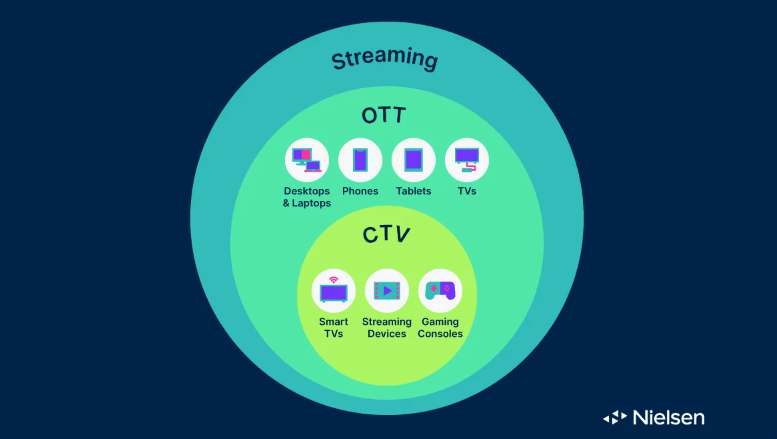

- Streaming: The process of delivering data (mainly audio or video content) in real time over the internet to a user’s device. Streaming can be done on any internet-enabled device.

- Over The Top (OTT): Refers to streaming services that are delivered via the internet rather than through traditional cable or satellite TV providers. Examples include Netflix, Disney+, YouTube, and Spotify.

- Connected TV (CTV): The method of streaming content on a television screen. Unlike OTT, CTV specifically requires a TV device. Older TVs without internet connectivity can become CTVs by connecting to a streaming device like Apple TV or a gaming console like PlayStation or Xbox. Most households now use smart TVs, which are inherently CTVs.

