Donald Trump’s Inauguration and the Future of the Oil & Gas Industry

On January 20, 2025, President Donald Trump was inaugurated. With Trump’s administration now in office, what does the future hold for the oil and gas industry? Let’s first examine Trump’s campaign promises regarding energy policy.

The Future of U.S. Energy Policy Under the Trump Administration

Trump’s 2024 campaign platform and the Republican Party’s stance on energy policy emphasize the following key points:

A. Expansion of Fossil Fuel Production

-

Under the slogan “Drill, Baby, Drill,” the administration aims to significantly expand oil and natural gas production.

-

Increased oil drilling on federal lands.

-

Regulatory rollbacks and streamlined permitting processes for energy production.

B. Energy Independence and Global Dominance

-

Goal to make the U.S. the world’s largest oil and natural gas producer.

-

Moving beyond energy independence to achieving “Energy Dominance.”

C. Reversal of Green Policies

-

Termination of Biden’s environmental policies, often labeled as the “Socialist Green New Deal.”

-

Re-withdrawal from the Paris Climate Agreement, which took effect on January 20, 2025.

D. Lower Energy Prices

-

Aims to stabilize prices and reduce energy costs through increased production.

-

Pledged to lower gasoline prices to below $2 per gallon.

Trump and the Republican Party’s energy policy prioritizes fossil fuel expansion as the foundation of energy production.

Executive Orders on Oil Signed on January 20, 2025

A. Declaration of National Energy Emergency

-

On his first day in office, President Trump declared a “National Energy Emergency.”

-

This unprecedented move aims to fast-track fossil fuel project approvals and boost domestic oil and gas production.

B. American Energy Promotion Executive Order

-

A comprehensive order with various provisions to “unleash America’s affordable and reliable energy resources.”

-

Lifting the moratorium on LNG export approvals.

-

Rolling back regulations on oil and gas production.

-

Revising regulations promoting electric vehicle sales.

C. Alaskan Resource Development Order

-

Signed an order lifting restrictions on oil, gas, and mineral extraction in Alaska.

-

Includes permitting development in parts of the Arctic National Wildlife Refuge (ANWR).

Projected Revenue Impact on Oil Companies from Increased Production

The Trump administration’s policies are expected to increase oil and gas production, affecting gasoline prices. However, the impact on oil and gas companies’ revenues and profits will depend on multiple factors.

A. Upstream Sector (Exploration, Drilling, and Production)

-

Upstream companies focus on oil and gas exploration, drilling, and production.

-

Examples: ExxonMobil, Chevron.

1. Revenue Impact

-

Increased production may boost sales volumes, but falling crude oil prices could reduce per-unit revenue.

2. Profitability Impact

-

Declining oil prices could reduce profitability.

-

Larger production scales could improve efficiency and cost savings, potentially increasing net income.

B. Downstream Sector (Refining and Distribution)

-

Downstream companies focus on refining, distribution, and marketing.

-

Examples: Royal Dutch Shell, BP.

1. Revenue Impact

-

Lower gasoline prices may reduce per-unit revenue.

-

However, increased demand and higher sales volume could offset this decline.

2. Profitability Impact

-

Profitability depends heavily on refining margins (crack spreads).

-

If crude oil prices drop faster than gasoline prices, short-term profitability may improve.

-

In the long run, an oversupply could reduce refining margins.

1. Company Overview

Aris Water Solutions is a U.S.-based environmental infrastructure and water treatment company specializing in the processing and recycling of produced water from the oil and gas industry. The company provides sustainable water management solutions that help reduce water consumption and carbon emissions across various industries. ARIS has a market capitalization of $1.5 billion.

