Peter Lynch’s 13 Characteristics of a “Perfect Stock”

In his books, Peter Lynch emphasized the importance of investing in undervalued and overlooked stocks that others ignore. According to him, the “perfect stock” often displays one or more of these 13 characteristics:

- It has a boring (or even ridiculous) name.

- It operates in a boring business.

- It deals with something that evokes disgust.

- It is a spin-off or an independently managed subsidiary.

- It is not held by institutional investors and is ignored by analysts.

- It is surrounded by rumors.

- It has a gloomy or depressing aspect.

- It belongs to a stagnant industry.

- It occupies a niche market that others overlook.

- Its products are consistently purchased by consumers.

- It uses technology in its operations.

- Insiders are buying shares of the company.

- The company itself is repurchasing its shares.

Following these principles, let’s take a closer look at the waste management industry, which fits several of Lynch’s criteria—often perceived as unappealing but essential and highly profitable.

Understanding Waste Management Practices in the United States

A. Disposal Methods

- Most waste is collected as general garbage and disposed of primarily in landfills.

- Some areas utilize incineration facilities or recycling centers.

- Food waste is often treated as general waste, although eco-friendly initiatives like composting programs are being implemented in select cities.

B. Cost Structure

- Waste collection services are typically contracted to local companies, with fees paid on a monthly or quarterly basis.

- Costs are determined by bin size or collection frequency—larger bins and additional pickups incur higher charges.

C. Recycling Rates

- The U.S. recycling rate for municipal solid waste is about 35%, which is relatively low.

- Recycling mandates vary by region, and differences in infrastructure make achieving consistent nationwide recycling rates challenging.

- Some states encourage recycling through deposit refund systems and public education programs.

D. Government Subsidies

- Waste management systems are predominantly operated by private companies, with limited government subsidies.

- Consumers bear the direct cost, while competition among private firms helps moderate service quality and pricing. However, residents may express dissatisfaction with price fluctuations, service coverage, or disposal methods.

Summary of the U.S. Waste Management Services Industry

In the U.S., most waste is disposed of through landfilling, and food waste is typically included with general garbage. Collection fees are based on bin size and service frequency, while the overall recycling rate remains low at around 35%. The industry is largely run by private companies, with limited government support and heavy reliance on consumer-paid services.

Industry Overview: Major Players in U.S. Waste Management

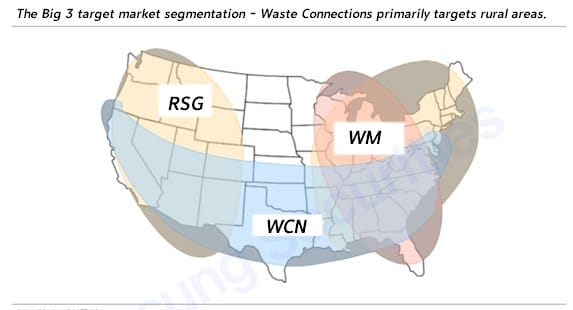

The U.S. waste management industry is dominated by three major players:

- Waste Management (WM): Market cap $91 billion

- Republic Services (RSG): Market cap $70 billion

- Waste Connections (WCN): Market cap $49 billion

Among these, Waste Management holds the largest market share. However, today’s focus is on Waste Connections (NYSE: WCN), the third-largest player.

Source : Samsung Securities

1. Company Overview

Waste Connections is one of North America’s leading waste management companies, serving approximately 9 million customers across 46 U.S. states and six Canadian provinces. The revenue breakdown is as follows: 86% from the U.S. and 14% from Canada.

2. Key Services

A. Waste Collection and Disposal

- Non-hazardous Waste Collection: Services for residential, commercial, and industrial clients.

- Waste Transportation: Transporting collected waste to treatment facilities or landfills.

- Landfill Operations: Managing 103 active landfills for waste disposal.

B. Recycling and Resource Recovery

- Recycling Materials: Cardboard, mixed paper, plastic containers, glass bottles, and metals.

- Resource Recovery: Recovering and reusing recyclable materials.

- Renewable Natural Gas (RNG): Producing renewable fuel from landfill emissions.

C. Special Waste Management

- E&P Waste Treatment: Handling waste from oil and gas exploration and production activities.

- Specialized Waste Services: Managing chemically or biologically sensitive waste that requires special treatment processes.