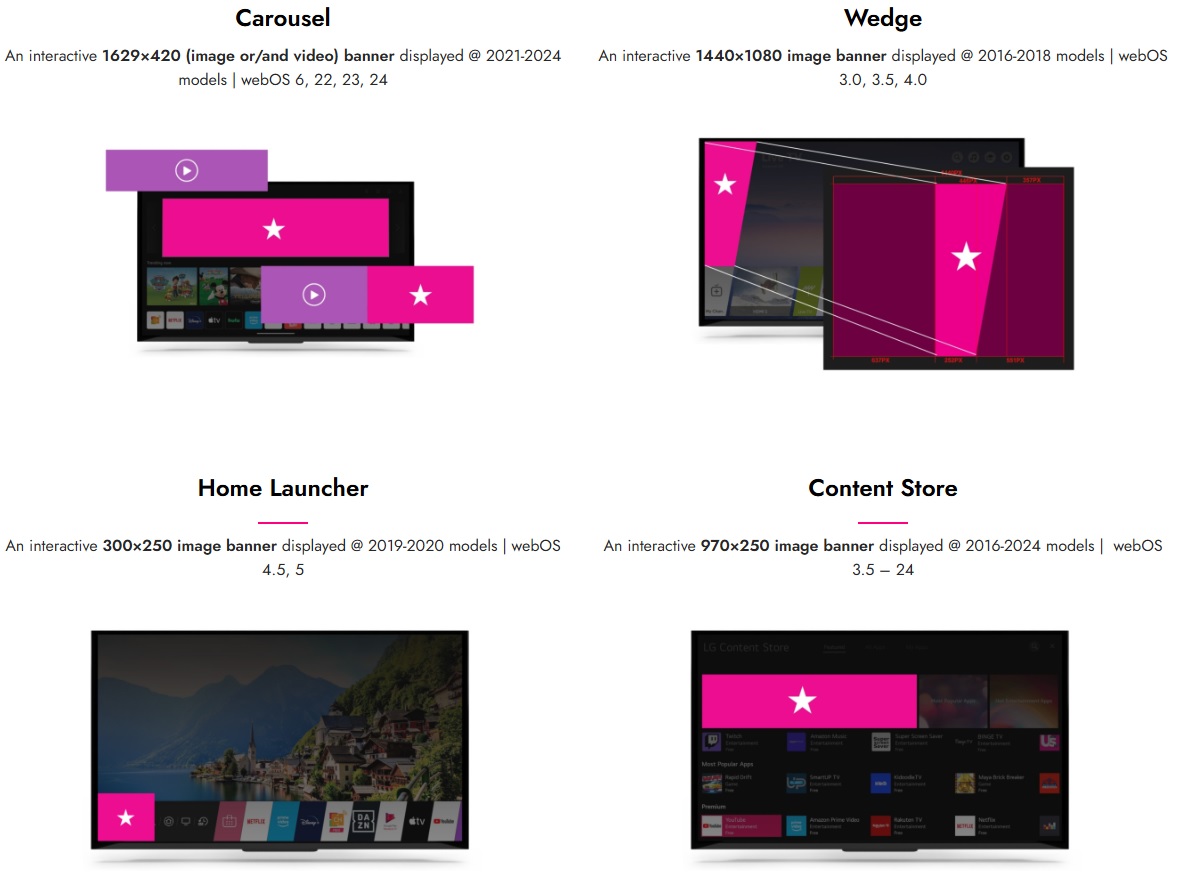

LG Smart TV ads

Source: https://acrossmedia241.com/ctv-lg-ads/

1. Company Overview

The Trade Desk (TTD) is a U.S.-based multinational technology company founded in 2009 by Jeff Green and David Pickles. It has a market capitalization of $66 billion.

TTD is the world’s largest independent Demand Side Platform (DSP), providing a real-time programmatic advertising purchasing platform. This allows advertisers and ad agencies to efficiently execute digital advertising campaigns across various media channels.

Through its cloud-based platform, TTD enables advertisers to plan, manage, optimize, and measure data-driven digital ad campaigns. The platform supports various ad formats and channels, including:

- Video ads

- Display ads

- Audio ads

- Digital out-of-home (DOOH) ads

- Native ads (ads designed to mimic the appearance and function of content, such as sponsored articles)

- Social media ads

Digital out-of-home (DOOH)

Terminology (2)