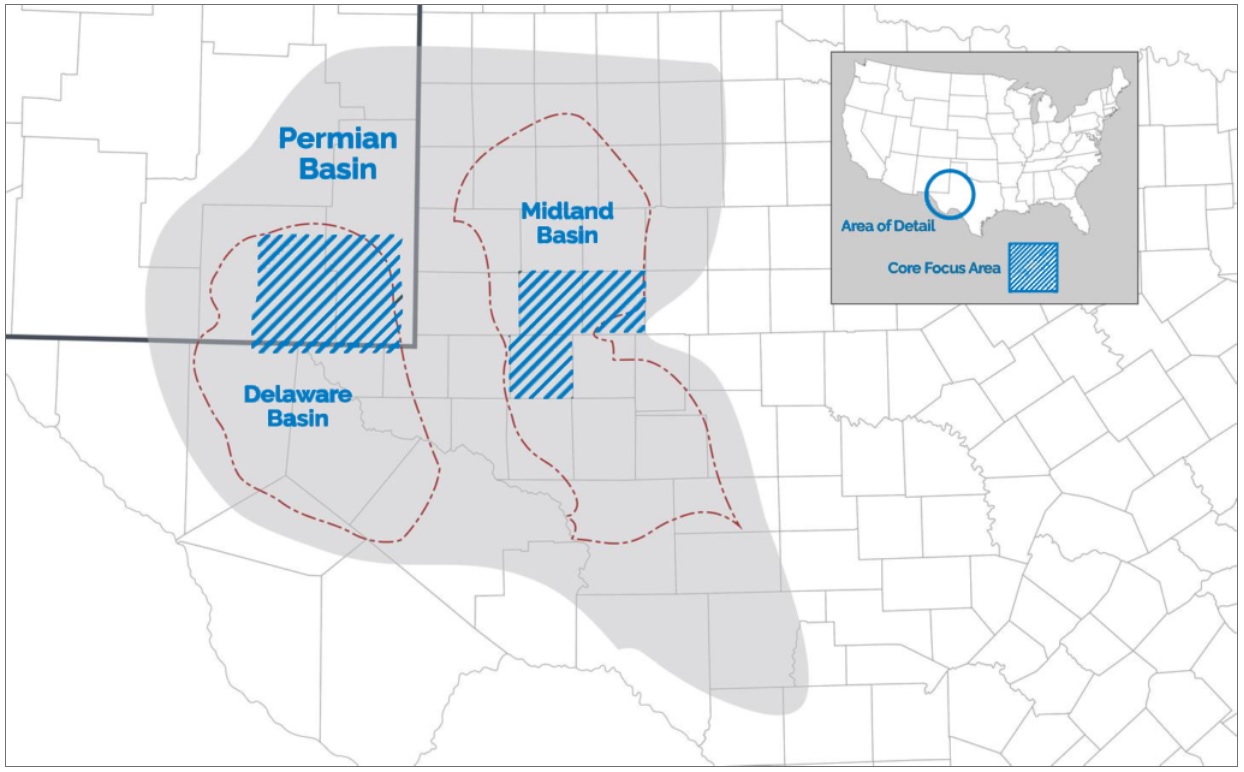

The company has established itself as a leading developer and operator of produced water infrastructure for hydraulic fracturing, commonly known as fracking, in the Permian Basin, one of the world’s largest energy-producing regions.