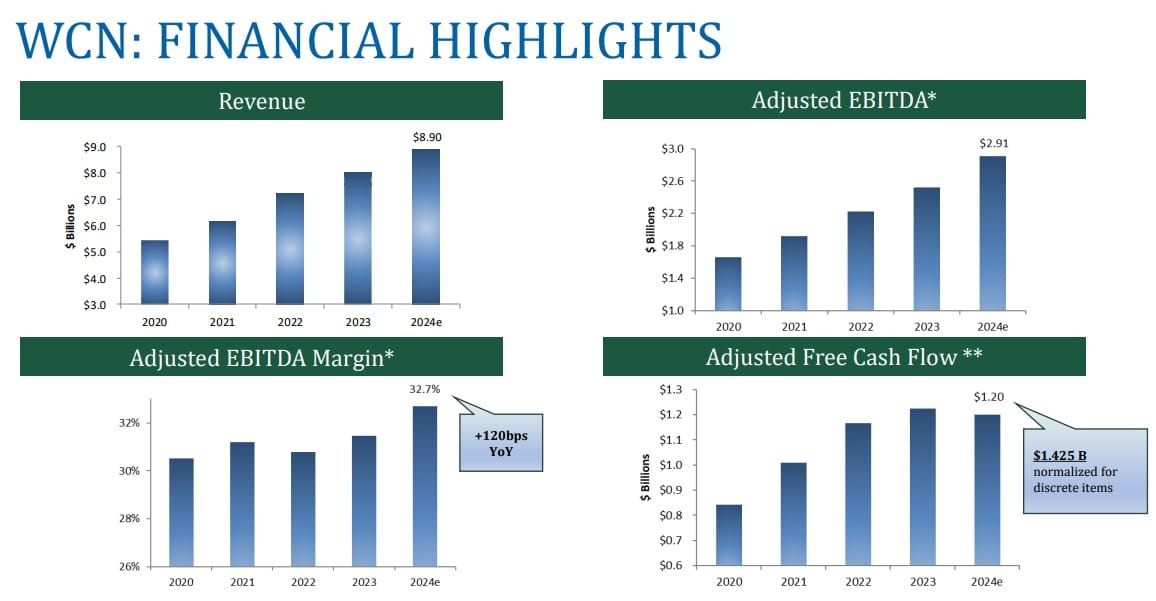

3. Financial Performance

Key financial metrics—revenue, EBITDA, EBITDA margin, and free cash flow—show an upward trend for Waste Connections:

- Free cash flow has steadily increased, indicating improved operational efficiency and growing market share.

- This surplus cash allows for reinvestment in M&A, R&D, dividend payments, and share buybacks, all of which contribute to long-term stock price growth.

Debt-to-Equity Ratio:

Over the past three quarters, Waste Connections has maintained a healthy debt-to-equity ratio below 200%:

- March 2024: Equity $7.78B, Debt $11.29B → Ratio: 144%

- June 2024: Equity $7.98B, Debt $11.31B → Ratio: 141%

- September 2024: Equity $8.26B, Debt $11.83B → Ratio: 143%

This demonstrates strong financial stability.

4. Competitive Advantages

A. Monopoly-like Position in Suburban and Rural Markets

- Waste Connections targets less competitive suburban and rural markets in Canada and the U.S. Northeast, where it secures exclusive contracts and builds a dominant presence.

- WCN’s market consists of approximately 40% exclusive or franchise territories, with the remaining 60% in competitive markets—primarily in secondary and rural areas—where we hold a strong market position.

B. Ample Landfill Capacity

- Waste Connections: Average landfill lifespan of 32 years, with plans for expansion.

- Waste Management: Average lifespan of 39 years, expansion on hold.

- Republic Services: Average lifespan of 8 years, with expansion plans.

- Competitors like Republic Services have an average landfill lifespan of only 8 years, making Waste Connections better positioned for long-term operations.

C. Consistent Dividend Growth

Although its dividend yield was modest at 0.71% in 2023, Waste Connections has maintained an 11–12% annual dividend growth rate for the past three years:

- 2023: +11.11% ($1.05/year)

- 2022: +11.83% ($0.945/year)

- 2021: +11.18% ($0.845/year)

5. Risk Factors

A. Economic Risks

- A slowdown in construction activity could reduce waste volumes through early 2025.

- Certain business segments, such as commercial and industrial waste collection, are sensitive to economic cycles.

B. Operational and Regulatory Risks

- The industry carries inherent safety risks that could affect the company’s reputation and financial performance.

C. Financial Risks

- Rising fuel and labor costs may pressure margins and operational efficiency.

6. Future Strategies and Vision

A. AI-Based Automated Sorting

- Robotics and Optical Sorters: Deployed at recycling facilities to improve sorting efficiency and reduce contamination.

- Waste Connections is partnering with AMP Robotics to build a next-generation recycling facility in Commerce City, Colorado, with AI-powered sorting systems capable of processing up to 62,000 tons annually by early 2026.

- Integrated into operations to identify commercial overage charge opportunities, enhancing overall efficiency.

B. Operational Technologies

- PFAS Treatment and Capture: Addressing landfill leachate through advanced treatment technologies to minimize environmental impact.

C. Sustainability Initiatives

- Electric Garbage Trucks: Currently testing all-electric trucks in New York City.

- Renewable Natural Gas (RNG): Investing in methane capture systems at landfills to produce clean energy and reduce carbon emissions.

D. Strategic Growth Plans

- Expanding M&A activity beyond the traditional annual spending range of $150M to $250M.

- Securing 12 commercial waste zone contracts and a citywide contract in New York City.

7. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Waste Connections (NYSE: WCN) is a major player in the North American waste management sector, serving about 9 million customers across 46 U.S. states and 6 Canadian provinces. Its key services include waste collection and disposal, recycling and resource recovery, and specialized waste management.

Waste Connections stands out as a stable yet growth-oriented investment opportunity within the essential waste management sector due to its strategic positioning in suburban markets, robust financial performance, consistent dividend growth, and innovative sustainability efforts powered by AI technology.

Investors seeking long-term value may find Waste Connections an attractive choice given its balance of stability and growth potential within a recession-resistant industry segment—provided they conduct thorough due diligence before making any investment decisions!

0 Comments