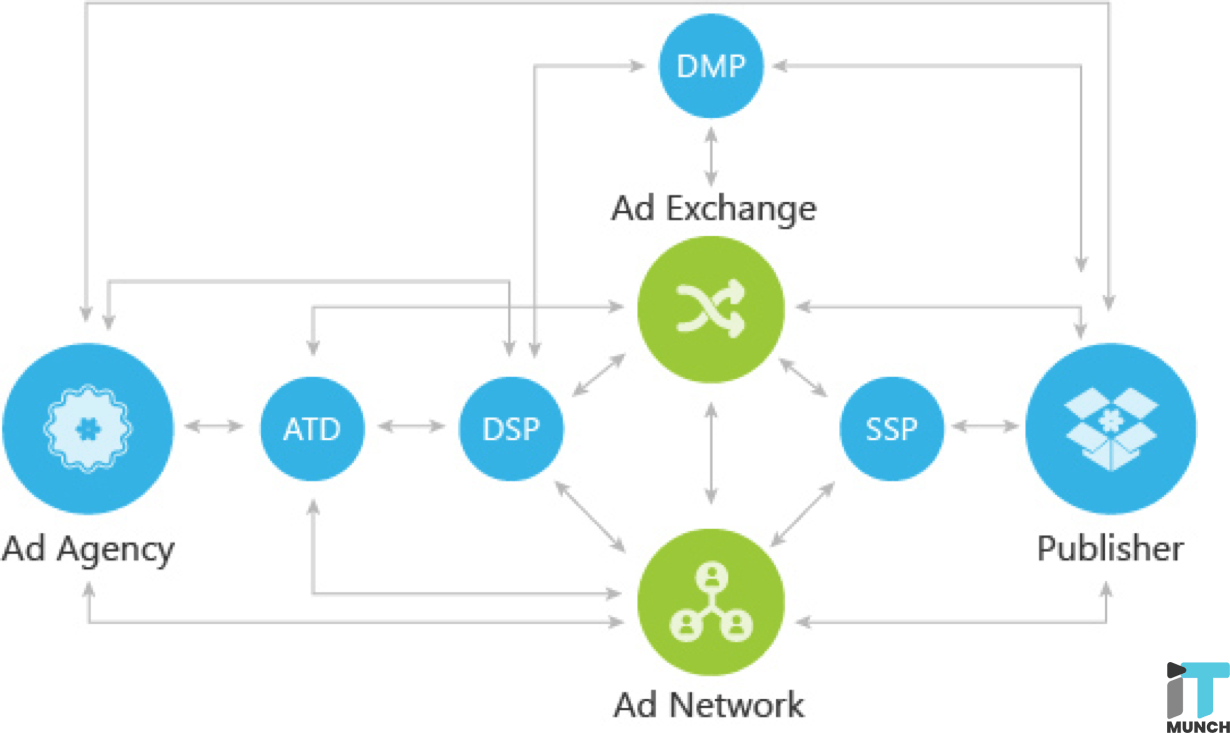

- AdTech: A combination of “advertising” and “technology,” referring to advanced technologies and tools used in digital advertising to enhance ad creation, distribution, targeting, and analytics.

Source: https://buildbusinessresults.com/everything-you-need-to-know-about-ad-tech/

- Ad Inventory: The total amount of ad space available for sale by a publisher (website or app operator) to advertisers.

- DSP (Demand-Side Platform): A software platform that enables advertisers or agencies to efficiently purchase and manage digital ads. For example, a sports brand launching a new running shoe can use a DSP to target running enthusiasts aged 20-40, bid on ad space in real-time, and optimize ad performance.

- SSP (Supply-Side Platform): A platform that helps publishers manage and sell their ad inventory programmatically, connecting them with multiple ad networks to maximize revenue.

- DMP (Data Management Platform): A platform used to collect, manage, analyze, and utilize data for advertising and marketing campaigns.

a. Functions of a DMP

- Data Collection: Gathers data from various sources such as websites and mobile apps.

- Data Integration: Combines collected data to create a unified user profile.

- Data Analysis: Analyzes user behavior and preferences to derive meaningful insights.

- Targeting Optimization: Develops more precise targeting strategies based on the analyzed data.

b. Example of a DMP

Consider an online shopping mall utilizing a DMP to collect and analyze customer data. The platform gathers data on website visitors, purchase history, and search patterns. This information is then integrated to analyze customer preferences and behavior. Based on these insights, the shopping mall can display relevant ads to customers interested in specific products, thereby optimizing its marketing strategy.

- Ad Exchange: A digital marketplace where advertisers and publishers buy and sell ad inventory in real time, primarily through Real-Time Bidding (RTB).

- Programmatic Advertising: Automated buying and selling of digital ad inventory using AI and RTB technology.

- RTB (Real-Time Bidding): A technology that enables real-time auctions for digital ad inventory, where the highest bidder’s ad is displayed.

2. Key Business Areas of TTD

TTD provides a self-service, cloud-based digital ad platform that helps advertisers optimize and manage campaigns across various devices and formats. It operates as a DSP, facilitating efficient ad purchasing.

TTD also offers the “Galileo” solution to activate first-party data, enabling advertisers to securely leverage their customer data for effective audience targeting.

The company excels in cross-channel advertising, covering CTV, mobile, and desktop ads, with CTV being its fastest-growing revenue segment.