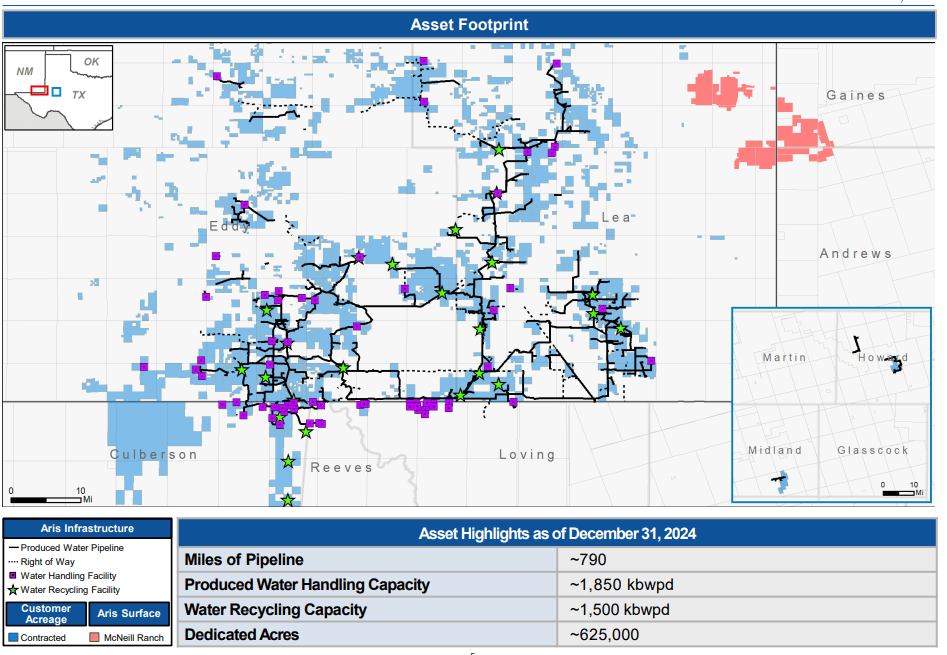

ARIS operates an extensive network, including more than 775 miles (approximately 1,247 km) of pipelines, 48 water treatment facilities, and 10 high-capacity recycling facilities. This infrastructure allows multiple oil companies to efficiently manage large-scale water treatment simultaneously.

Aris Water Solutions’ primary operating regions, including the Delaware Basin and Midland Basin within the Permian Basin

Pipeline infrastructure map

Terminology

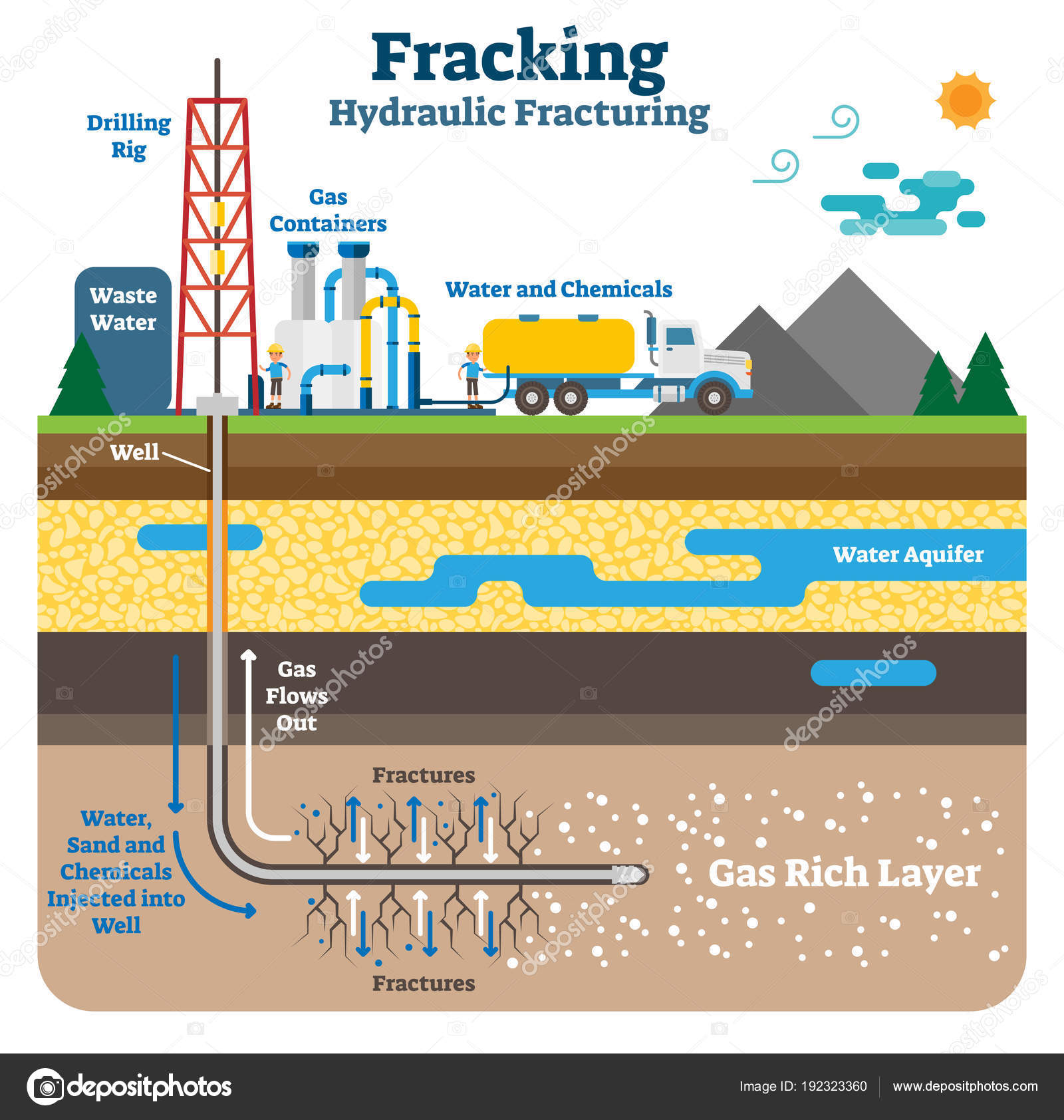

Hydraulic Fracturing (Fracking)

Hydraulic fracturing is a process used after an oil or natural gas well has been drilled. High-pressure fluids are injected into underground rock formations to create fractures, enhancing the flow of oil or natural gas.

One drawback of fracking is its substantial water requirement, as it relies on large volumes of groundwater or aquifer-stored water. Since these water sources are limited, the water used in fracking must be treated and reused. This purification process is a core part of ARIS’s business.

Produced Water

Produced water refers to the byproduct generated during the extraction of oil and natural gas. It originates from underground reservoirs and surfaces along with hydrocarbons. When oil reaches the surface, it often carries injected water, chemicals, and naturally occurring brine from rock formations. This mixture is what is known as produced water.

In the Permian Basin, the world’s largest fracking region, approximately four barrels of produced water are generated for every barrel of oil extracted.

The U.S. oil and gas industry produces over 24 billion barrels of produced water annually, with the Permian Basin accounting for nearly one-third of that total. Additionally, the Permian Basin currently generates around 5 billion barrels more water annually than can be recycled. This means that more produced water is being generated than can be effectively reused. If Aris Water Solutions can meet the growing demand for produced water treatment, the company’s future prospects look promising.