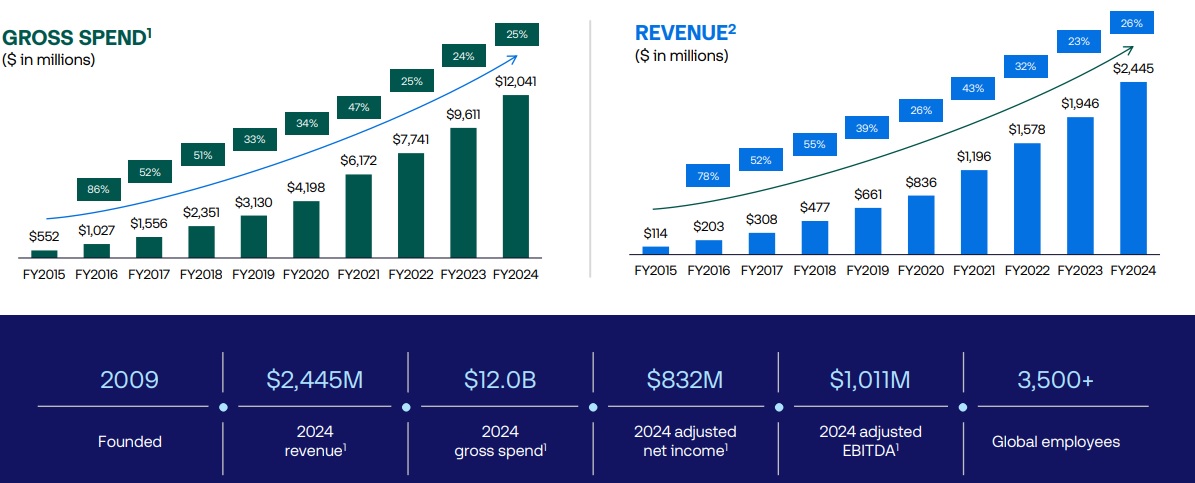

3. Financial Performance

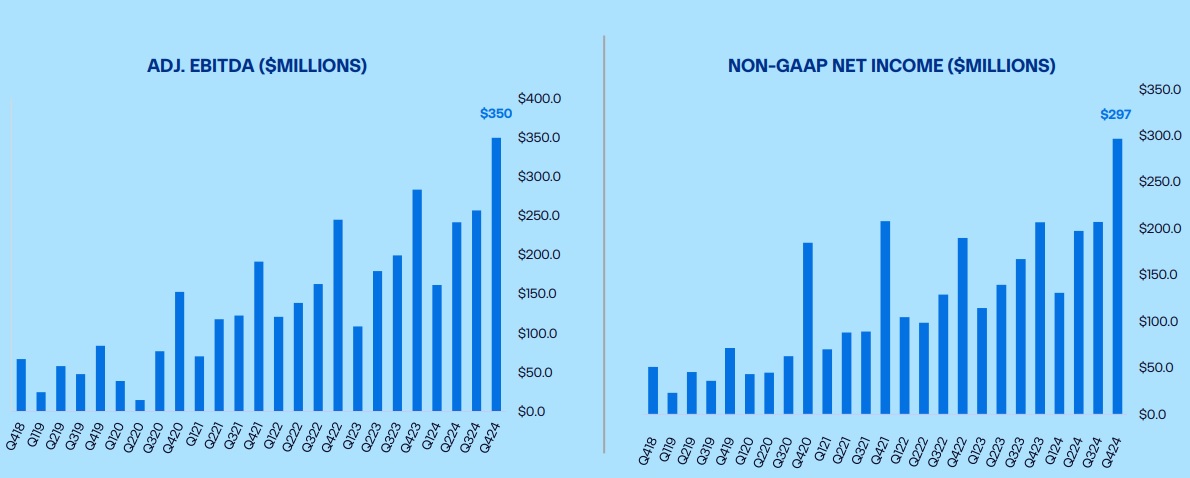

On the left: ADJ.EBITDA / On the right: NON-GAAP NET INCOME

A.Strong revenue growth, EBITDA margins, and free cash flow generation continued in Q4 2024:

- Q4 revenue grew 22% year-over-year to $741 million.