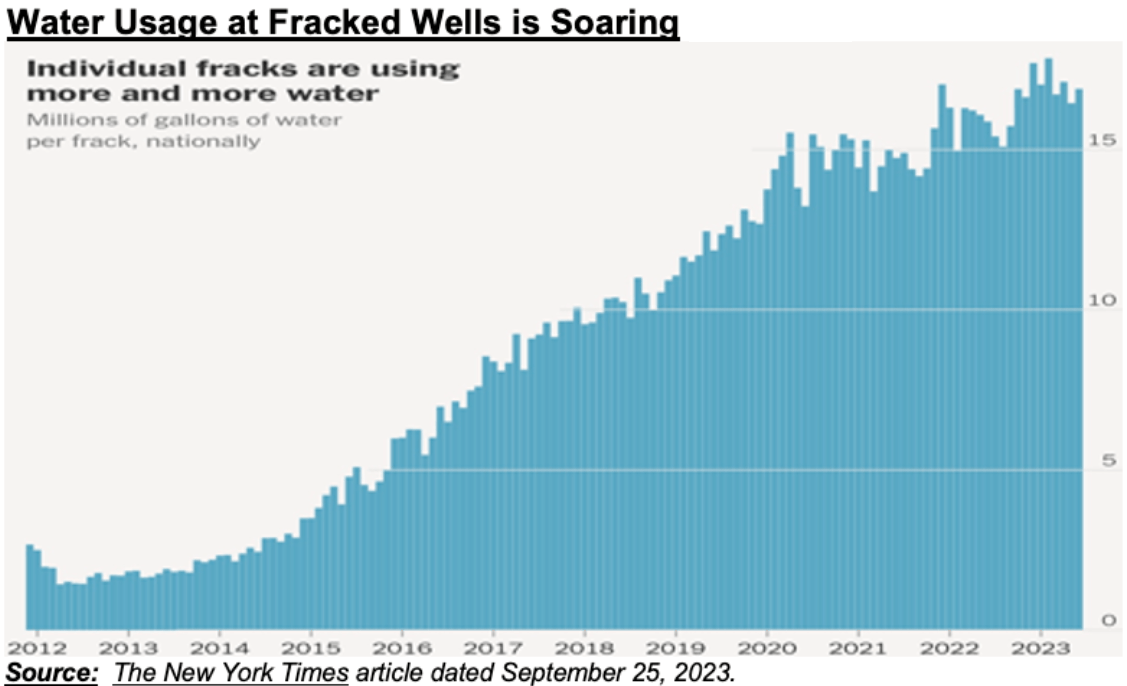

The amount of water used in hydraulic fracturing has increased by more than 700% since 2011.

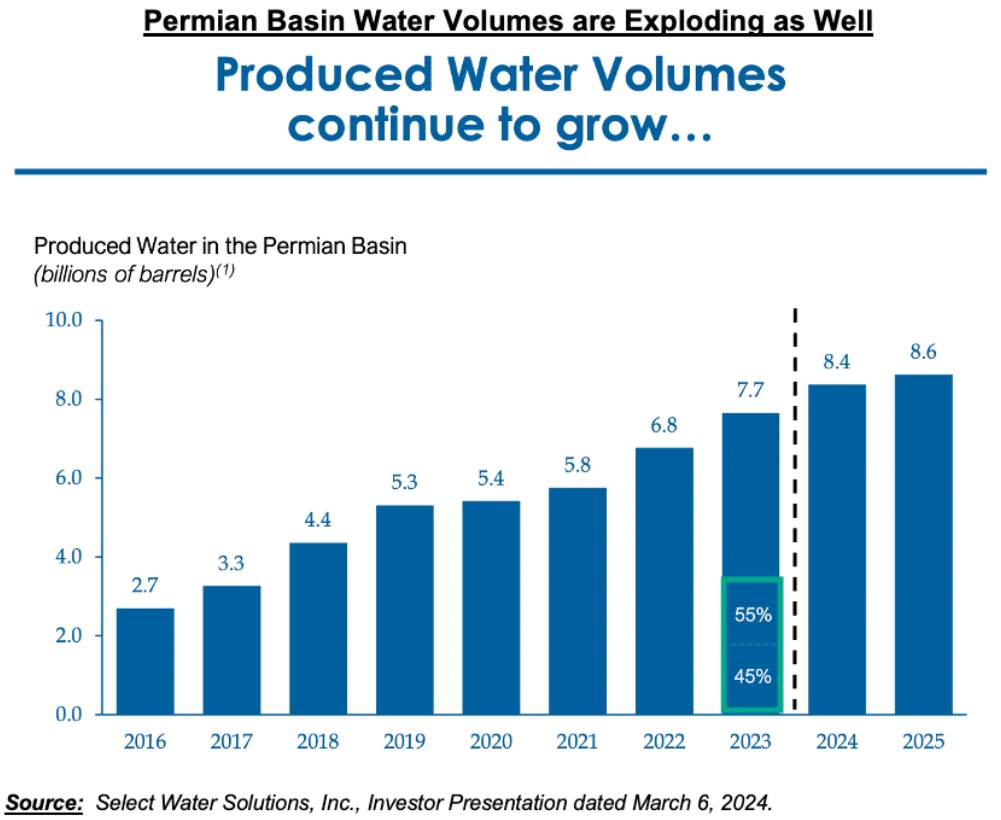

The volume of produced water in the Permian Basin continues to rise.

2. Major Business Areas and Technologies

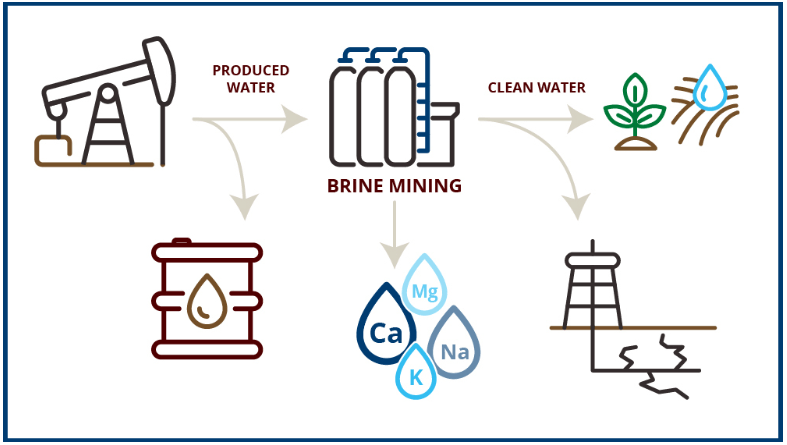

A. Produced Water Management and Recycling

-

Integrated Pipeline Infrastructure: A comprehensive pipeline network has been established in key areas of the Permian Basin to efficiently collect and transport produced water.

-

End-to-End Water Treatment Solutions: A comprehensive solution is provided for collecting, treating, and recycling water generated during oil and gas production.

B. Sustainable Water Management Solutions

-

Water Recycling: Treated produced water is repurposed for various applications, including agriculture, mineral extraction, industrial processes, and aquifer replenishment.

-

arbon Footprint Reduction: Helps clients reduce water consumption and carbon emissions.

-

Carbon Footprint Reduction: Helps clients reduce water consumption and carbon emissions.

Key Features of End-to-End Water Resource Management

A. Business Strengths

- Stable core business and high growth potential through diverse revenue streams

- Increased service demand due to Permian Basin completion activities and rising production

- Growing reliance on an extensive network to help clients achieve sustainability goals

B. Commercial Advantages

- Ensures a stable supply of recycled water through significant contracted produced water volumes collected via the system

- Enhances growth visibility through established contracted water treatment solution agreements with major clients

C. Operational Advantages

- Possesses significant assets, including pipeline land-use rights, produced water treatment, and water recycling permits

- Investments in existing water collection systems enable water recycling and create barriers to entry for potential competitors

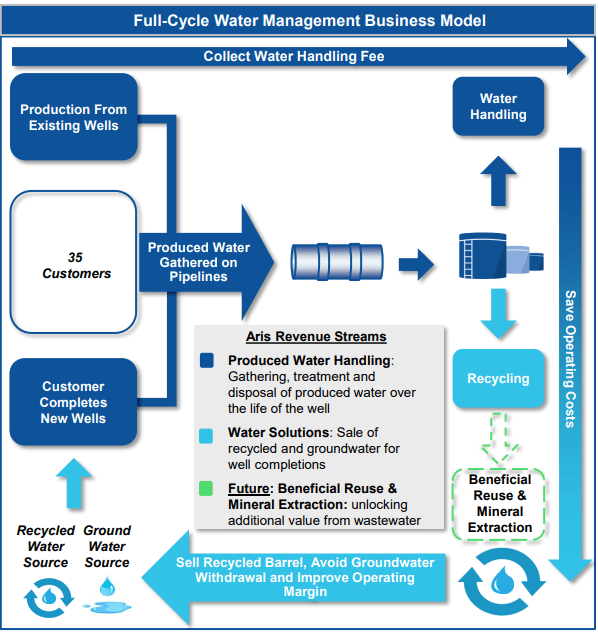

3. Business Model

A. Core Process

- Produced water generated from existing wells

- Collection of produced water via pipelines

- Water treatment and recycling

- Beneficial reuse and mineral extraction

B. Revenue Streams

- Produced Water Handling: Collection, treatment, and disposal of produced water

- Water Solutions: Sale of recycled water and groundwater for well completions

- Future Business: Beneficial reuse and mineral extraction to create additional value from wastewater

The company has a customer base of 35 and operates a business model that improves operating margins and reduces groundwater withdrawals by utilizing recycled water and groundwater.