- Adjusted EBITDA was $350 million, representing a 47% margin.

- Free cash flow for Q4 was $177 million.

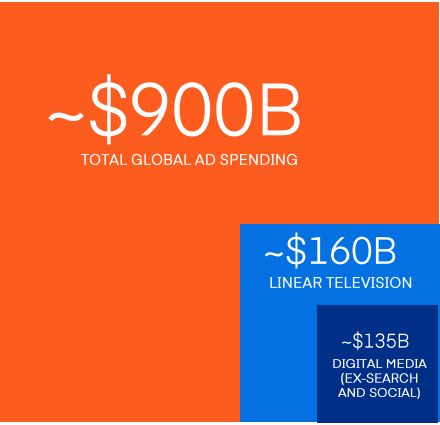

B. The total addressable market (TAM) for advertising continues to expand, with CTV remaining a key growth driver:

- CTV/video remains The Trade Desk’s largest channel, representing a high 40s percentage share of their business in Q.

- CTV advertising is still a small fraction of total TV ad spend relative to linear, indicating significant growth potential.

C. Additional Q4 2024 highlights:

- Total revenue for 2024 reached $2.4 billion, a 26% year-over-year increase.

- Platform spend exceeded $12 billion for the year.

- Customer retention remained above 95% for the 11th consecutive year.

4. Competitive Advantages

A. Independent DSP with Transparency and Trust

- Avoiding conflicts of interest: Unlike Amazon and Google, which operate both ad platforms and ad inventory, TTD does not sell its own media inventory.

- Data transparency: Amazon and Google limit external access to their platform data, making independent performance validation difficult.

Examples of Conflicts of Interest

a. Amazon

- Advertising Platform: Amazon Advertising

- Ad Inventory: Amazon.com website, apps, Fire TV, etc.

Amazon sells ads for products available on its platform while simultaneously selling its own private-label products (e.g., AmazonBasics). This creates a situation where Amazon could potentially favor its own products by reporting better ad performance or limiting the visibility of competing products.

b. Google (Alphabet)

- Advertising Platform: Google Ads

- Ad Inventory: Google Search, YouTube, Google Display Network, etc.

Google provides both paid advertisements and organic search results on its search engine results pages. To encourage advertisers to spend more on ads, Google may overstate the effectiveness of paid advertisements or reduce the prominence of organic search results.

B. Omnichannel Advertising

TTD partners with over 350 companies and ad exchanges, offering diverse ad opportunities across video, audio, and display formats. The company ensures a unified advertising strategy by integrating multiple digital channels into connected campaigns.

C. Data Measurement & Analytics

TTD’s DMP integrates first-party and third-party data to create precise audience segments. It supports demographic, interest-based, and behavioral targeting, as well as cross-channel performance optimization.

D. AI-Powered Optimization

TTD’s AI engine, Koa™, analyzes data to help advertisers make informed decisions and identify trends and opportunities. Koa enhances transparency in decision-making, allowing advertisers to adjust its operations according to specific performance goals.