4. Financial Performance

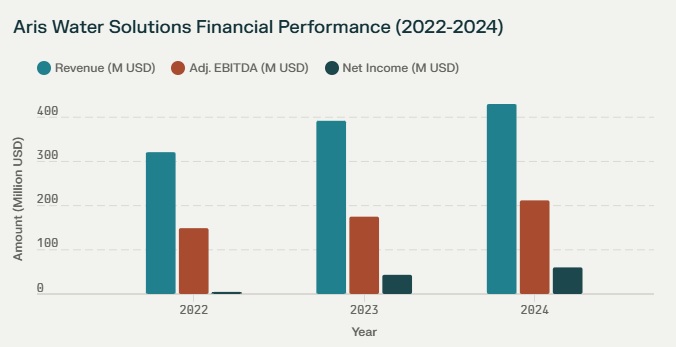

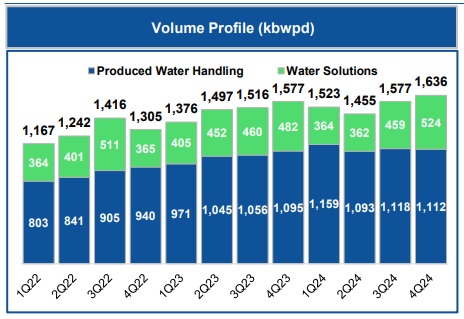

A. Graph Description

- Green Bar (Revenue): Revenue has steadily increased, growing from approximately $321 million in 2022 to around $500 million in 2024.

- Brown Bar (Adjusted EBITDA): Adjusted EBITDA grew from approximately $149 million in 2022 to $200–$212 million in 2024.

- Blue Bar (Net Income): Net income more than doubled, rising from around $30 million in 2022 to approximately $65.6 million in 2024.

B. Key Highlights

a. Revenue:

- 2022: $321M

- 2023: $392M (22% growth from 2022)

- 2024: $430M (10% growth from 2023)

b. Adjusted EBITDA:

- 2022: $149M

- 2023: $175M (17% growth from 2022)

- 2024: $211.9M (21% growth from 2023)

c. Net Income:

- 2022: $4.8M

- 2023: $43.4M (a significant increase)

- 2024: $60.2M (39% growth from 2023)

C. Observations

- Revenue and Adjusted EBITDA showed steady annual growth, reflecting improved operational efficiency and business expansion.

- Net Income exhibited the most dramatic increase, particularly between 2022 and 2023, indicating stronger profitability.

5. Competitive Advantages

A. Operational Performance

- Increasing volumes of produced water handling and water treatment solutions over time due to:

a. Pipeline and Infrastructure Expansion

-

- Aris has built a pipeline network of over 775 miles within the Permian Basin, including approximately 550 miles of large-diameter pipelines (12–24 inches) that enable high-capacity water transportation.

- This robust infrastructure creates significant entry barriers for competitors.

b. Rising Demand

-

- Increased oil and gas extraction activities, such as hydraulic fracturing, have led to higher volumes of produced water. Approximately four barrels of produced water are generated per barrel of oil, driving continued demand for treatment and recycling.

- Declining availability and rising costs of fresh groundwater encourage oil and gas companies to prefer produced water recycling.

c. Sustainable Water Management Solutions

-

- Aris supports customers in reducing groundwater use and increasing produced water recycling, enhancing environmental sustainability.

- Over the past three years, the company has helped reduce groundwater use by approximately 270 million barrels.

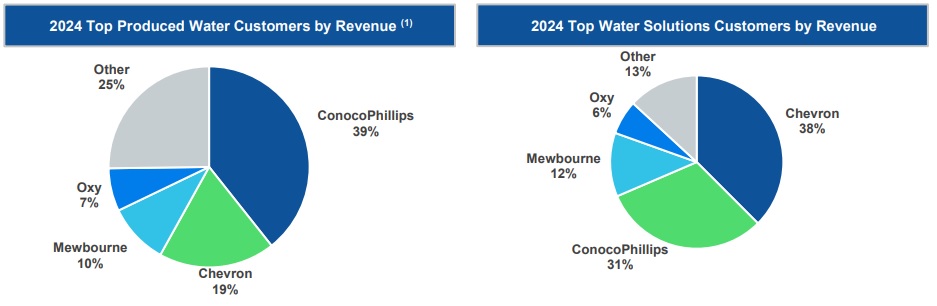

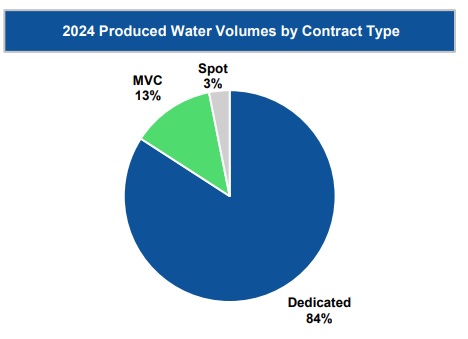

B. Stable Revenue Structure

- As of 2023, 84% of water treatment revenue is derived from long-term contracts, ensuring stable cash flow and revenue predictability.

- Strong relationships with key customers

a. Key Customers

-

ConocoPhillips holds the largest share at 39% and is also Aris’s major shareholder, owning a 22% stake.

-

Chevron follows at 18%, Newbourne at 13%, Oxy at 7%, and other customers at 23%.

b. Contract Types

-

Average remaining contract duration: Approximately 7.0 years

-

Dedicated contracts: 84%

-

Minimum Volume Commitment (MVC): 13%

-

Spot contracts: 3%

6. Risk Factors

A. Financial Risks

-

High long-term debt of $452 million as of Q3 2024.

-

Interest coverage ratio of 2.9x, indicating moderate debt servicing capability.

B. Market and Industry Risks

-

Dependency on oil and gas production levels.

-

Volatility in energy markets impacting revenue stability.

C. Regulatory and Operational Risks

-

Environmental regulations may increase compliance costs.

-

Infrastructure-related issues could disrupt operations.

D. Strategic Risks

-

High reliance on key clients (e.g., ConocoPhillips at 39% of revenue).

7. Future Vision and Growth Strategies

A. Research & Innovation

- Agricultural Water Treatment Research: Aris has received research grants from the U.S. Department of Energy to develop produced water treatment and desalination technologies for non-consumptive agricultural use.

- Greenhouse Research: In collaboration with Texas A&M AgriLife, the company is conducting research on growing cotton and forage crops using treated produced water.

- Mineral Extraction Technology: Aris is expanding its research into extracting valuable minerals such as lithium, rubidium, cesium, gallium, and platinum group metals from produced water.

After separating oil from produced water, the company utilizes a brine mining process to recover essential minerals and other valuable components. The treated brine can then be repurposed for agricultural applications or further purified for use in hydraulic fracturing to enhance additional oil recovery.

Source: https://engineering.tamu.edu/news/2024/01/mining-the-treasures-locked-away-in-produced-water.html

B. Business Diversification

-

Expansion into new water recycling applications.

-

Plans to build an iodine extraction facility in the Permian Basin by late 2025.

8. Two-Minute Pitch

Peter Lynch emphasized the importance of being able to deliver a two-minute pitch about a stock you are interested in, including the reasons for buying it, the company’s prospects, and its story. If you have thoroughly researched and can confidently articulate this two-minute pitch, you may consider purchasing the stock.

(Note: All investment decisions and responsibilities rest solely with you. Always invest with surplus funds and focus on long-term investments.)

Since President Trump’s inauguration, U.S. energy policy has been heavily focused on the oil and gas industry, driving a sharp rise in stock prices within the sector. However, whether this upward trend will continue remains uncertain. If profitability improvements do not keep pace, stock prices could stagnate.

In this environment, Aris Water Solutions (ARIS) stands out as a key player, specializing in the treatment and recycling of produced water from oil and gas operations. The company has built an extensive pipeline network in the Permian Basin, Texas, providing sustainable water management solutions. Over the past three years, Aris has demonstrated strong financial performance, with consistent growth in revenue, adjusted EBITDA, and net income.

The company’s growth is driven by increasing demand for hydraulic fracturing, the expansion of its pipeline and infrastructure network (which creates a competitive moat), and the oil and gas industry’s growing preference for produced water recycling. While its long-term contract-based business model ensures stable revenue, Aris faces several risks, including financial liabilities, market and industry volatility, infrastructure dependence, and environmental regulations. Additionally, its high reliance on major customers poses a strategic risk.

To position itself for the future, Aris Water Solutions is actively diversifying its business by investing in agricultural water treatment research, greenhouse studies, and mineral extraction technologies.

0 Comments