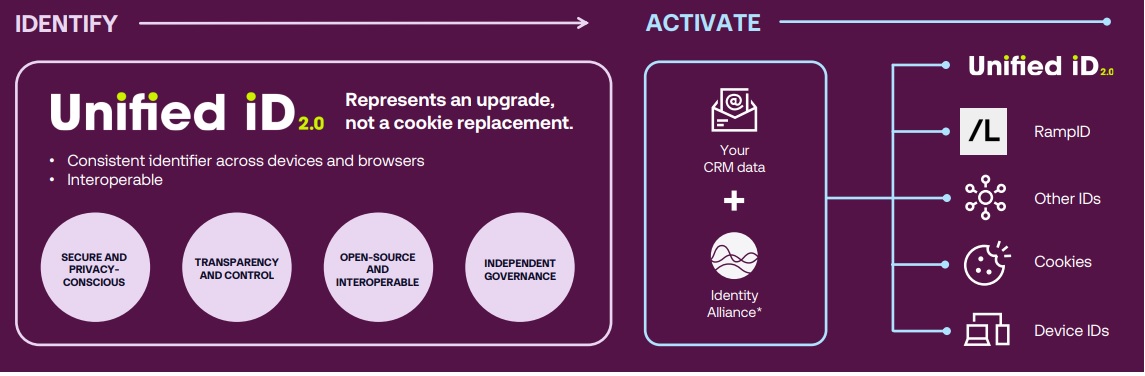

E. Unified ID 2.0 (UID2)

a. What is UID2?

UID2 is an encrypted identifier created using a user’s email address or phone number. It is generated based on user consent and prioritizes data privacy.

As an open-source framework, UID2 enables publishers, advertisers, and digital ad platforms to utilize first-party data for identification across Connected TV (CTV), websites, and mobile apps.

Source : https://www.adexchanger.com/programmatic/programmatic-audio-is-a-tough-market-so-soundcloud-is-leading-with-display-and-video/

b. Background of UID2’s Development

Google announced plans to eliminate third-party cookies from the Chrome browser by 2022. This decision stemmed from privacy concerns surrounding cookie-based tracking and efforts by companies to gain more control over user data.

The removal of third-party cookies raised concerns that advertisers would lose precise user targeting capabilities. There was also fear that the reduced effectiveness of digital ads would lead to greater dependency on cookies. As a result, the industry needed a new identification framework that could enable cross-site targeting and performance measurement without relying on cookies.

In response, The Trade Desk and other independent AdTech companies introduced Unified ID 2.0 (UID2), an open-source initiative based on email authentication.

c. The Role and Importance of UID2

Ultimately, UID2 plays a crucial role in helping The Trade Desk maintain and expand its competitive position in the digital advertising ecosystem. As a privacy-conscious alternative to third-party cookies, UID2 allows for precise targeting and performance measurement while respecting user privacy. This strengthens demand for The Trade Desk’s platform and maximizes its growth potential.

Source : TTD 2024Q4 Presentation

Terminology (3)

A. First-Party Data

First-party data refers to customer information that a company collects and owns directly.

a. Examples:

- Website visit history

- Purchase records

- Email subscription data

- CRM (Customer Relationship Management) data

b. Advantages:

- High accuracy and relevance

B. Third-Party Data

Third-party data is information acquired or purchased from external data providers.

a. Examples:

- Demographic information

- Interest-based data

- Behavioral data

- Purchase intent data

b. Advantages:

- Access to large-scale data sets

c. Cookies

Cookies are small data files stored on a user’s computer or mobile device by a website.

When a user visits a website for the first time, cookies are created. Upon returning, the website reads these cookies to provide a personalized experience. Common uses include maintaining login sessions, saving shopping cart contents, and storing user preferences.

5. Risks

- Competitive threats: Intense competition from major tech firms like Google, Facebook, and Amazon.

- Economic risks: Potential reductions in ad spending due to economic downturns.

- Cybersecurity risks: Increasing threats to data integrity and platform security.

6. Future Growth Vision

A. Expansion of Market

The transition from traditional to digital advertising presents significant growth potential. CTV accounts for approximately 45% of TTD’s total revenue and is expected to drive further growth.

B. Strength of CTV Advertising

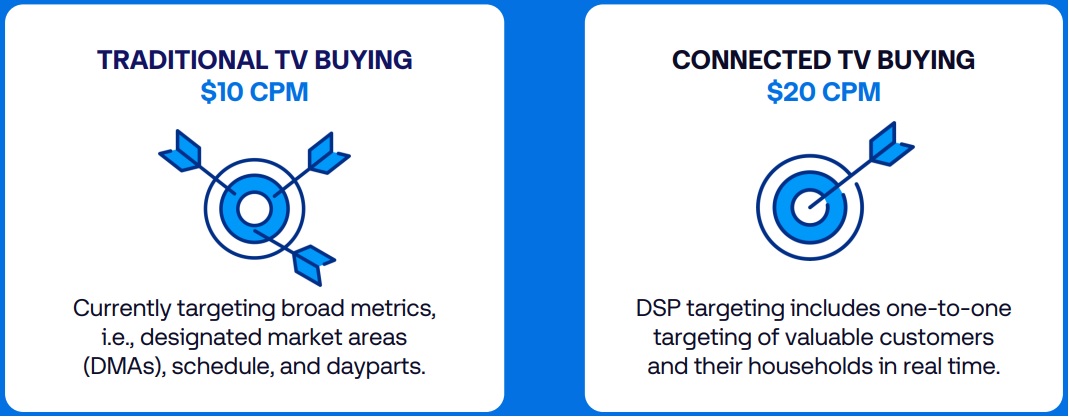

Traditional TV vs. Connected TV (CTV) Advertising Models

a. Traditional TV Advertising Model ($10 CPM [Cost per 1,000 Impressions])

- Targeting is based on broad indicators (e.g., newspaper ads, TV commercials between programs).

- Ads are placed using basic criteria such as DMA (Designated Market Area), time slots, and days of the week.

- Lower CPM of $10 due to broader and less precise targeting.

b. Connected TV (CTV) Advertising Model ($20 CPM)

- Enables precise targeting through a Demand-Side Platform (DSP).

- Real-time, one-on-one targeting of high-value customers and their households.

- Higher CPM of $20 due to more accurate targeting and increased ad efficiency.

The evolution of these decision-making systems has made TV ad purchasing more efficient and has enhanced revenue for publishers. In particular, CTV’s precise targeting capabilities allow for more effective ad execution, justifying the higher CPM.

C. Ventura (Launching in 2025)

Ventura is a new streaming TV operating system designed to revolutionize advertising and user experience by offering:

- Content-agnostic approach: Unlike Google TV or Amazon Fire TV, Ventura does not own content, ensuring a fair and transparent ecosystem.

- Fewer but more relevant ads: Leveraging UID2 to reduce ad fatigue while enhancing targeting efficiency.

- OEM and streaming platform partnerships: Collaborating with Disney, Paramount, Tubi, and Sonos to roll out Ventura.

D. Expansion of Retail Data Utilization

TTD is integrating retail data (e.g., purchase history) into ad strategies, allowing non-endemic brands (e.g., financial services) to leverage consumer insights for precise targeting.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

The Trade Desk is a pioneering independent Demand-Side Platform (DSP) in the programmatic advertising market, where major tech giants like Google, Amazon, and Meta hold significant market shares. The company provides a comprehensive DSP and Data Management Platform (DMP) to help advertisers effectively run campaigns across various digital channels.

The Trade Desk has consistently demonstrated strong financial performance. The company’s Gross Spend—the total amount advertisers spend on its platform—is increasing, driving revenue growth. Among its business segments, Connected TV (CTV) is the fastest-growing and largest sector, with continued expansion expected in the future.

Key competitive advantages of The Trade Desk include omnichannel advertising execution, advanced data measurement and analytics capabilities, the use of its AI engine, Koa™, and the adoption of Unified ID 2.0 (UID2). These factors play a crucial role in maintaining TTD’s competitiveness in the advertising market.

Looking ahead, The Trade Desk’s growth strategy focuses on market expansion, leveraging the strengths of CTV advertising, launching Ventura, and increasing the utilization of retail data to sustain long-term growth.

However, the company faces intense competition from tech giants like Google, Facebook, and Amazon. Additionally, economic downturns or market uncertainties could lead to reduced ad spending. Cybersecurity risks also remain a challenge.

Advertising is an integral part of the modern economy and is unlikely to disappear. As time progresses, digital advertising is expected to take up a larger share of the industry. If you see a promising future for digital advertising, investing in The Trade Desk may be worth considering.

0 Comments